Sanmei Stock 4000-word in-depth Research Report

$Sanmei(603379.SH)$ZJJH(600160.SH) $DONGYUE GROUP(00189.HK) Recently researched Sanmei Shares, the core is the oligopoly of fluorine refrigerants under policy quotas, achieving profit explosion through product price increases.

🎯 Mainly produces second and third-generation fluorine refrigerants, the industry is controlled by China's quota system forming entry barriers, with high CR5 concentration; demand is weakly cyclical essential consumables (e.g., air conditioners), third-generation remains mainstream; currently extending to fluorine fine chemicals (lithium hexafluorophosphate, PVDF), integrated layout to hedge cycles.

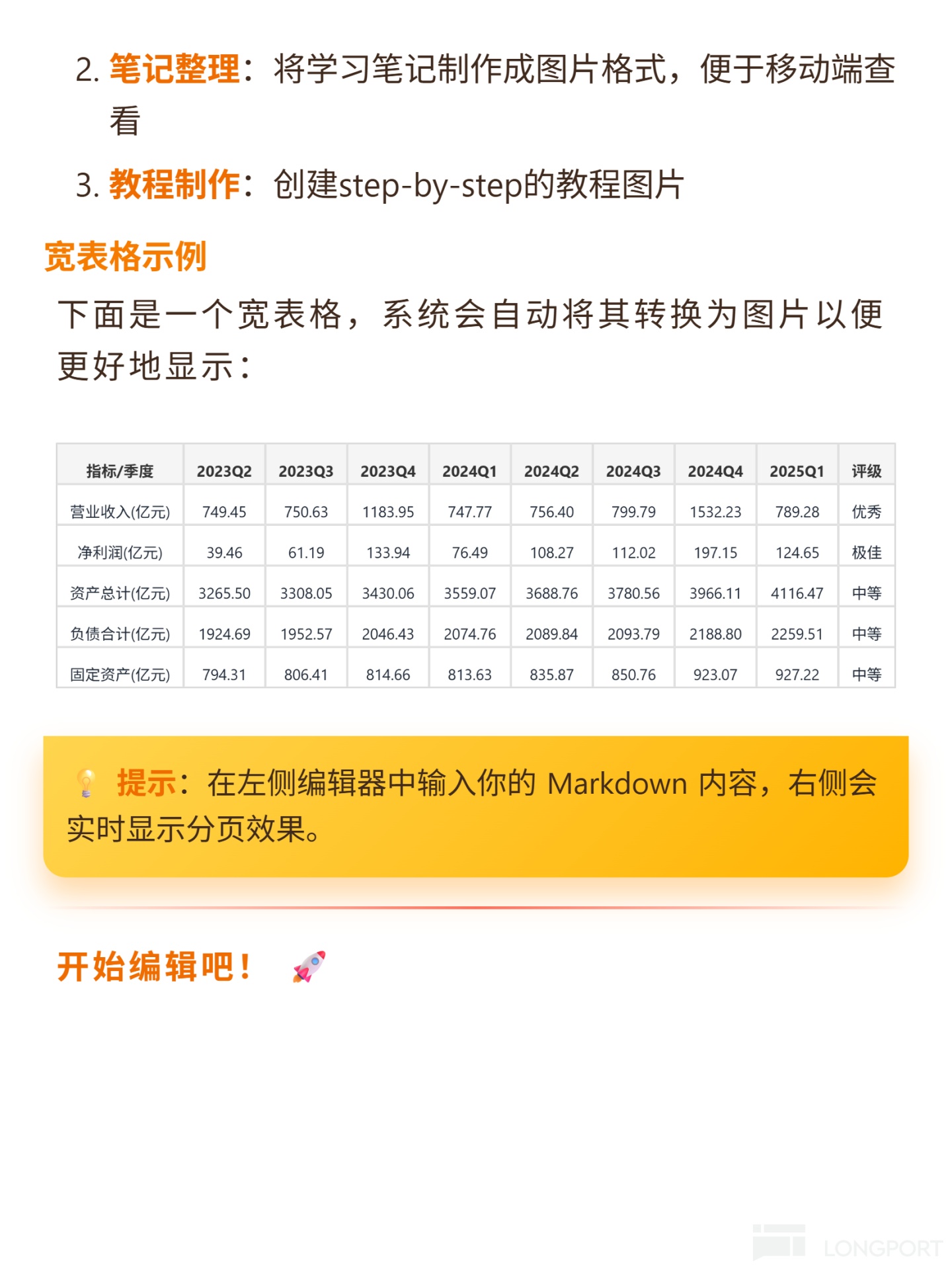

📈 Q1-Q3 2025 revenue 4.429B (+45.72%), net profit 1.591B (+183.66%), gross margin 50.73%, net margin 35.67%; profit growth mainly due to 56.5% average refrigerant price increase (quota contraction); ROE 22.64% (driven by high net margin, debt ratio only 17.43%); operating cash flow 1.561B, net profit cash ratio 98.1%, free cash flow turned positive; sales expense ratio 1.07%, stable clients.

🔍 Risks: profits rely on product increases, need to watch for cycle downturns; sales growth steady, no significant market share expansion.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.