段永平解释段永平:王石当面问的题,大道在 15 年前就答完了

Hello everyone, I'm Jack.

I'm doing something foolish: writing about the constituent companies of the S&P 500 in order of their founding.

Steve Jobs once said, "In the end, everything comes down to taste."

Taste is the ability to recognize excellence. In the world of investing, this taste first points to the ability to understand business models. As Buffett emphasized, to evaluate a company, one must start with its business model. Only by truly "seeing" can one perceive what excellence is, and taste can form standards through insight.

Buffett's method is extremely simple: turn every page. He once read the thousands of pages of the Moody's manual twice, leaving no corner unexplored. When Munger was surprised by his familiarity with a small California company, the answer was still—he had already "turned that page."

Therefore, we chose to start with the S&P 500. Turning every page is the first step in building taste.

This is a long run about "value" and also an upgrade in cognition.

I suggest following first, then reading, and we'll dive deep together.

So far, I've reintroduced you to:

【1】Colgate-Palmolive 1806

【2】Bunge Global 1818

【3】McKesson 1833

【4】Deere & Company 1837

【5】P&G 1837

【6】Stanley Black & Decker 1843 (Part 1)

-Main Text-

These past two days, the video of Wang Shi's dialogue with Duan Yongping, "Common Talk" Season 3, has gone viral.

My social media feed is full of praise, with everyone saying Duan is "relaxed" and "transparent."

But after watching it, I only felt "repetition."

Why repetition?

Because every word Duan Yongping said to Wang Shi in the video is not only logically consistent with what he typed on Snowball ten or fifteen years ago, but even the rhetoric is exactly the same.

It's almost like "reciting the original text."

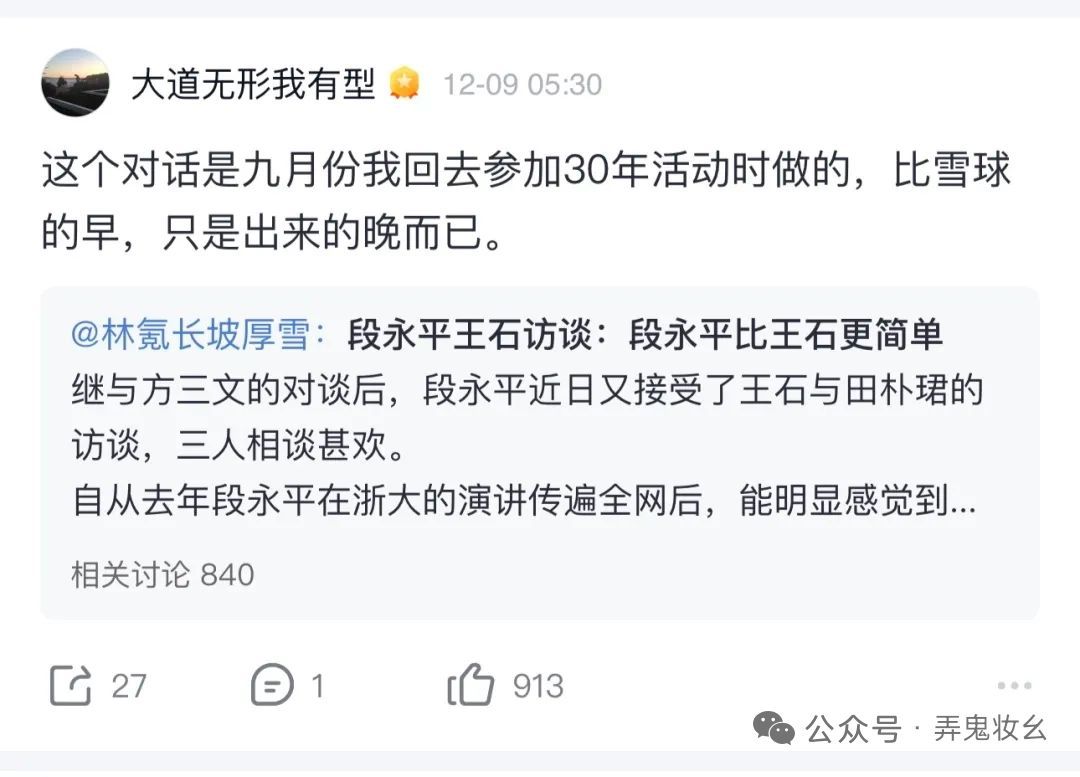

There's an interesting detail: a while ago, Snowball's founder "Abbot" also released a video of a dialogue with Duan Yongping. Although Abbot's video was released earlier, it was actually recorded later than Wang Shi's.

