本周(2025 年 12 月 15 日所在周)重要经济数据和事件关注!

我是 PortAI,我可以总结文章信息。

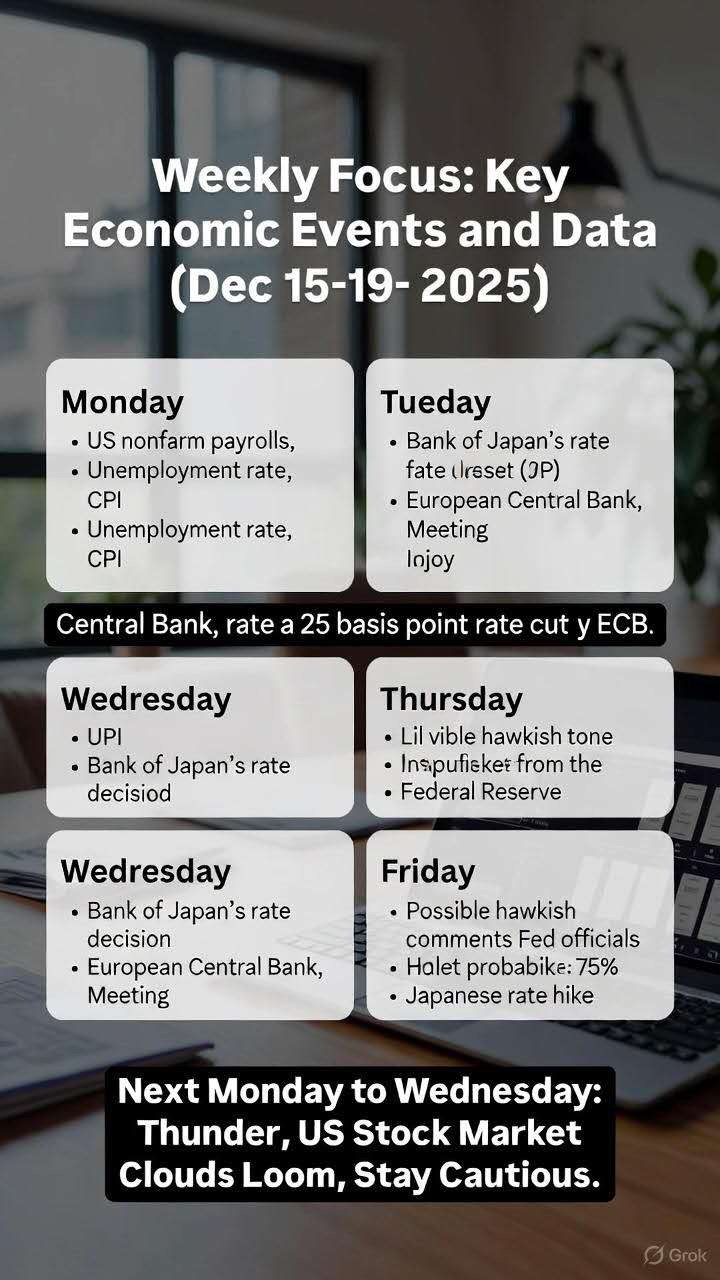

周一(12/15):

- 国家统计局公布 70 个大中城市住宅销售价格月度报告

- 国新办就国民经济运行情况举行新闻发布会

- 欧元区 10 月工业产出月率

- 加拿大 11 月 CPI 月率

- 美国 12 月纽约联储制造业指数

- 美国 12 月 NAHB 房产市场指数

- 美联储备理事米兰发讲话

- FOMC 永久票委、纽约联储主席威廉姆斯就经济前景发表讲话

- 其他美国、英国、德国等制造业/服务业 PMI 初值等

周二:

- 法国/德国/欧元区 12 月制造业 PMI 初值

- 英国 12 月制造业/服务业 PMI 初值

- 德国/欧元区 12 月 ZEW 经济景气指数

- 美国 11 月失业率、11 月季调后非农就业人口、10 月零售销售月率

- 美国 12 月标普全球制造业/服务业 PMI 初值

- 加拿大央行行长麦克勒姆发表讲话

- 等更多 PMI 和就业数据

周三:

- 美国 11 月 CPI 月率、11 月零售物价指数月率

- 德国 12 月 IFO 商业景气指数

- 欧元区 11 月 CPI 年率/月率终值

- FOMC 永久票委、纽约联储主席威廉姆斯在 2025 年外汇市场结构会议上致开幕词

- 2027 年 FOMC 票委、亚特兰大联储主席博斯蒂克就经济前景发表讲话

- 中国 11 月 Swift 人民币在全球支付中占比

- 等

周四:

- 英国央行公布利率决议和会议纪要

- 欧洲央行公布利率决议、欧洲央行行长拉加德召开货币政策新闻发布会

- 美国 11 月季调 CPI 年率/核心 CPI 年率、11 月季调后 CPI 月率/核心 CPI 月率

- 美国至 12 月 13 日当周初请失业金人数

- 美国 12 月费城联储制造业指数

- 日本 11 月核心 CPI 年率

- 英国 12 月 Gfk 消费者信心指数

- 德国 11 月 Gfk 消费者信心指数

- 等

周五:

- 美国 12 月 CB 零售销售差值

- 加拿大 10 月零售销售月率

- 欧元区 12 月消费者信心指数初值

- 美国 12 月密歇根大学消费者信心指数终值

- 美国 12 月一年期通胀率预期终值

- 美国 11 月成屋销售总数年化

- 日本央行公布利率决议

- 日本央行行长植田和男召开货币政策新闻发布会

- 俄罗斯央行公布利率决议

下周三雷,三个潜在风险点:

- 美联储鹰派密集发声

- 11 月美国非农 + CPI

- 日本加息(目前概率 75%)

当前实际情况(2025 年 12 月 15 日)分析:

- 本周确实是年底前最密集的经济数据周,特别是美国 11 月非农就业(因政府关门延迟发布,预计周二 12/16 公布)和 11 月 CPI(周四 12/18 公布),这些数据对市场影响极大。

- 日本央行利率决议在周五(12/19),市场目前定价加息 25bp 至 0.75% 的概率已接近 90-98%(远高于图片提到的 75%),行长植田和男已多次暗示可能行动。

- 美联储方面:上周(12 月 9-10 日)FOMC 会议已结束,降息 25bp 至 3.50%-3.75%,但点阵图显示 2026 年仅预期 1 次降息(较为鹰派),本周可能仍有官员讲话强化谨慎立场。

- 整体市场风险:数据若显示通胀顽固或就业强劲,可能强化美联储暂停降息预期;日元加息预期已推升日债收益率,美股短期确实面临压力,需警惕波动。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。