Rate Of Return

Rate Of Return AGQ Return Rate

AGQ Return RateGold up! Silver up!

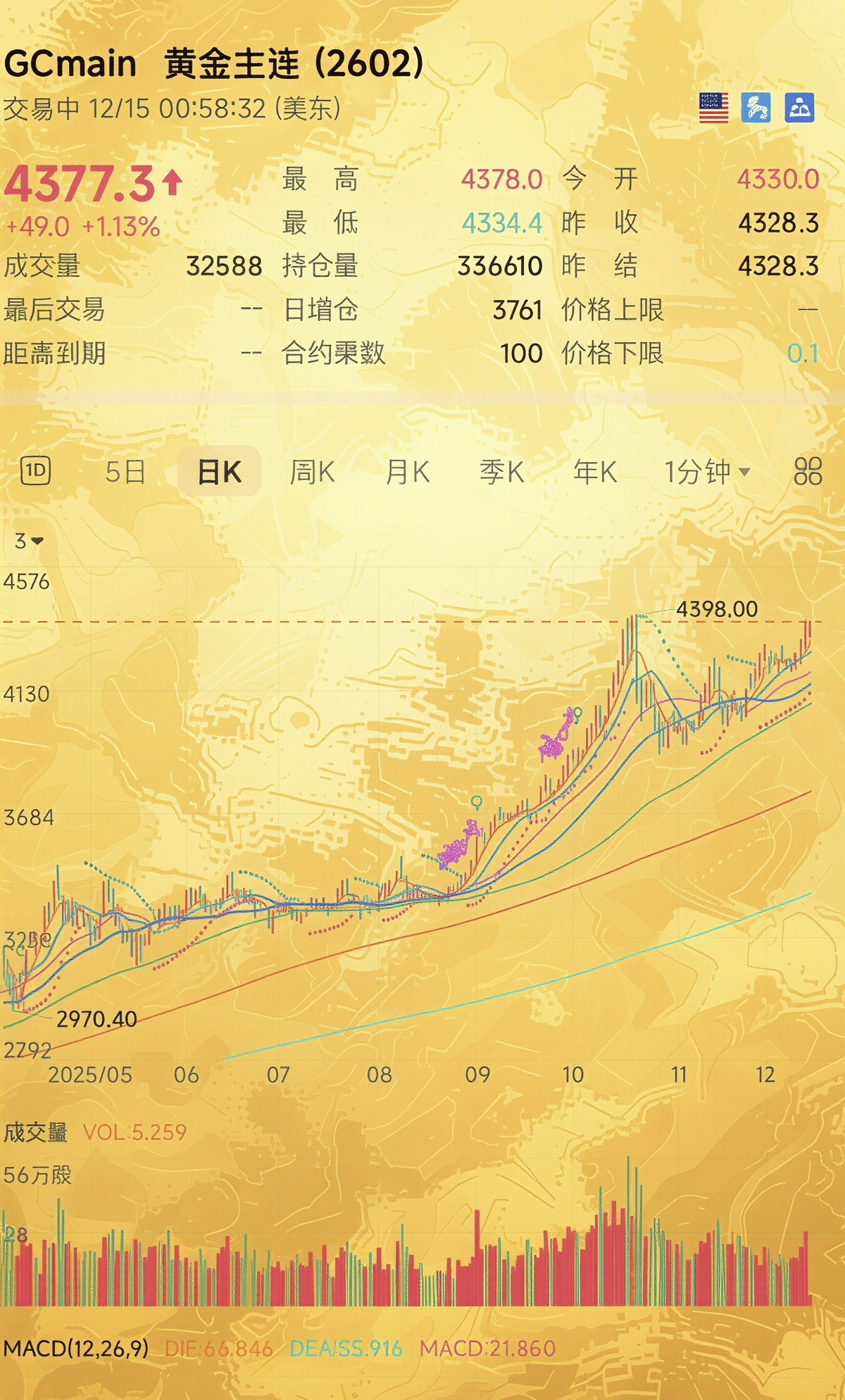

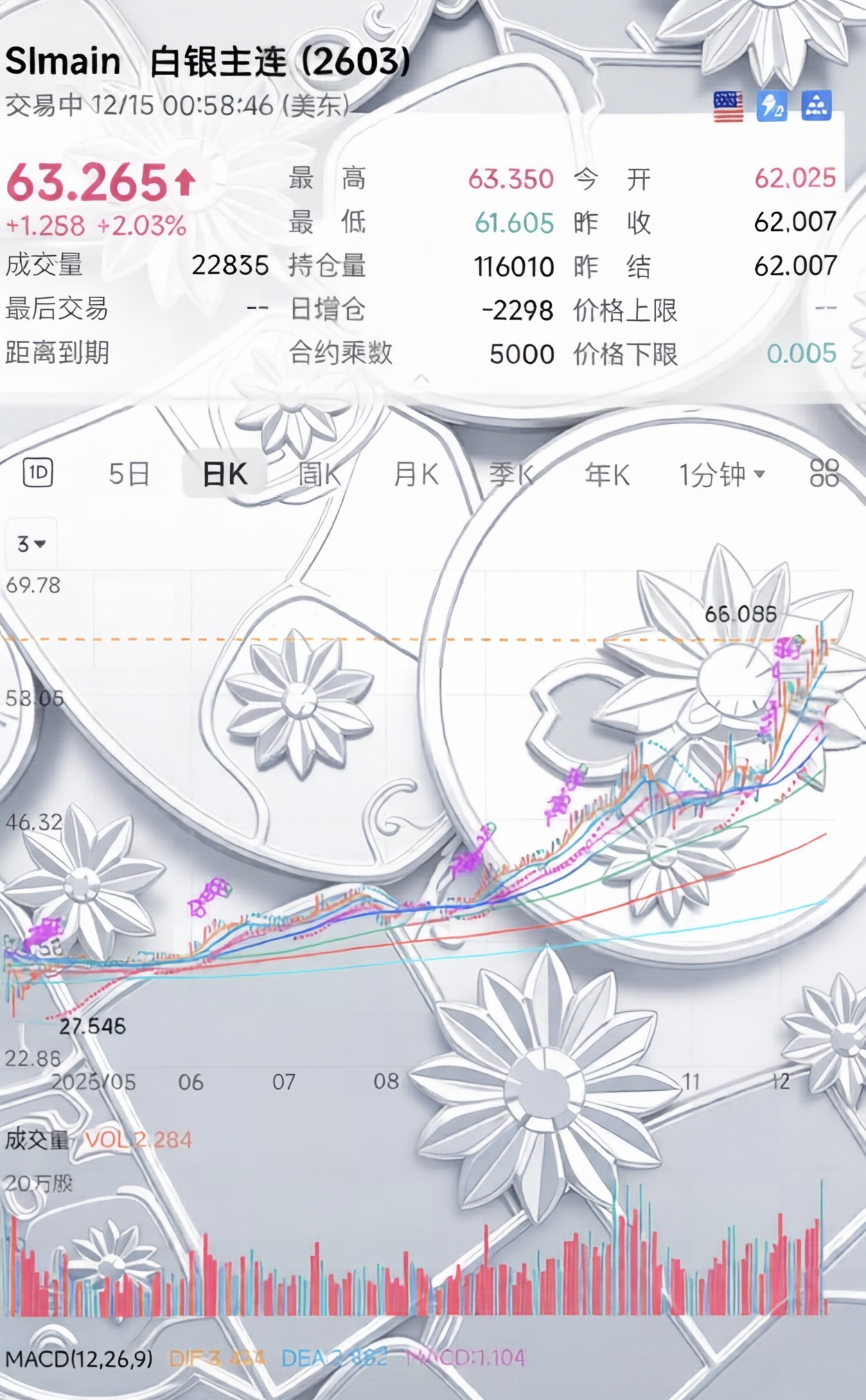

The current gold price has surpassed the $4,300 mark, approaching historical highs with strong market sentiment. Technically, the daily K-line chart of gold futures (GCmain) shows prices in an upward channel, with the MACD indicator forming a golden cross and strong short-term momentum. Silver futures (SLmain) are also strengthening, indicating broad investor favor towards precious metals.

Future Trend Analysis:

Short-term Drivers:

- U.S. November non-farm payrolls and CPI data will influence Fed policy outlook. Weak data or easing inflation may strengthen rate cut expectations, benefiting gold.

- An unexpected rate hike by the Bank of Japan could briefly suppress gold prices, but long-term trends depend on global monetary policy divergence.

Medium-term Logic:

- Geopolitical risks (e.g., Middle East tensions, Russia-Ukraine conflict) and safe-haven demand remain core supports for gold.

- The inverse correlation between the U.S. dollar index and gold suggests further gains if the dollar weakens on Fed rate cut expectations.

Long-term Perspective:

- Central banks' continued gold reserve accumulation (2025 global central bank purchases hit record highs) underpins structural demand.

- Inflation expectations and real interest rates remain key determinants of gold's equilibrium price.

Key Risks:

- Policy Risk: Delayed Fed rate cuts or hawkish signals may trigger gold price corrections.

- Technical Risk: Current prices near previous resistance levels; failure to break through could lead to pullbacks.

- Liquidity Risk: Overheated sentiment makes markets vulnerable to sudden sell-offs (e.g., geopolitical de-escalation, strong economic data).

Monitor market reactions to Friday's BoJ decision and U.S. jobs data, alongside position and volume trends for continuity signals.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.