And the result? You'll find that whether it's to Wang Shi (recorded earlier) or Abbot (recorded later), Duan Yongping's answers seem to be cut from the same mold.

In a business world that's eager to chase new trends every three days and create new concepts every five, a billionaire with a fortune of hundreds of billions has been repeating the same "wheel-spinning words" for over a decade.

There are only two possibilities:

Either he's a fraud, with his lines memorized to perfection.

Or his spiritual core is extremely stable, and it doesn't need updating because it's universal.

Duan Yongping is clearly the latter.

What does this mean? It means he's a true long-termist.

What is long-termism?

Long-termism isn't about how long you've endured (in fact, you don't need to endure). It's about the things you believe in remaining unchanged for decades.

Today, let's not be abstract or serve up motivational platitudes. To prove this point, I'll do some hardcore "archaeology."

I've come up with a new approach: "Duan Yongping Annotates Duan Yongping."

Putting Duan Yongping's words to Wang Shi in 2025 side by side with the words he wrote from 2007 to 2019 (under the pseudonym "Dadao").

You'll find that this is a "self-confirmation" across time and space.

Duan Yongping has had a huge influence on me, not just because he was my guide to reading Buffett, but more importantly because he helped me understand what corporate culture is.

It's fair to say that without Duan Yongping's tireless explanations of corporate culture from the perspective of an entrepreneur and manager, I wouldn't have understood the importance of corporate culture. My understanding might have remained shallow, stuck at "corporate culture is just empty, useless rhetoric."

This is both an "archaeological" exercise and a review. I enjoy it, finding new insights with each reading. Let's begin.

01

Duan Yongping: Back then, many people were talking about some issues with Vanke. I said that at least the things you're seeing are probably not true. Because I felt that the impression Wang Shi gave me wasn't of someone who would go into a back room to discuss cooking the books with the finance team. Making mistakes is possible, but falsifying is another matter. So looking at your financial data at the time, I thought the price was clearly cheap. I did buy it, and later sold it after it rose a lot, just when Vanke's price was particularly low.

Dadao: I remember when we bought Vanke, someone asked me, 'What if Vanke's books are fake?' I said, based on my understanding of Wang Shi, he's absolutely not the type to lock himself in a room with the finance team to cook up fake books to deceive shareholders. Actually, I wasn't close to Wang Shi then, and I'm still not now—it was just intuition. (2010-03-14)

02

Wang Shi: I didn't expect to still be running a business at this age. You've gone from "Little Overlord" to now, and people talk about your entrepreneurial phase. But in reality, the people you've mentored, and many others who aren't mentioned, have come from your company. How did this logical system form? What are its key features?

Duan Yongping: We call it corporate culture. This culture is about being rational and thinking long-term. So it's about being user-oriented, consumer-oriented, doing things with integrity, doing the right things, and doing things right. These things might not seem like much, but if you do them for thirty years, it becomes powerful. BBK has been around for thirty years now.

Stick to doing the right things, and if you find you're wrong, correct it quickly. Keep this up for decades, and it really has great power. But if you're talking about a single thing, a single day, or a single phase, whether every action will definitely bring you the greatest benefit—no one really knows.

Dadao: My view on doing the right things is: if you find you're wrong, correct it immediately. No matter how big the cost, it's the smallest cost.

Actually, there are many people in this world (including me) who often know something is wrong but, for various reasons, refuse to change. As a result, the mistake grows bigger. Haha, I've definitely made this kind of mistake. No one is immune to mistakes, but those who know this principle make fewer mistakes and correct them faster, and in the end... (2010-03-14)

Dadao: If you can stick to "integrity," you'll be amazing many years later.

