Rate Of Return

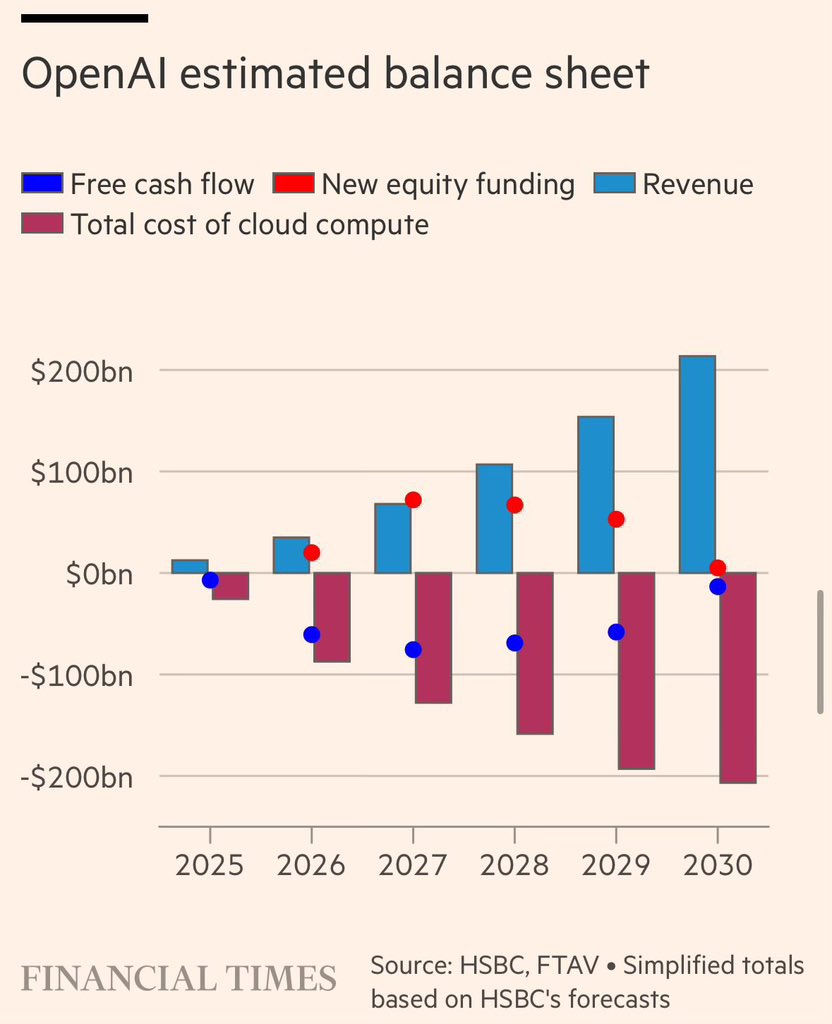

Rate Of ReturnThis might be the most misunderstood chart in the field of artificial intelligence at present.

Everyone sees that OpenAI's revenue will exceed $200 billion by 2030 and considers it a "money-printing machine."

But the real story is darker and more interesting: computing costs and revenue are exploding simultaneously, free cash flow remains negative, and survival depends on continuous equity financing.

This isn't SaaS—it's an arms race. OpenAI is burning cash to buy time, scale, and model advantages—they're betting that whoever reaches "escape velocity" first will rewrite the economic landscape of the future.

The question in AI isn't "Who can make money?"

It's about who can endure the longest and the most losses... and still come out on top.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.