Rate Of Return

Rate Of Return AGQ Return Rate

AGQ Return RateThe truth behind the "500,000 threshold": The larger the account size, the more stable the profit?

Yesterday, I saw Dad's financial sharing, which was very interesting:

1. Quick data overview

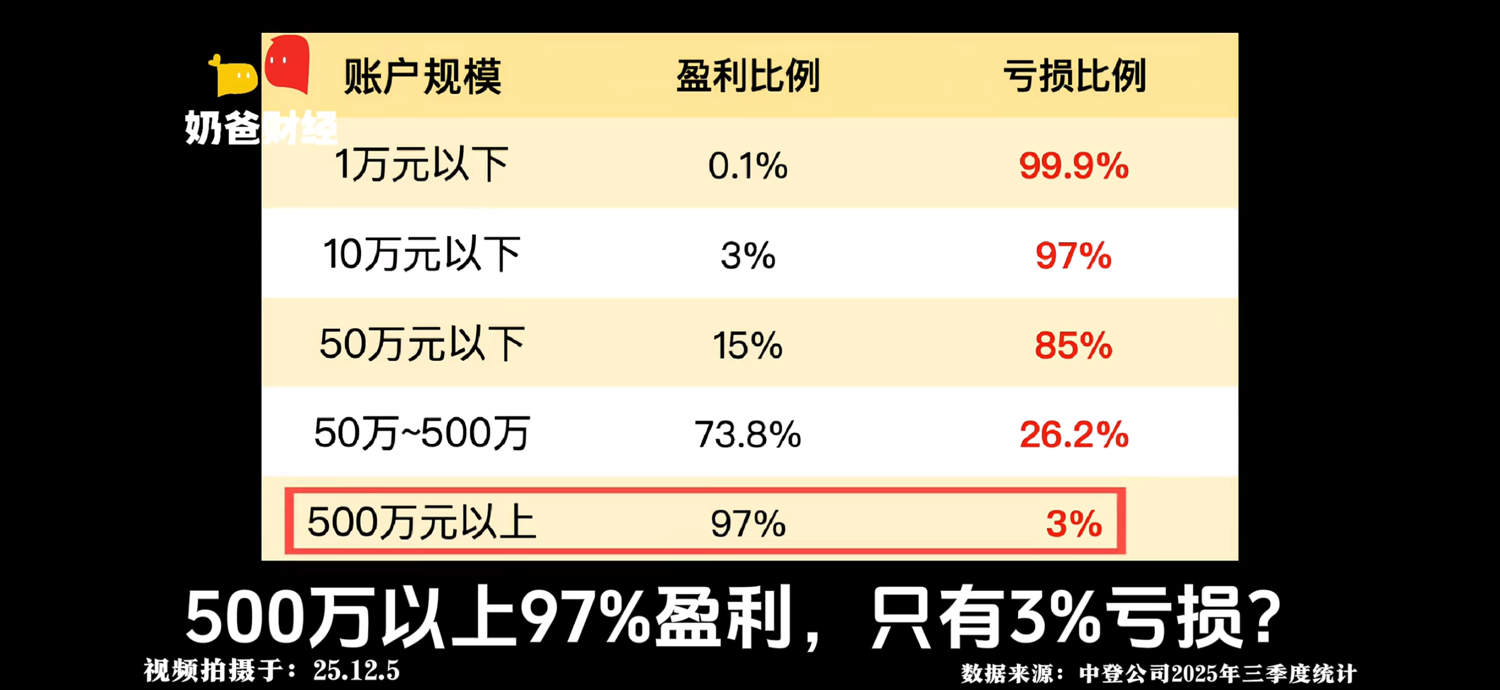

According to the statistics from China Securities Depository and Clearing Corporation Limited (CSDC) for the third quarter of 2025, the profitability ratio of A-share accounts is steeply positively correlated with the capital scale:

• Below 10,000 yuan: 0.1% profit

• Below 100,000 yuan: 3% profit

• Below 500,000 yuan: 15% profit

• 500,000–5,000,000 yuan: 73.8% profit

• Above 5,000,000 yuan: 97% profit, only 3% loss

2. Phenomenon breakdown

• "Capital moat" effect: Large funds can diversify allocations, hedge, and withstand volatility without being shaken out.

• "Information + tools" premium: High-net-worth clients have easier access to broker research, margin trading, derivatives, and other tools to protect positions.

• "Behavioral differences": Small accounts often chase highs and sell lows frequently, with transaction fees and slippage eroding capital; large accounts tend to hold long-term or invest in undervalued stocks, reducing mistakes.

3. Implications for ordinary investors

① Prioritize "expanding capital" over "pursuing high returns"—first accumulate the first pot of gold through salary, side jobs, and index fund investments, then consider stock picking.

② Replace "emotion" with "rules"—set position limits and stop-loss lines in advance to avoid the high-frequency trading traps common in small accounts.

③ Use "tools" to narrow the gap—low-cost broad-based ETFs, public REITs, convertible bond subscriptions, etc., can replicate part of institutional risk-return structures without 5 million yuan.

④ Make "not losing" the primary goal—remember that 85% of accounts below 500,000 yuan lose money; first learn to defend, then expand.

4. One-sentence summary

The data is cruel but honest: Account size is a "talisman" for profitability, but discipline, tools, and patience are the real tickets for ordinary people to navigate bull and bear markets, grow their capital, and eventually enter the "97% profit zone."

Let’s do a quick survey: What’s your profit/loss situation?

请问您的资产规模和盈亏情况大概怎样?

Single Choice

- 1万以下 盈利0%

- 1万以下 亏损0%

- 10万以下 盈利0%

- 10万以下 亏损25%

- 50万以下 盈利25%

- 50万以下 亏损0%

- 50-500万 盈利25%

- 50-500万 亏损0%

- 500万以上 盈利0%

- 500万以上 亏损25%

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.