As the saying goes, "Borrow and return, and you can borrow again." Here, "borrow and return" is "integrity," and "borrow again" is actually "utilitarian." When you stop thinking about "borrowing again," you're truly "integrity." (2013-02-24)

Tian Pujun: This is what I'm most curious about. You said you stepped back from the business over twenty years ago, but as you said, corporate culture is especially important. How can the corporate culture still be maintained after you stepped back? Including people who came out of BBK, like those now running their own successful businesses, such as vivo and OPPO. How is corporate culture passed on?

Duan Yongping: When hiring, you need to hire people who fit the corporate culture. It's not necessarily about identifying everyone at the moment of hiring. After three to five years of work, you'll know who fits and who doesn't, and those who don't fit will leave on their own.

Duan Yongping: I have deep feelings about delegation. Here's how I see it: you go from instructing to guiding, consulting, delegating, and then finally, there's one more phrase: "Never out of control." What keeps a company from losing control is its culture. From hiring, you need to find people who are a good match, focusing on suitability and qualification. Suitability refers to corporate culture, and qualification refers to ability.

Dadao: This is about qualification and suitability. Qualification refers to ability, and suitability refers to alignment with corporate culture. People developed internally tend to have strong suitability, while sometimes external hires for certain roles have better qualification.

Suitability is harder to cultivate—it takes a long time, and sometimes even a long time isn't enough. Qualification, in most cases, can be cultivated.

Sometimes we bring in urgently needed technical talent because their qualification is important, while suitability can often be cultivated over time. We generally don't bring in senior executives because it's hard to cultivate their suitability. (2010-03-24)

Dadao: You're absolutely right—qualified talent can be cultivated, and the reason people leave is suitability. (2010-03-26)

Netizen: Speaking of evaluating people, I'd like to ask: in an interview setting, what are some good ways to judge whether someone is a "culture fit" or has "integrity"? It seems hard to assess "suitability" in a short time.

Duan Yongping: You'll know over time. I don't have a good short-term method. (2014-09)

Dadao: At BBK, employees who've been there for decades are everywhere. Everyone understands and likes the culture, so they stay—even many former Little Overlord employees are still around.

But our young guys are still full of passion—let them take over. They're doing great.

Duan Yongping: So I've always felt I'm not the best CEO material, so I found better candidates than me. The current CEOs of OPPO and vivo are about ten years younger than me, with better education and learning abilities, and they understand corporate culture the same way I do (we call them "like-minded"), so I chose to step back from the front lines.

Over a decade later, I can now proudly say I was right. Here, I can also unofficially announce that I stepped down as CEO over a decade ago (in fact, I've long been out of the position and not involved in governance). As one of the founders, I still pay close attention to our company (like everyone else, I mainly follow it online now), but I've long stopped being involved in any frontline decisions. The so-called "operations" or "remote control" mentioned online are completely nonexistent.

By the way, our educational electronics company is also doing very well—probably the best in China's educational products sector—and its CEO is also very young (to me, at least).

Also, when I have time, I'll write down some memories (all from over a decade ago) and related insights or reflections on running a business. Having been away from the front lines for so long, my memories may not be entirely accurate, and I probably can't recall things I didn't like. ("The 'Unsecret' Secret: Integrity + Equanimity" 2016-10-12)

Dadao: Our culture is called "integrity." Integrity means doing what you're supposed to do—being rational and thinking long-term. Most people will discuss whether something makes money, but we often discuss whether it's the right thing to do. If it's wrong, we should stop immediately; if it's right, we should do it right. Making mistakes while doing things right is unavoidable—there's always a learning curve, so just keep moving forward.

Jack:

No need to overexplain "integrity," right? Over twenty years ago, when Dadao was active in the public eye, he welded "integrity" and "Duan Yongping" together.

Online explanations of "integrity" have proliferated endlessly. Here, I'll link vivo's Shen Wei: Upholding Integrity for Longevity and OPPO CEO Chen Mingyong on the New Meaning of 'Integrity'.

Why these two people?

No way.

No way.

No way.

You can't have read this far and still not know Duan Yongping is the boss behind OPPO and vivo, right?

