Preferred choice for hard tech investment: Analysis of the allocation value of E Fund Dual Innovation 50ETF

Author: Baosheng

Recently, hard-tech ETFs have seen a surge in issuance, with thematic products like AI-focused and semiconductor-focused ETFs being launched intensively, attracting continuous capital inflows into the tech sector. For ordinary investors, how to filter out products that balance breadth and efficiency among the many options? E Fund CSI STAR and ChiNext 50 ETF (159781), with its core advantages of cross-market coverage, high liquidity, and low fees, has become a preferred tool for investing in the hard-tech sector. Below is an in-depth analysis combining screening logic and peer comparisons.

1. Hard-Tech Fund Screening Logic: Product Fit Under a Three-Dimensional Framework

Scientific screening of hard-tech funds should focus on three core dimensions: coverage breadth, operational efficiency, and risk diversification. The E Fund CSI STAR and ChiNext 50 ETF (159781) precisely matches this logical framework.

(1) Coverage Breadth: Cross-Market Layout to Overcome Sector Limitations

The core challenge in hard-tech investing is that a single sector cannot fully capture industry dividends—the STAR Market focuses on cutting-edge hard-tech but some companies are still in the growth stage, while the ChiNext Market has mature growth stocks but lacks cutting-edge tech exposure. The CSI STAR and ChiNext 50 Index, tracked by E Fund CSI STAR and ChiNext 50 ETF (159781), selects 50 leading companies with large market caps and good liquidity from these two markets, with ChiNext accounting for 57.85% and STAR Market for 42.15%. It perfectly covers core sectors like electronics (38%), power equipment (24%), and communications (22%), enabling one-stop exposure to high-growth areas such as semiconductor localization, new energy, and AI infrastructure.

(2) Operational Efficiency: Dual Advantages of Scale and Fees

Investment efficiency directly impacts long-term returns. The E Fund CSI STAR and ChiNext 50 ETF (159781) excels in key metrics:

· Scale and Liquidity: As of December 2025, the fund size reached RMB 11.963 billion, with an average daily turnover of RMB 274 million over the past 20 trading days. The ample scale avoids the impact of subscriptions and redemptions seen in smaller funds, while high liquidity reduces slippage costs for large trades, with significantly lower premium/discount volatility compared to smaller peers.

· Fee Costs: The total expense ratio is only 0.20% (0.15% management fee + 0.05% custody fee), far below the 1.5%-2.0% annual fees of actively managed tech funds, allowing long-term holders to amplify cost advantages through compounding.

(3) Risk Diversification: The Natural Advantage of Indexing

Hard-tech sectors are highly volatile, making diversification key to risk control. The E Fund CSI STAR and ChiNext 50 ETF (159781) achieves natural diversification through cross-market and cross-sector allocation of its 50 constituents. The top 10 holdings account for over 52%, retaining the elasticity of leaders like CATL, SMIC, and Cambricon while avoiding the impact of single-stock black swan events. With an annualized tracking error of just 0.25%, it accurately replicates index returns while controlling additional risks.

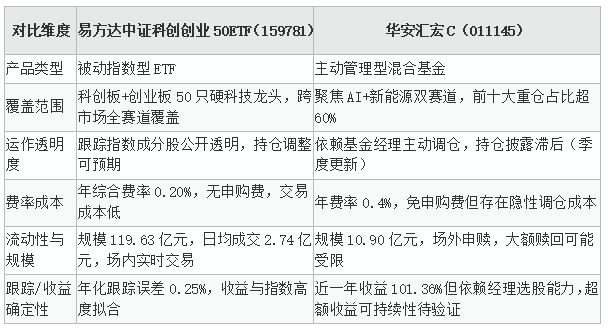

2. Peer Comparison: E Fund 159781 vs. Huaan Huihong C (011145)

Using the widely followed Huaan Huihong C (011145) as a comparison, the two differ significantly in product type, operational model, and use cases, with E Fund CSI STAR and ChiNext 50 ETF (159781) offering more prominent allocation advantages.

