LMND StockPro

LMND StockPro Lemonade

LemonadeExecution is the moat: Why Lemonade's competitive advantage is the "Great Wall"

In the investment and tech circles, I often hear an extremely arrogant argument: "What you're doing, I can do too, so you have no moat." This is perhaps the biggest lie in the business world. I want to refute this view with a more brutal but realistic perspective: You "can" do it, but you haven't. If you lack this execution before I'm buried, then to me, your so-called "potential" is meaningless, and the moat I've built is the Great Wall.

This is like saying everyone has a chance to win an Olympic gold medal or a Nobel Prize before they die. The theoretical probability of these two things is never zero, and the probability of "the probability not being zero" is even 100%. But what's the point? Business competition doesn't believe in "theoretically possible"—it only believes in "what's already done." Today, I want to use Lemonade (LMND)'s situation in 2025 to discuss why, for those giants still making PPTs about possibilities, $Lemonade(LMND.US) has already become a species they cannot surpass.

The "Frankenstein" Dilemma of Traditional Giants

First, let's talk about the elephants in the room—traditional insurance giants like State Farm and Allstate. There's a naive belief in the market that as long as these giants are willing, they can just write a check to Palantir (PLTR), bring in the most advanced AI models, and crush Lemonade in no time.

Paperbag specifically asked Lemonade's management about this during an earnings call, and their response confirmed my long-standing observation. Traditional insurers don't face a technical problem; they face a genetic problem. If you dig into their backend, you'll find it's a pile of legacy systems: policy management runs on decades-old systems, claims processing uses another vendor, and CRM is from a third party. These systems even require overnight batch processing to sync data. You want to run real-time AI on this fragmented "Frankenstein" architecture? It's like trying to fit a Boeing 747 engine onto a horse-drawn carriage—the result can only be disaster.

Lemonade's Shai Wininger once pointed out sharply: Legacy insurers have been outsourcing data science for over a decade. Aside from rising costs, has consumer experience fundamentally improved? No. Because AI can't just be an add-on "patch"; it must be the foundation. Lemonade has its own operating system called Blender, a unified full-stack system. From the second a user clicks an ad, to AI Maya quoting, LTV prediction, and AI Jim paying claims, all data flows in a closed loop at millisecond speed. This architectural unity is something traditional giants can't buy, no matter how much they spend—unless they have the courage to tear down a century's worth of infrastructure and start over.

But that's not even the deadliest part. The deadliest part is the conflict of interest. State Farm has nearly 20,000 agents; Allstate has over 10,000. Lemonade's core logic is "disintermediation," replacing humans with AI to save 15% in commission costs. If traditional giants do the same and lower prices, what happens to those tens of thousands of agents who rely on commissions? The moment they try to push full automation, their agent network will revolt. So, traditional giants aren't "unable" to do it—they're "unwilling." This internal political deadlock is Lemonade's safest moat.

The Lesson for New Challengers: Data Isn't a Panacea

When we turn to emerging tech challengers, the story is equally fascinating. For years, Tesla Insurance was seen as Lemonade's biggest threat because Tesla had God's-eye-view data on vehicles. In theory, this should have been a dimensionality reduction attack. But the reality of 2024-2025 slapped this "data-only" theory in the face.

Tesla's insurance business hasn't been smooth sailing. Not only did its combined ratio exceed 100%, leading to losses, but it also faced harsh regulatory scrutiny in places like California due to poor claims service and slow response times. This taught us a vivid lesson: Insurance isn't just a data industry; it's a service industry. Calculating that my chance of a car crash is 0.1% is impressive—that's data capability. But when I'm actually in a crash on the highway, standing helplessly on the roadside, I need someone—or an extremely smart AI—to comfort me, arrange a tow truck, handle medical disputes, and navigate complex regulatory compliance. That's service capability.