Duan Yongping: But right and wrong are important. In China, the proportion of companies that seriously consider right and wrong isn't high, because everyone is desperately rushing to make more money—profit orientation is strong. We're more user-oriented—by "user," I mean consumer-oriented, not client-oriented.

Client orientation can get complicated, but consumer orientation is simple: what does your end-user really want, and what can we provide? Culture is all about this.

Dadao: In our company, the standard for judging whether something is right or wrong is our corporate culture—integrity, honesty, quality, consumer orientation, etc.

We stick to what's right, and if something's wrong, no matter the cost, we don't do it—we stop it. If we can't determine whether something is right, we can list what's wrong—that makes understanding and execution easier.

Of course, there are exceptions. When we were making Super VCDs, the actual resolution was 350 lines, but our competitors claimed 500 lines. We couldn't lie and say 500 lines to deceive consumers, but if we didn't say 500 lines, consumers would buy from other brands. So we said "significantly improved resolution," which worked well.

But on matters of principle, you can't compromise—right is right, wrong is wrong. Right and wrong shouldn't yield to profit. (2011)

Duan Yongping: At our 30th anniversary celebration, the event's theme was "Healthier, Longer-lasting." I proposed this back then because at the time, many were saying, "We want to be a Fortune 500 company" or "We want to be a top 500 by revenue"—all about scale. I said that's not important. Our company has never set goals like "achieve X revenue" or "earn X profit." We just say "healthier, longer-lasting." Anything unhealthy or unsustainable should be stopped.

Dadao: Vision means everyone's vision (long-term view). Writing it on paper is useless.

Our company's vision is "healthier, longer-lasting." That means we shouldn't do anything unhealthy or unsustainable (even if it makes money now). (2010-11-10)

03

Duan Yongping: Yes. Jobs was a clockmaker—he built this kind of corporate culture. Apple's user orientation is very strong. Although big companies can make mistakes, overall, I think it's a good company.

Dadao: I used to think Jobs was a timekeeper, but recently it struck me that Apple couldn't be what it is today based solely on Jobs. Today, Jobs' role isn't that significant anymore. Even if Jobs didn't plan to return, Apple would keep moving forward by inertia.

Also, why did Apple's board invite Jobs back after firing him? That's not easy to do. (2011-01-22)

Dadao: It wasn't until January this year that I suddenly realized Jobs was also a great clockmaker. His problem was that he was also an extremely rare timekeeper—Collins and I were fooled, otherwise I would've bought Apple years ago. (2011-11-04)

Dadao: Built to Last is a great book, but it cost me the chance to invest in Apple early because after reading it, I categorized Jobs as a timekeeper (most people still think so). Luckily, I later realized he was also a great clockmaker. (2012-03-25)

Netizen: What made you suddenly realize Jobs was also a great clockmaker?

Dadao: Because I saw the clock. (2012-03-29)

Dadao: Add one: discovering and appointing Cook as CEO. (2015-03-20)

Dadao: Cook is a better CEO than Jobs. Cook is more rational and deeply understands Jobs' vision. When I mentioned to an investing elder that I thought Cook was actually a better CEO, he said he thought so too.

Built to Last calls Jobs a "timekeeper," but he was also a great "clockmaker." Cook is one of Jobs' greatest inventions (discoveries). (2018-08-07)

Jack:

Here's a fun fact: most people misunderstand the title Built to Last. They think it's about "finding ways to keep a business going" (even if it's mediocre). But the author explained: it's about "building a business worthy of lasting." If the business itself is bad, it doesn't deserve to last.

04

Duan Yongping: Back then, people said these companies (like NetEase) would delist. Our company has always been private—we never went public. Does that mean it's worthless?

This company has value. I was willing to buy it, so I did. It all depends on whether you understand the business. I don't think it was luck, but I can't replicate the same returns at the same point. If I could, I'd be the world's richest man by now.

Dadao: The simplest way I distinguish investing from speculating is:

At the current price, would you still buy this company if it weren't public? If yes, that's investing; if no, that's speculating.

When I bought NetEase at that price (in such volume), it was because NASDAQ had a rule: stocks below $1 for a certain time would delist. Many feared delisting and sold below $1.

