还真给我这破嘴说中了,如果博通财报也雷,画面更不敢想象,但这跌的也太离谱了,只是毛利率收缩 1%,财报还是非常亮眼的🥲

再次庆幸这段时间我一直克制轻仓,虽然错过不少涨幅但也最大限度控制了风险。也庆幸昨天只是小仓位买入,就是预感博通也会来个大的。

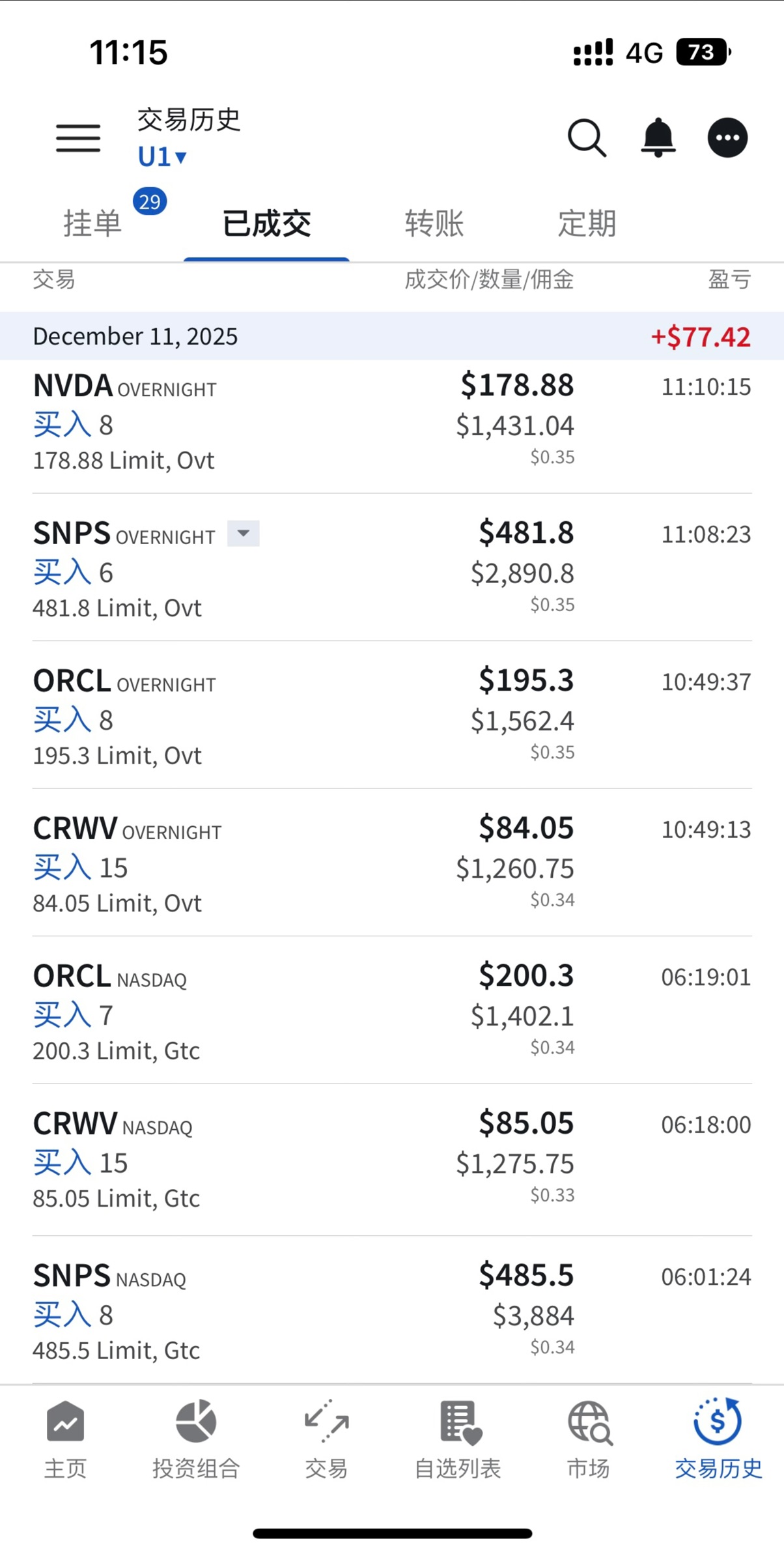

今天既是风险也是机会,我又开启了疯狂乱买,瞬间又满仓了,说好的淡定一点也做不到,到处是便宜筹码..接下来又要开启躺平生活了..

