CLF Return Rate

CLF Return Rate Feed Explorer

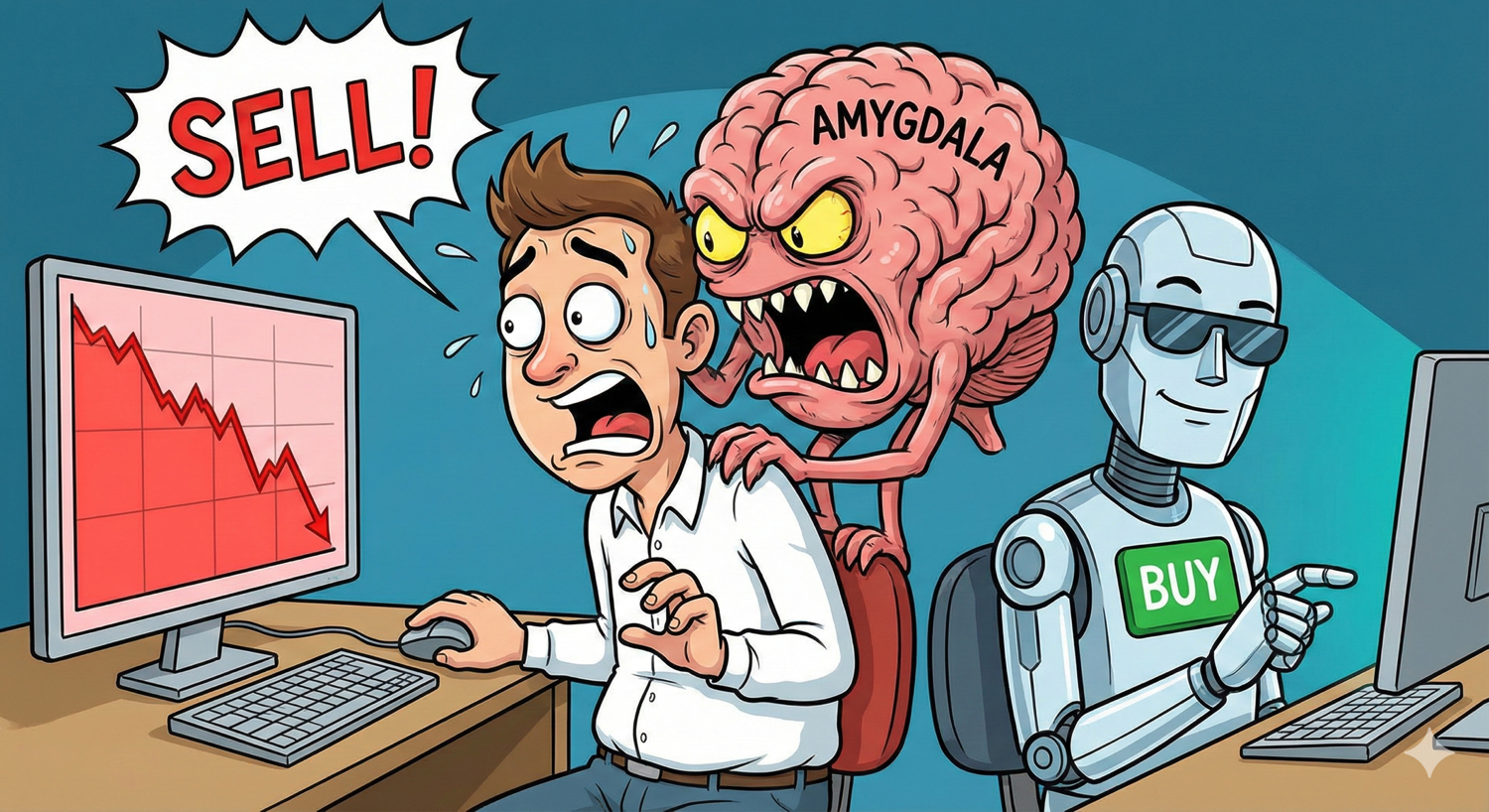

Feed ExplorerThe Self-Portrait of Retail Investors - Haha😂 Feels like nano drew my brain🧠

1. The Biological Trap: Fight or Flight

Your brain is working against you. When stock prices plummet, the fear center in your brain (amygdala) screams at you to "Run away/Cut losses!" Meanwhile, those emotionless, robot-like professional institutions (smart money) are calmly buying the blood-stained chips you panic-sold.