Why wasn't I afraid? That's my investing philosophy. I buy based on value, not whether it's public. BBK never went public, but selling it for that reason would be absurd—why start a company then? This is in my bones. (2007 China Entrepreneur)

Netizen: Is the highest level of investing buying a company you'd hold even if it delisted, recouping your investment through dividends?

Dadao: Pretty much. (2010-03-31)

Dadao: The simplest definition of investing: if you had enough money, you'd buy the whole company at this price and take it private. With little money, you can only buy a small piece. Think about what that means. (2010-03-26)

Netizen C: No wonder BBK isn't in a hurry to go public. Everyone has different needs at different times. What's the point of taking a public company private? Any precedents?

Dadao: Haha, not literally. The point is: if this weren't a public company, would you buy at this price? If not, it's not value investing. (2010-03-26)

Dadao: Delisting and listing have no direct relation to whether a business improves or deteriorates. (2011-11-25)

Dadao: All your questions boil down to future cash flows (discounted). If you understand that, you're good.

If Coca-Cola stopped growing forever, with annual profits of $5B and a market cap of $3B, would you buy? Buy it, take it private, and you'd make a killing. (2011-02-14)

Netizen: Dadao, why are most people unwilling to get rich slowly?

Dadao: Actually, I don't want to get rich slowly either—I just don't know how to get rich quickly. (2019-06-03)

Jack:

Someone asked me: What if Pinduoduo delists? Will it relist in HK?

I don't think I can say it better than Dadao above.

"I have nothing to add."

05

Tian Pujun: (Meeting Buffett) What was your biggest takeaway?

Duan Yongping: My biggest takeaway was asking him what he looks for in a company. He said the business model. That stuck with me because we look at everything. I asked what he looks at first, and he said the business model—if that's wrong, he stops there. He has filters: the right people and the right price. For me, I don't even mention price.

Price is luck, but the business model must pass the first test, and you must like the corporate culture.

Bad culture can ruin a good business model. That's why I like Apple—I like their business model and culture. Of course, our company is great too—just not public.

Dadao: Nothing much to say. The reasons for buying (Apple) haven't changed, the target price hasn't changed.

right business + right people + right price + time=good result. Not a sufficient formula, but good results are likely. (2013-04-20)

Dadao: Good business models and cultures are what I like to invest in. Add a good price, and it's perfect.

Long-term (10-20+ years), sticking to good business models and cultures usually yields good returns. Plus, it's stress-free—no need to overthink.

In short, if investors think in 10-20 year terms when deciding, results are unlikely to be bad. Otherwise, who knows? Finding companies you can understand for 10-20 years is hard—10-8 such opportunities in a lifetime is plenty. (2015-04-11)

Dadao: Three things: business model, corporate culture, and price. Price is least important. (2019-03-14)

06

Duan Yongping: Jack Ma said equanimity is actually unequanimity, because ordinary people rarely have it. Our company's equanimity is about being rational and long-term. Rationality isn't easy, but rationality and long-term thinking are the same—thinking long-term requires rationality. To stay rational, you need equanimity. So you must block out distractions—it's logical. It boils down to one thing: if you're a long-termist, many problems solve themselves over time.

Dadao: Equanimity is actually unequanimity—hard for anyone. (2010-03-24)

Dadao: Now with equanimity, I know a business's biggest rival is itself. (2010-09-18)

Dadao: Equanimity means returning to the essence. As Jack Ma said, it's unequanimity because it's rare. (2012-03-10)

Netizen: Equanimity is so hard—is it impossible? Any tips?

Dadao: The market dips a bit and you're like this? Ordinary people struggle with equanimity—that's why it's unequanimity. If you don't focus on the essence, unequanimity is normal. Conversely, if you focus on the essence, equanimity comes naturally. (2015-05-29)

Dadao: On the wrong path, equanimity is impossible—like those using margin yesterday. You know. (2015-05-29)

Final Words

After these "self-annotations," how do you feel?

Does it seem like Duan Yongping hasn't "progressed" in over a decade?

He keeps repeating the same things.

Wang Shi asked 2025 questions, and Duan gave 2010 answers. And he's used these answers for 30 years—from business to investing, China to the US—without changing a comma.

