HK IPO Subscription: Nanhua Futures Shares Subscription Analysis

Nanhua Futures is a leading comprehensive futures company in China, established in 1996 and headquartered in Hangzhou. Its business covers domestic futures brokerage, risk management, wealth management, and overseas financial services. It was listed on the Shanghai Stock Exchange in 2019.

The company plans to allocate the net proceeds of approximately HKD 1.41 billion from the global offering to its Hong Kong subsidiary, Heng Hua International, to strengthen its overseas capital base and expand its international business.

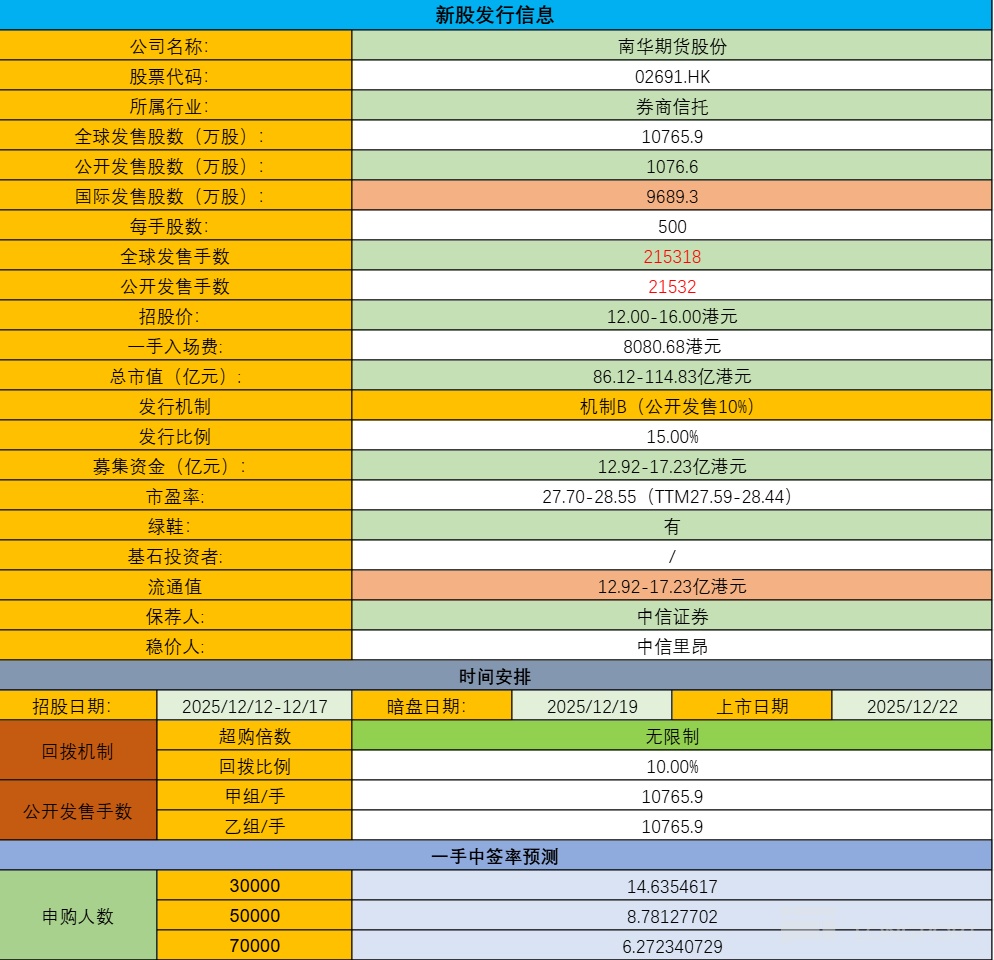

Offering Information and Lottery Rate

The company is offering 107.659 million shares globally, with 500 shares per lot. As of the time of writing, the oversubscription rate is 0.88x. The offering follows Mechanism B, with 107,659 lots each for Group A and Group B. It is estimated that 30,000 to 70,000 investors will participate, with a one-lot winning rate of 10%. Subscribing to 200 lots guarantees one lot.

Financial Performance

Revenue: HKD 954 million in 2022, HKD 1.293 billion in 2023, HKD 1.355 billion in 2024, and RMB 1.273 billion for the last 12 months as of June 30, 2025.

Operating Profit: Gross loss of HKD 296 million in 2022, gross profit of HKD 487 million in 2023, and HKD 519 million in 2024. For the last 12 months as of June 30, 2025, the gross profit was RMB 507 million.

Net Profit: HKD 246 million in 2022, HKD 403 million in 2023, and HKD 458 million in 2024. For the last 12 months as of June 30, 2025, the net profit was HKD 459 million.

In the first half of 2025, the company's operating cash flow showed a net outflow of RMB 440 million, mainly due to an increase in customer deposits and bank balances, while overall liquidity remained stable.

Comprehensive Review

Nanhua Futures was listed on the Shanghai Stock Exchange in 2019 under the A-share name "Nanhua Futures" (Stock Code: 603093). As of Friday's close, the A-share price was RMB 19.30, equivalent to approximately HKD 21.29 per share. The H-share offering price is set at HKD 12.00-16.00, with an H/A premium rate ranging from -43.63% to -24.84%. For comparison, the H/A premium rate of similar futures company Hongye Futures is -69.71%, while most other securities have H/A premium rates between -40% and -60%. In terms of premium rates, this offering holds no appeal.

The only highlight of this offering is CITIC Securities as the sole sponsor and CITIC CLSA as the stabilizing agent. Beyond that, there's little to see. A/H dual-listed stocks have now returned to being ignored. CITIC Securities is also powerless when it comes to A/H stocks—they excel at manipulating sub-HKD 10 billion meme stocks," but that's about it. Especially for these A/H dual-listed stocks, they're just not worth it. But for the sake of making money, what does an unbroken record matter? Besides, every A/H stock that's come before has broken its issue price—so who cares!

There are no other highlights. Financial and securities stocks in Hong Kong generally trade at around 10x P/E, while Nanhua Futures is more than double that. No matter which way you look at it, there's no reason to subscribe. The only hope is that CITIC puts in some effort to avoid making the winners of the lottery too miserable. Looking at this wave, there's not a single good one—mining and auto stocks are actually more normal.

Subscription Plan:

Pass.

$NANHUA FUTURES(02691.HK)

Disclaimer: Investing involves risks, and participation requires caution. The stocks mentioned in this article are for personal trading records only and do not constitute investment advice. If losses occur due to such investments, no responsibility will be taken! If this article is helpful to you, please like, share, and forward it to friends in need. Thank you very much!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.