The comparison shows that while Huaan Huihong C (011145)’s active management may generate alpha in specific market conditions, it suffers from sector concentration, low transparency, and scale limitations. In contrast, the passive indexing approach of E Fund CSI STAR and ChiNext 50 ETF (159781) better aligns with ordinary investors’ core needs for the hard-tech sector: “long-term exposure, risk diversification, and cost control.” Especially amid increasing structural divergence in the tech sector, its cross-market broad-based nature provides better resilience against single-sector adjustments.

3. Practical Strategies: Use Cases and Allocation Methods for E Fund 159781

Given the current market environment and product features, E Fund CSI STAR and ChiNext 50 ETF (159781) can adapt to different investment needs, forming an integrated “universal logic + product fit” approach.

(1) Strategy by Investment Horizon

· Long-Term Dollar-Cost Averaging (3-5 years): Hard-tech industries are supported by policies and innovation, with solid long-term growth logic. Investors can invest fixed amounts on fixed dates monthly, leveraging the product’s low fees to maximize compounding effects, smoothing market volatility costs, and benefiting from trends like semiconductor localization and AI adoption.

· Short-Term Trading: With an average daily turnover of RMB 274 million, the product ensures smooth entry and exit. After sector pullbacks (e.g., valuations falling below the 50% historical percentile), investors can moderately increase positions to capture rebounds but should limit allocation (recommended ≤30% of the portfolio) to avoid chasing highs.

(2) Allocation by Risk Appetite

· Conservative Investors: Use E Fund CSI STAR and ChiNext 50 ETF (159781) as the core tech allocation (15%-20% of the portfolio), paired with broad-based ETFs (e.g., CSI 300 ETF) and bond funds, forming a balanced “growth + stability” mix to reduce single-sector volatility.

· Growth-Oriented Investors: Use E Fund CSI STAR and ChiNext 50 ETF (159781) as the base (70% of tech allocation), supplemented by thematic ETFs (e.g., semiconductor ETF), balancing broad-based risk control with sector-specific upside.

· Off-Exchange Investors: Investors without brokerage accounts can participate via feeder funds (Class A 013304/Class C 013305), which invest in the ETF and trade at NAV, avoiding on-exchange premium risks.

(3) Current Allocation Timing

After the tech sector’s correction since October, valuations are gradually returning to reasonable levels, and overseas rate-cut expectations have eased macro pressures. Investors can adopt a “phased entry” strategy: initially allocate 40% of the target position, add 30% if the index falls >10%, and adjust the remaining 30% flexibly based on quarterly earnings, balancing opportunity capture and short-term risk control.

4. Risk Disclosures and Investment Notes

1. Market Volatility Risk: Hard-tech sectors are highly volatile. The CSI STAR and ChiNext 50 Index has historically experienced drawdowns exceeding 70%, and the ETF’s NAV may fluctuate significantly with the index. Short-term investors should proceed cautiously.

2. Liquidity Risk: While the product currently has good liquidity, extreme market conditions may widen premiums/discounts or reduce trading volume. Investors should avoid large concentrated trades.

3. Industry Policy Risk: Tech industries are policy-sensitive. Adjustments to supportive policies or slower-than-expected tech breakthroughs may lead to valuation downgrades.

4. Investment Discipline: This article does not promise any returns. Investors should tailor allocation plans to their risk tolerance, avoid “chasing highs and selling lows,” and align long-term holdings with industry cycles rather than short-term sentiment.

Conclusion

Amid the surge in hard-tech ETF issuance, E Fund CSI STAR and ChiNext 50 ETF (159781) stands out with its core advantages of “cross-market coverage, high liquidity, low fees, and strong diversification.” Compared to actively managed products like Huaan Huihong C (011145), its passive indexing approach better suits ordinary investors’ needs for hard-tech exposure. Investors can leverage this tool through dollar-cost averaging or portfolio allocation, adhering to risk discipline while capturing the long-term growth opportunities in China’s hard-tech industry.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.