We think there must be some secret to making money, some undisclosed high-level insight.

But Duan's decades of practice and records show: the secret is those clichéd common sense.

As Colin Huang said, his biggest takeaway from meeting Buffett was "believing in the power of simplicity and common sense."

Some principles are timeless.

If you get it, congrats—you're closer to the "Way." If it seems "unremarkable," that's normal. After all, the great Way is simple, yet all beings suffer.

Some words sound like platitudes because we're not yet capable of living them.

Finally, a gift:

Duan Yongping: This is a passage from the final chapter of Steve Jobs' biography, "Legacy: The Brightest Heaven of Invention." I've read it many times—it reveals a soul that, despite its shadows, always shone.

Jim Collins summarized in Built to Last that great companies have "purpose beyond profit." Jobs and Apple embodied this perfectly. (2014-02-01)

Jobs:

My passion has been to build an enduring company where people were motivated to make great products. Everything else was secondary. Sure, it was great to make a profit, because that was what allowed you to make great products. But the products, not the profits, were the motivation. Sculley flipped these priorities to where the goal was to make money. It's a subtle difference, but it ends up meaning everything—the people you hire, who gets promoted, what you discuss in meetings.

Some people say, "Give the customers what they want." But that's not my approach. Our job is to figure out what they're going to want before they do. I think Henry Ford once said, "If I'd asked customers what they wanted, they would have told me, 'A faster horse!'" People don't know what they want until you show it to them. That's why I never rely on market research. Our task is to read things that are not yet on the page.

Polaroid's Edwin Land talked about the intersection of the humanities and science. I like that intersection. There's something magical about it. Lots of people innovate; that's not what distinguishes us. Apple resonates with people because there's a deep current of humanity in our innovation. I think great artists and great engineers are similar in that they both have a desire to express themselves. In fact, some of the best people working on the original Mac were poets and musicians. In the seventies, computers became a way for people to express their creativity. Great artists like Leonardo da Vinci and Michelangelo were also great at science. Michelangelo knew a lot about how to quarry stone, not just how to sculpt.

People pay us to integrate things for them, because they can't think about everything 24/7. If you have a burning desire to build great products, it pushes you to integrate, to merge your hardware and software and content management. You want to break new ground, so you have to do it yourself. If you want to allow your products to be open to other hardware or software, you have to give up some vision.

Over the years, different companies have been Silicon Valley's exemplar. For a while, it was HP. Later, in the semiconductor era, it was Fairchild and Intel. I think Apple was for a while, then faded. Today, I'd say it's Apple and Google—Apple more. I think Apple has stood the test of time. It's had ups and downs, but it's still at the forefront.

It's easy to poke holes in Microsoft. They've clearly lost their dominance, become largely irrelevant. But I admire what they did, and how hard it was. They were very good at the business side. They never had the ambition in products. Bill likes to portray himself as a product guy, but he's really not. He's a businessman. Winning business was more important than making great products. He became the richest guy, and if that was his goal, he achieved it. But it was never my goal, and I wonder if it was his. I admire him for the company he built—it's impressive—and I like working with him. He's bright and funny. But Microsoft never had humanities and arts. Even after seeing the Mac, they couldn't copy it well. They didn't get it at all.

I have my own theory about why companies like IBM or Microsoft decline. They do well, innovate, become monopolies, then the product quality becomes less important. They start valuing great salespeople, because they're the ones driving sales, rewriting revenue numbers, not product engineers and designers. So the salespeople end up running the company. IBM's John Akers was a smart, eloquent, great salesperson, but he knew nothing about product. The same happened at Xerox. Sales guys run the company, product guys don't matter, and many lose passion. That happened at Apple when Sculley came in—my mistake—and at Microsoft under Ballmer. Apple was lucky to rebound, but I think as long as Ballmer's at the helm, Microsoft won't improve.

I hate it when people call themselves "entrepreneurs" when what they're really trying to do is start a company to sell or go public. They don't want to do the hard work of building a real company, which is the hardest work in business. Only then can you truly contribute and add to the legacy. You want to build a company that will still stand a generation or two later. That's what Walt Disney, Hewlett and Packard, and the Intel founders did. They built enduring companies, not just made money. That's what I want for Apple.