$甲骨文(ORCL.US)昨天 200 做 T 卖了一部分,今天补仓 70 股,190 以上买多了,导致成本 191 没做低多少,若尾盘反弹会卖出一部分,已经成第一重仓了,260 以上分批卖。

$Meta(META.US)昨天 253T 了一部分,今天 641.8 买入 8 股,成本做高到 635 了,二重仓,730 以上分批卖。

$Coreweave(CRWV.US)今天空单平仓后陆续买进 170 股,成本 81.1,期间会配合做 T 降成本,要求不高,拿到 100+ 还是可以的。

$英伟达(NVDA.US)在 175.5 补仓 7 股,成本 176,达子一直没到我 170 的理想建仓价,但又不想错过,陆陆续续买了几十股,反弹就卖跌了就补。

$博通(AVGO.US)昨天做空提前止损亏了 50 刀不甘心,今天做多买 13 股,成本 366.6, 让我赚 50 刀不过分吧?

$IREN(IREN.US)成本 40.8 买了 60 股,$新思科技(SNPS.US)成本 465 买 6 股。 博通、新思和 IREN 是短线投机,尾盘能反弹盈利就清仓。

除了狗屎运没人能买在最低点,我大概率又买在半山腰,但建仓本就要从被套开始,才有机会补仓捞更便宜的筹码,最终获取更大的利润。

我始终认为机会是跌出来的,风险是涨出来的,优质股票每一次大跌都是建仓的好机会,哪怕是抄在半山腰也比追高被套好太多。

打字这会儿大盘好像反弹了,今天抄底浮亏从 1300 降到 300 多,安心了不少哈哈😂 这里不能放图,成交记录放留言区了。

个人胡乱操作,不是投资建议。

甲骨文一个财报把科技股乃至大盘都带崩了🙃

老朋友都知道上个月 30 多个点利润回吐之后,我就止损清仓了不少票,留现金以防大盘继续下跌,虽然错过德州仪器和新思科技等不少涨幅,仓位降低也导致利润只回本一半,但没什么可惜的,遇到今天这种大跌我反而盈利,还等来抄底的机会。

目前空仓 7 成,持仓只剩 META 成本 630 和达子成本 175,meta 仓位不少没跌到成本价懒得补仓,达子在 178.8 补了一点,等 170 再加仓。

昨天 200 股 CRWV 空单被套没止损,今天又因祸得福,盘中 85 平仓腾出不少资金,盘后 85、84 买了点正股,66 的价格还历历在目,只有 80 以下才会考虑加大仓位。

看新思科技财报暴涨了 8 个点又回落,成本 483 买了 14 股,投机赌盘中会反弹,能盈利 100 刀就跑。

甲骨文昨天 220 清仓,盘后 200 和 195 限价单被触发,等 188 和 180 再补,甲骨文能 180 以下我会重仓长持。微软和亚马逊没到 460 和 210 理想价格,暂时没操作。

今天看似咔咔一顿买,其实相比我之前的操作保守了很多,只是小仓位买入观察,因为感觉更大的风险和机会可能在明天。

甲骨文一个财报大盘就跌成这样,如果明天博通财报也爆雷,那画面不敢想象,相比甲骨文,一路暴涨的博通 ai 泡沫只会更多..

只是个人胡乱操作,不是投资建议。

$纳指 100 ETF - Invesco(QQQ.US)$标普 500 ETF - SPDR(SPY.US)$英伟达(NVDA.US)$Meta(META.US)$甲骨文(ORCL.US)$Coreweave(CRWV.US)$微软(MSFT.US)$博通(AVGO.US)$新思科技(SNPS.US)$亚马逊(AMZN.US)$特斯拉(TSLA.US)

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。