Commemorative

Commemorative Traded Value

Traded ValueSo-called "cash management" and "capital-preserving wealth management" are inherently absurd and ironic when applied to a company that markets itself on domestic GPUs, hard technology, and breakthroughs in core technologies. Moore Thread is a red enterprise that has long controlled media channels to repeatedly push narratives like "domestic substitution," "chokepoint," and "strategic security," successfully creating technological and emotional anxiety in the capital markets to secure financing.

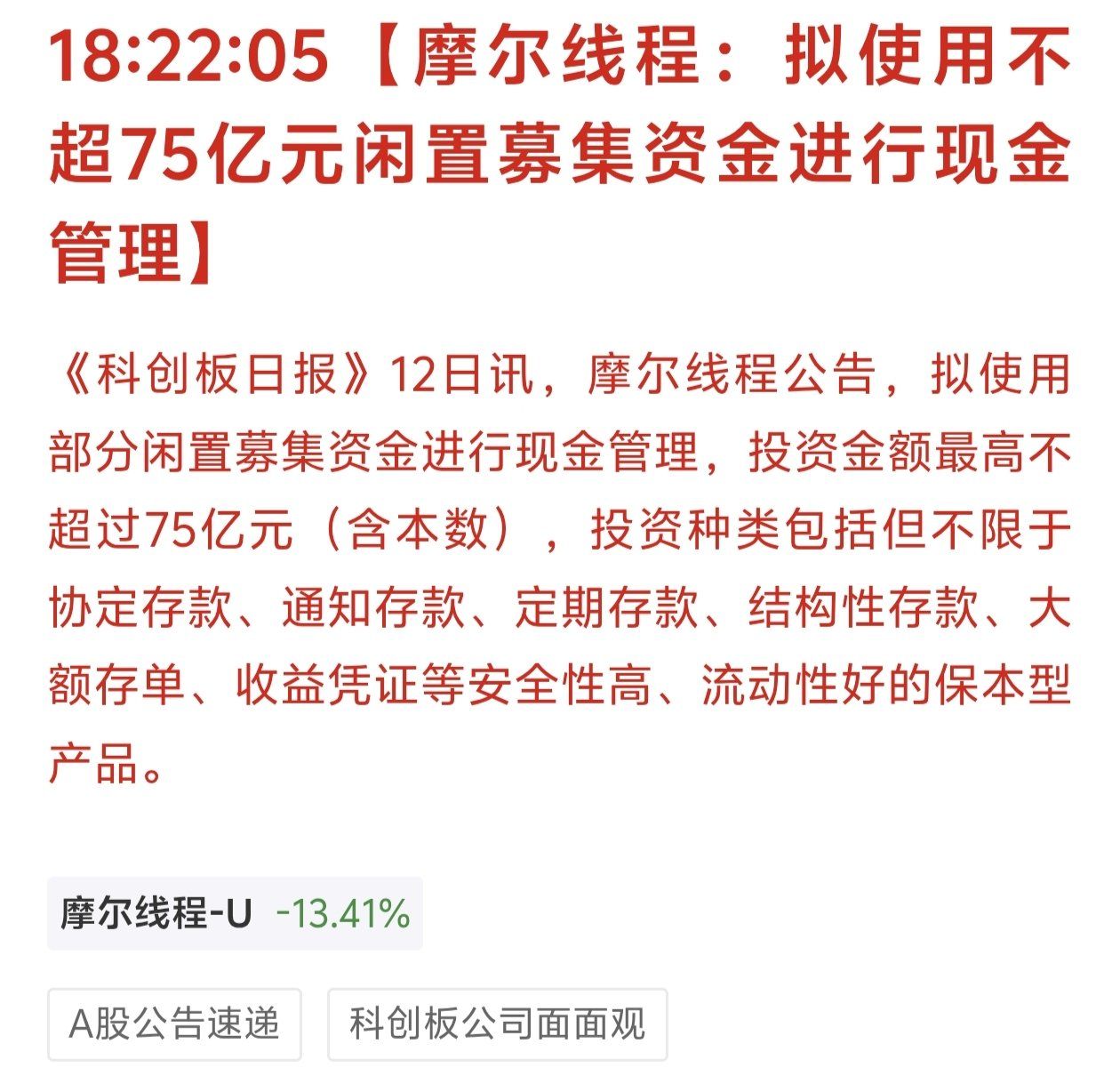

Yet, once the real money was in hand, it allocated up to 7.5 billion yuan of raised funds to low-risk financial products like structured deposits and income certificates.

This is not prudent management—it is a complete betrayal of investors. The original intent of fundraising was to invest in high-risk, high-uncertainty R&D activities that could lead to technological breakthroughs, not to turn investors' money into "quasi-financial assets" on the company's books under the cover of policy protection and patriotic narratives.

This was absolutely premeditated. If a company, at the stage when it most needs to prove its technical capabilities, chooses "capital-preserving wealth management" over "high-intensity R&D," the issue is no longer about "spending money cautiously" but about whether it was always better at capital manipulation and narrative mobilization than actual technological breakthroughs.

Monopolize the narrative with power, then leverage the narrative to secure resources—resources that are not used for the goals promised in the narrative. Moore Thread's case is practically textbook. Create security anxiety, amplify the tech myth through state media, secure financing under the guise of "national need," and ultimately avoid real technological risks, passing the costs to the market while locking profits into leaders' overseas bank accounts.

Using "national narratives" to secure financing is purely a monetization of power endorsement—it's corruption. If an ordinary consumer goods company invested the money, no one would complain. But you secured financing through national narratives, state media amplification, and strategic rhetoric.

Brief explanation: The raised funds refer to money previously secured from the market through IPOs, private placements, and bond issuances, originally stated in the prospectus as "for R&D and production-line ecosystem development." Now, they say the original purpose of the fundraising is no longer needed—wait for further notice while they deposit it into "Yu'ebao" to earn interest.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.