Great Wall Motors 4000-word in-depth research report

$GWMOTOR(02333.HK)$BYD(002594.SZ) Recently researched Great Wall Motor, with the core logic being its cost and technological barriers built via full-chain integration, while showing financial resilience during cyclical fluctuations.

🎯 Core logic: Mainly operates in self-owned brand SUVs and pickups, focusing on the domestic market; achieves supply chain independence through vertical integration (with subsidiaries like Honeycomb Energy and Haomo AI for core components). Pickup market share exceeds 40%, with strong brand recognition for Haval SUVs; 95% of revenue comes from vehicle sales, with new energy vehicles accounting for ~35% in 2024; growth driven by in-house R&D (2024 R&D expense ratio 6.5%+, Hi4 hybrid tech) and globalization (2024 overseas sales 300K+ units, 18% share).

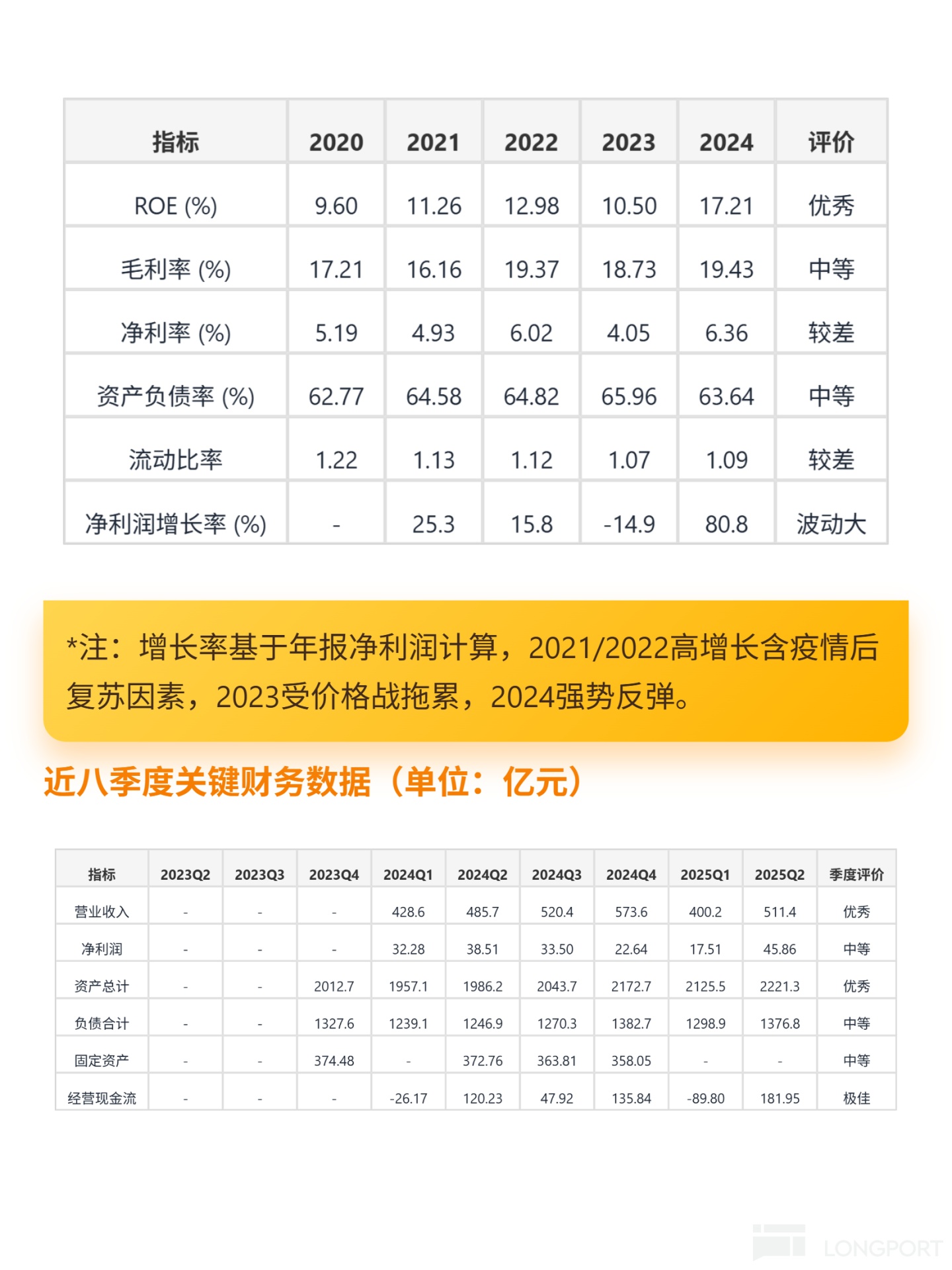

📈 Financial highlights: 2024 ROE 17.21% (manufacturing excellence, non-leveraged), gross margin 19.43% (stable growth); FCF RMB 16.045B (turned positive, strong cash generation), net profit cash ratio 2.19x (high-quality earnings); but net margin remains low (2024: 6.36%), current ratio near 1.0 (tight liquidity), inventory turnover 6.18x in 2024 (slight decline, possibly due to NEV ramp-up); minimal goodwill with no impairment risk, sustainable profitability.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.