I don't think I'm harsh on people, but if someone screws up, I tell them. Honesty is my responsibility. I know what I'm talking about, and I'm usually right. That's the culture I tried to create. We're brutally honest with each other—anyone can tell me they think I'm full of shit, and I can say the same. We've had fierce fights, yelling—some of my best times. Telling Ron, "That store looks like shit," in front of others didn't bother me. Or saying, "God, we really screwed this up," to the person responsible. That's our rule: be super honest. Maybe there's a better way, like a gentlemen's club with ties and polite language, but I'm not good at that—I'm from California's middle class.

Sometimes I'm too hard on people. When Reed was six, I came home after firing someone and thought about how someone tells their family and young child they're unemployed. It's tough. But someone has to do it. Keeping the team excellent is my responsibility—if I don't, no one will.

You have to keep pushing innovation. Dylan could've kept singing protest songs and made money, but he didn't. He had to move on—in 1965, adding electric music alienated many. His 1966 Europe tour was his peak. He'd start acoustic, the crowd loved it, then bring out The Band on electric instruments, sometimes getting booed. Once, before "Like a Rolling Stone," someone yelled, "Judas!" Dylan said, "Play it fucking loud!" And they did. The Beatles evolved too. They kept moving, improving. That's what I try to do—keep moving. Otherwise, as Dylan said, if you're not busy being born, you're busy dying.

What drives me? I think most creators want to express gratitude for standing on others' shoulders. I didn't invent my language or math. I don't grow my food or make my clothes. Everything I do depends on others, their contributions. Many want to give back, add to the stream. We can only express it in ways most understand—we can't write Dylan songs or Stoppard plays. We try with our talents to express deep feelings, gratitude, add something. That's what drives me. 2014-02-01

Jack: I've read this many times too.

The End—Qin Wang circles the pillar

This article was handmade by an ordinary netizen using traditional methods, with no AI involvement.

-END-

Hello everyone, I'm Jack.

I'm writing about the S&P 500's constituent companies in order of their founding.

Why?

Because in the business world, time is the harshest judge and the fairest coronator.

In this series, I follow the "Lindy Effect"—for things that don't die naturally (like tech, ideas, companies), the longer they've existed, the longer they're likely to exist.

We're dissecting not stock price movements but the "bones" and "muscles" of business models. So I've excluded financials and utilities.

Why? Banks and insurers' balance sheets are often opaque "black boxes," with leverage their oxygen and poison. Utilities are stable but rely on licenses and regulation, lacking free-market grit. We seek non-financial entities that survived brutal competition.

Going company by company, we'll see a grand panorama:

From 18th-century canals and mills, to 19th-century rails and steel, to 20th-century consumer goods and oil, to 21st-century Silicon Valley chips. This isn't just an S&P 500 list—it's living capitalist evolution.

In this journey, we'll explore "built to last" secrets, answering:

Cycle-proof genes: How did some survive civil war, depression, world wars, and bubbles? How did they "turn the elephant" amid tech waves?

Moat essence: Unrivaled scale? Inflation-proof brand mindsets? High switching costs? We'll peel back financials to see competitive edges.

Business first principles: Whether selling drugs, soda, or software, good businesses share underlying logic. We'll extract "unchanging" truths from these centenarians.

Some call the S&P 500 "Blue Star Beta"—Earth's economic growth average. To me, these 500 companies hold humanity's collaborative wisdom.

This is a marathon. If you believe in "getting rich slowly" and are obsessively curious about "good businesses," follow me. We start with the oldest—let's go.

Completed so far:

【1】Colgate-Palmolive 1806: My Worthless Dog Eats Better Than Me, Wall Street Laughs Madly

【4】Deere & Company 1837: Wheeled Robots Before Tesla—A 188-Year-Old Tractor Maker?

【5】P&G 1837: The Whampoa of Global Business Leaders, Costco's Biggest Victim?

【6】Stanley Black & Decker 1843: Car Burned, Ice in Thermos Unmelt...And It's True (Part 1)

$PDD(PDD.US) $Apple(AAPL.US) $Vanke(000002.SZ)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.