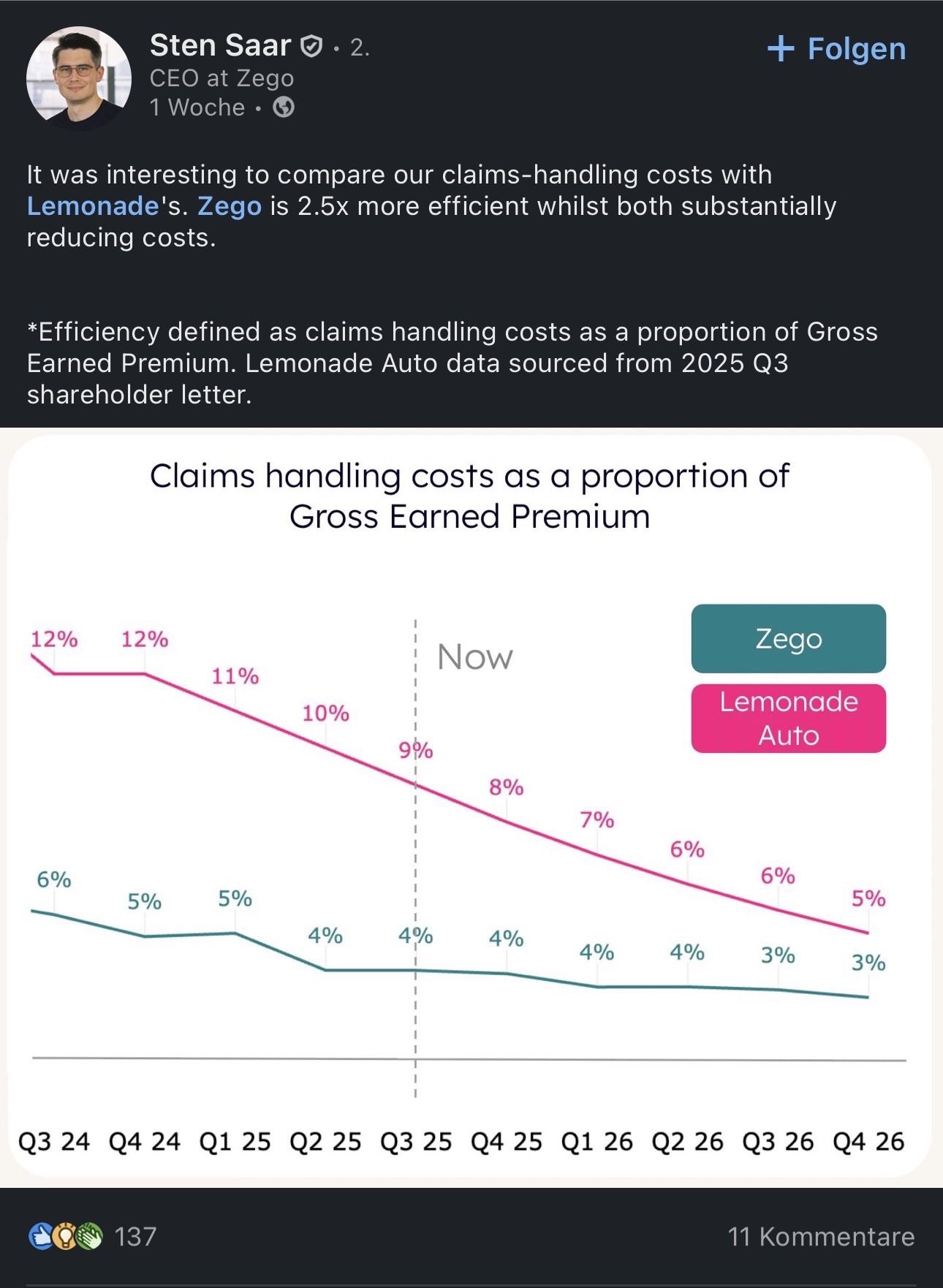

Data advantage alone isn't enough. Tesla thought having data meant it could do insurance, only to stumble in the operational quagmire of "dirty work." In contrast, Lemonade spent a full decade not just training AI algorithms but also training AI's "emotional intelligence" and full compliance systems. Recently, some have compared it to the UK unicorn Zego, claiming Zego has higher claims efficiency in commercial auto insurance. Let me clarify a misconception: Zego deals with B2B commercial fleets—standardized scenarios with easy data access. Lemonade tackles the hardest C-end personal market, facing all sorts of fraud and emotional consumers. In such a complex environment, Lemonade still managed to lower its Loss Adjustment Expense (LAE) ratio to 7% and achieve positive cash flow in Q3 2025, proving it has built a complete, human-tested AI service loop.

The Endgame for Tech Giants: Acquisition Is the Only Ticket

Finally, let's look at the real titans: Google, Amazon, ByteDance. People always assume that if these tech giants want in, Lemonade is finished. Here, I want to cite ByteDance's recent launch of the "Doubao Phone." Before ByteDance did this, all smartphone makers and internet giants were touting "AI OS" and "AI phones" with gorgeous PPTs. But the result? Others didn't do it; ByteDance did. When the Nubia M153, equipped with the Doubao assistant, operates apps like a human, it's no longer a question of "who can do it" but "who has already taken the position."

That fact alone is a moat.

Google once tried Google Compare and failed. Amazon tried Insurance Store and shut it down in 2024. Why? Because they found the ROIC (Return on Invested Capital) of insurance too low, and regulation is extremely fragmented. The U.S. has 50 states, each with its own laws—a nightmare for tech giants pursuing exponential growth and global standardization. They can't recklessly enter the insurance industry and push radical AI reforms because the opportunity cost is too high.

But that doesn't mean they'll stay out forever. My prediction is they'll wait. They'll wait for Lemonade to reach $5 billion or even $10 billion in premiums, proving this AI leverage model can stably achieve "zero marginal cost" profitability. By then, Lemonade will be the only target in the market with a tech stack isomorphic to the giants'—and one that's already solved all the regulatory and operational dirty work for them. The endgame will likely be participation via competition or acquisition. And for Lemonade, whether acquired or growing independently, it means massive value unlocking.

Conclusion

So, back to the opening line. In this world, let's salute those who "have already done it."

State Farm is still figuring out how to balance agent interests. Tesla is still learning how to handle claims complaints. Google is still watching regulatory winds in insurance. Lemonade, meanwhile, is the only company in this no-man's-land that has already coded its core systems, secured licenses in all 50 states, validated its LTV/CAC model, and achieved positive cash flow.

To those who haven't finished the job: Shut up. For us investors, Lemonade's "already done," built through a decade of relentless execution, is the sturdiest Great Wall.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.