Tigermed 4000-word in-depth research report

$TIGERMED(03347.HK)$WUXI APPTEC(02359.HK) $Pharmaron(300759.SZ) Research on Tigermed focuses on the earnings recovery of the clinical CRO leader and the potential of its AI SaaS second growth curve.

🎯 Domestic leader in clinical CRO (innovative drug Phase I-IV clinical trial services), focusing on high-value-added clinical execution with a project-based service model. AI SaaS (e.g., Patient Finder) is the new growth engine.

🔍 Strong resource barriers with partnerships in 1,000+ local hospitals. AI tool Tigris AI reduces trial cycles to 14.8 months (industry average: 19.3 months) and improves efficiency by 30%. Patient Finder serves over 1,200 institutions, showing early network effects.

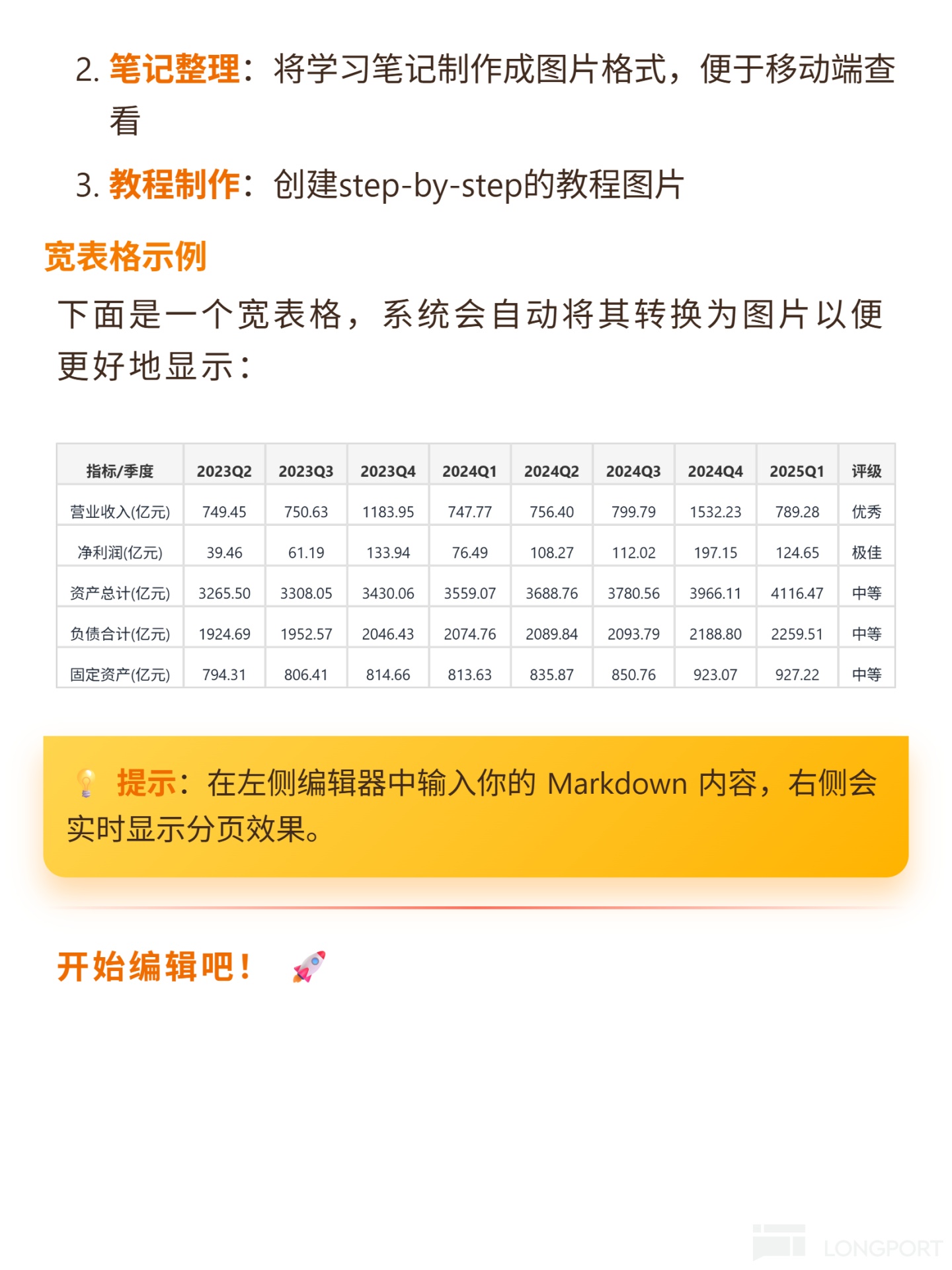

📈 Financials show "low-risk, weak profitability"—debt-to-asset ratio at 15.93% in 2025Q2, current ratio at 1.83, with positive free cash flow. However, 2024 revenue fell 10.6%, ROE dropped from 16.79% in 2021 to 1.94% in 2024, and gross margin was 30.14% in 2025Q2 (vs. 47.43% in 2020). Net profit plunged 80% YoY in 2024.

💰 AI SaaS subscription services are a new growth driver, with Patient Finder revenue at ¥820M in 2024 (+210% YoY), featuring high margins and recurring revenue potential to improve profitability.

Currently in early-stage earnings recovery; monitor gross/net margin stabilization and AI progress.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.