Ping An Good Doctor 4000-word in-depth research report

$PA GOODDOCTOR(01833.HK)$JD HEALTH(06618.HK) $ALI HEALTH(00241.HK)Research on Ping An Good Doctor reveals that the biggest takeaway is: an internet healthcare platform reliant on group synergies, which has just achieved marginal profitability but has weak financial foundations, with long-term value constrained by industry policies and monetization efficiency.

🎯 Core logic: Ping An Good Doctor is an online healthcare service platform under Ping An Group, positioned as a "connector" (connecting users, doctors, pharmaceutical companies, and insurers). New users mainly come from group life insurance and bank referrals, with 99% of revenue from mainland China. Growth is constrained by industry policies and its own monetization efficiency.

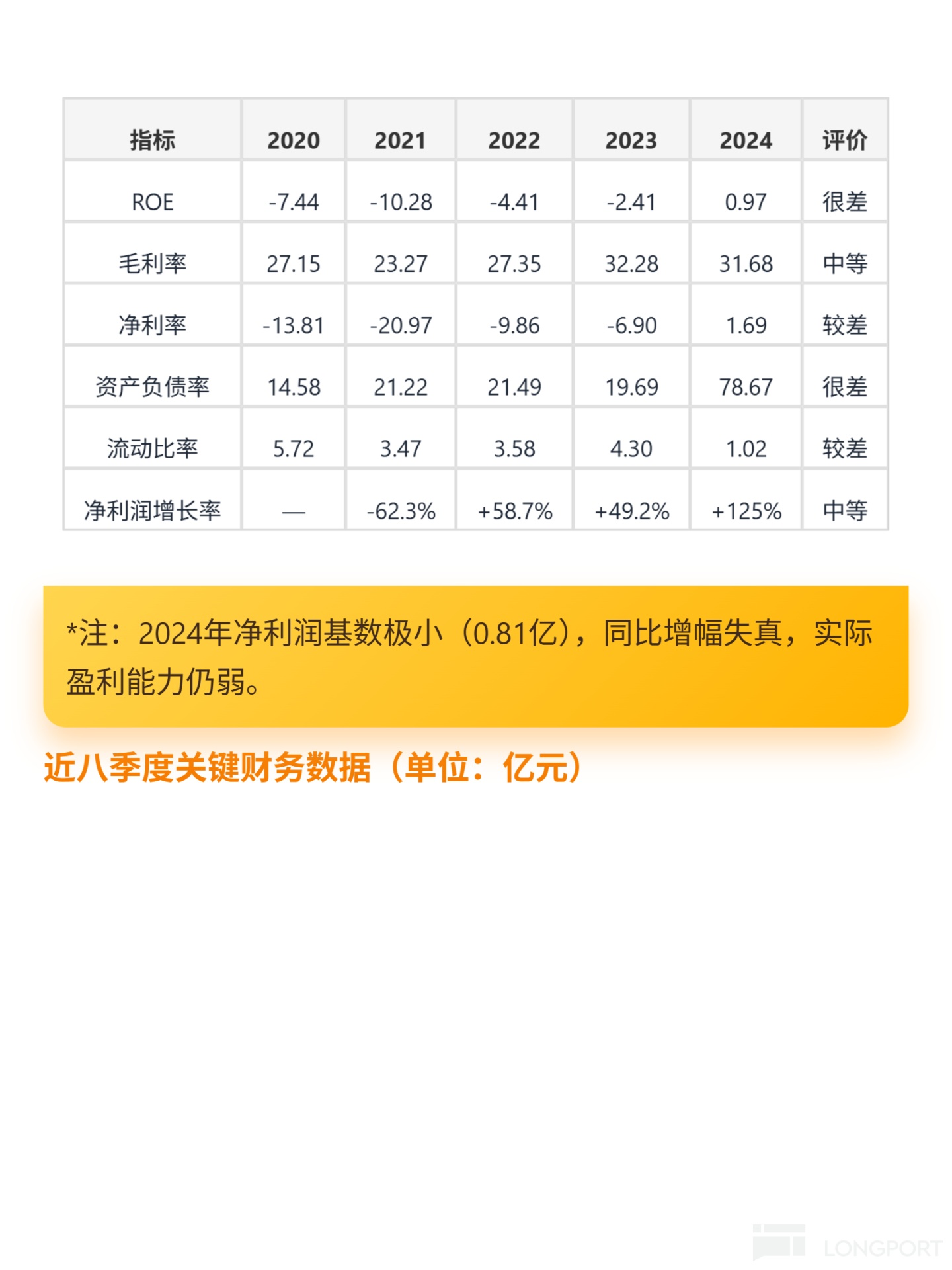

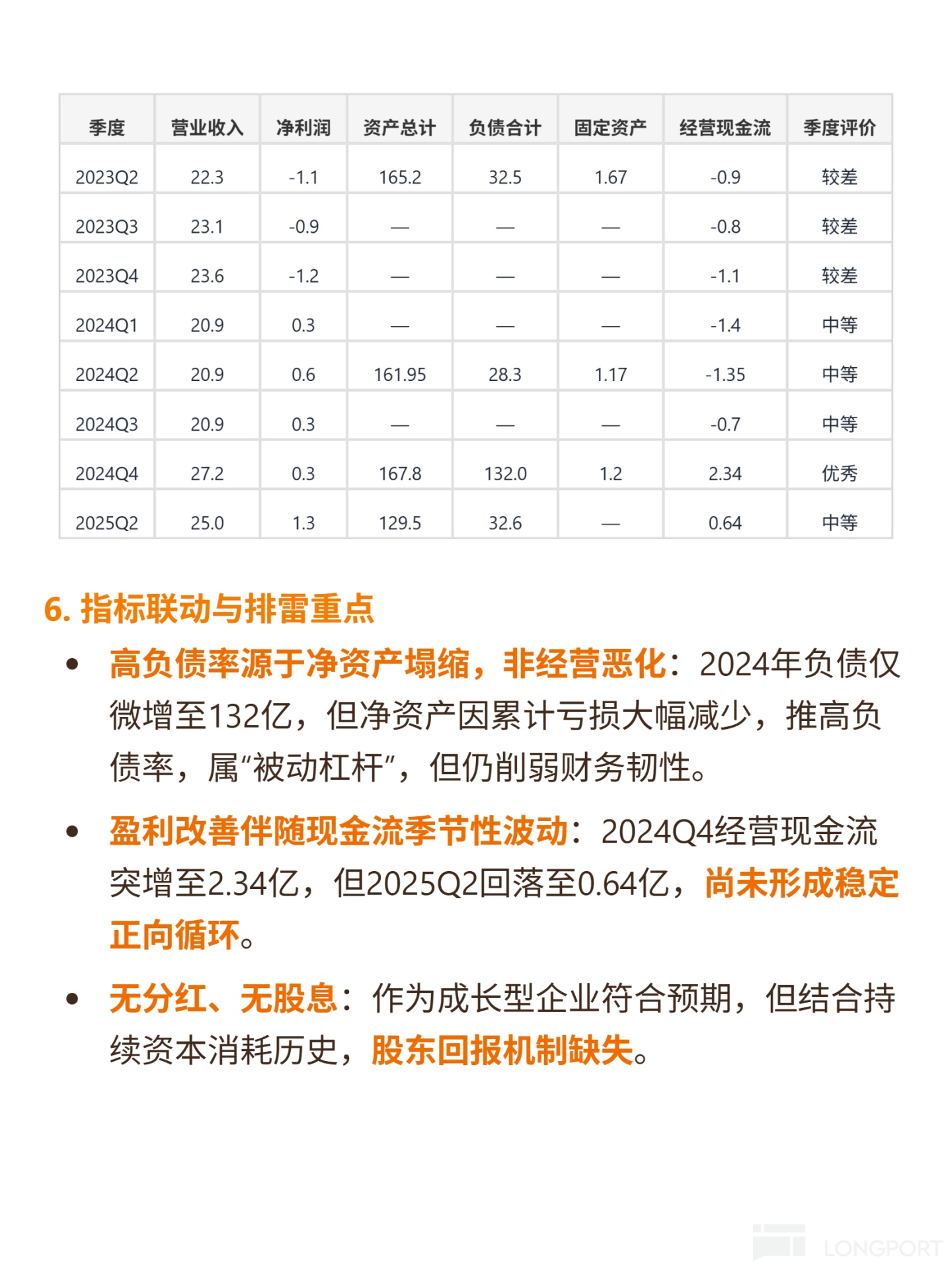

📈 Financial highlights: First marginal profit in 2024 (net margin of 1.69%), ROE turned positive to 0.97%, operating cash flow (¥99 million) and free cash flow (¥65 million) turned positive for the first time in nearly five years. However, three-year revenue CAGR was -13.5% (2021-2024), with profit improvement driven by cost-cutting. The debt-to-asset ratio surged to 78.67%, and the current ratio is close to 1 (1.02), indicating significant short-term liquidity pressure.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.