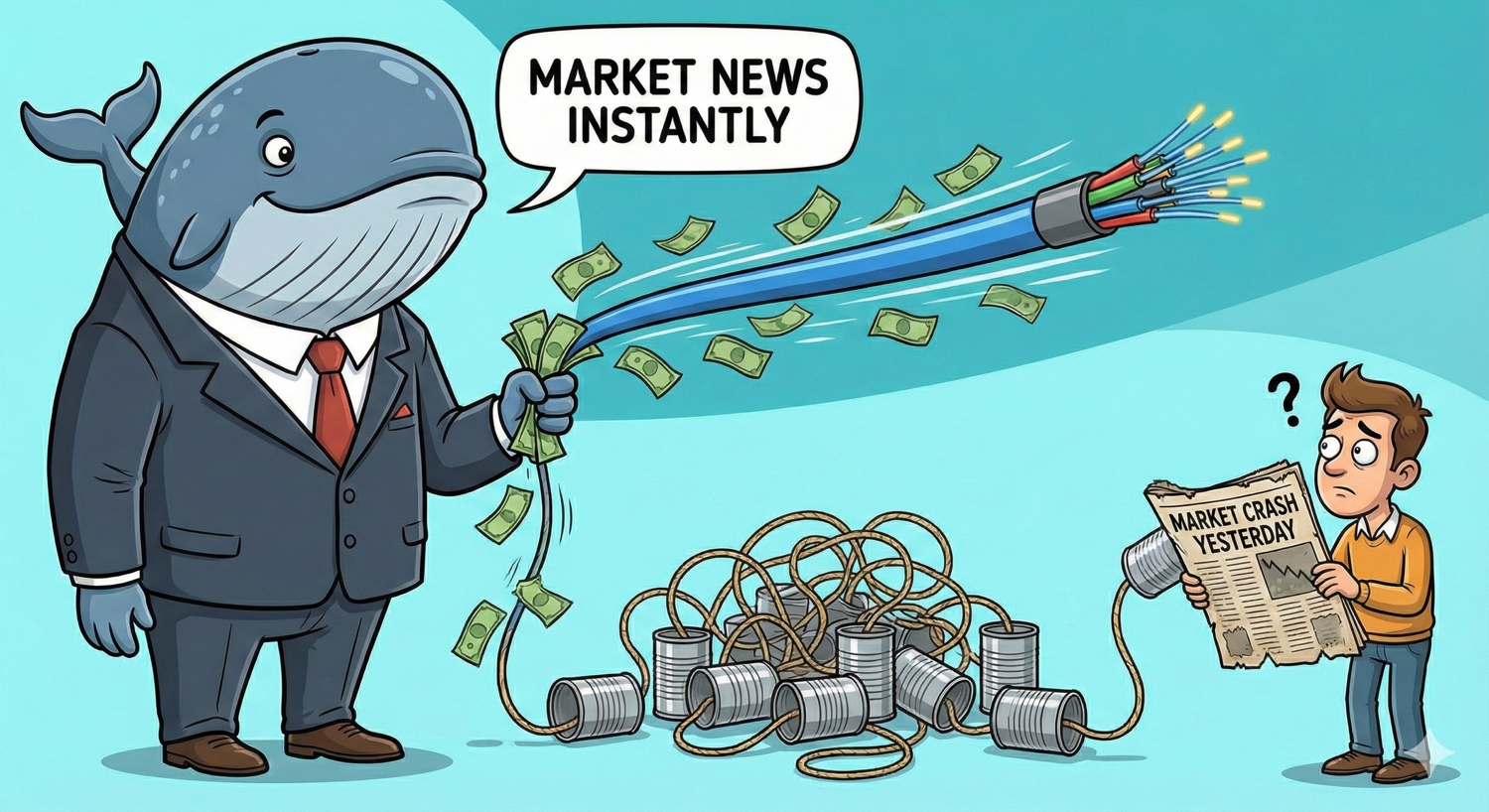

2. The Information Lag You're trading on "old news." Market "whales" get information instantly through dedicated fiber optics and Bloomberg terminals. By the time you see positive news on social media days later, it's already outdated. Jumping in at this point often means you're just "taking over" for those who've already positioned themselves.

3. The "Lottery Ticket" Mindset You want to get rich overnight; institutions want to get rich slowly. With little capital, retail investors always want to turn $5,000 into $50,000 through high-risk options like winning the lottery. "Smart money" pursues steady long-term compound interest. The faster you try to make money, the faster you often lose it.

4. Overconfidence Bias Money earned by luck is lost by skill. One lucky big bet can make retail investors hallucinate that they're "trading geniuses." This overconfidence will make you ignore risks, and eventually, during the next market correction, you'll vomit back all the money you earned, principal and interest included.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.