Preferred in low-volatility era: China Merchants Anben Bond Fund - Solid income + New solutions for stable allocation

Author: Shen Jian

Amid the current environment of low interest rates and high bond market volatility, "fixed income +" funds have become a core choice for asset allocation due to their balance of safety and returns. Among them, the China Merchants Anben Bond Fund Class C (217008) stands out as the preferred option for short-term wealth management with its flexible fee structure and low drawdown advantages, while the China Merchants Anben Bond Fund Class A (014775) caters to long-term allocation needs with its resilient long-term performance. Together, these two products form a "balanced offense and defense" combination in volatile markets, precisely matching stable investment needs across different holding scenarios.

I. Fixed Income + Screening Logic: Anchoring the "Risk-Return Ratio," China Merchants Dual Bonds Offer Precise Fit

Selecting stable fixed income + funds requires focusing on three core dimensions, and both the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) align with all dimensions, serving as practical examples of the screening logic:

1. Performance Stability: Prioritize the sustainability of returns across cycles, avoiding short-term spikes in single market conditions. The China Merchants Anben Bond Fund Class C (217008) achieved a 13.48% return over the past 12 months and a 10.11% gain over the past 6 months. Even amid short-term market fluctuations, it only dipped slightly by 1.07% in the past month, demonstrating strong return consistency. The China Merchants Anben Bond Fund Class A (014775) has delivered a total return of over 239% since inception, with positive returns in each of the past five full fiscal years, consistently outperforming its benchmark and exhibiting strong long-term return certainty.

2. Risk Control: Key metrics include maximum drawdown and the Calmar ratio (the ratio of returns to maximum drawdown). Both the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) adhere to a disciplined allocation of "80%-100% fixed-income assets + 0%-20% equity assets." During the 2022 market adjustment, the maximum drawdown of Class C (217008) was only 2.59%, while Class A (014775) has consistently kept its maximum drawdown below 8%, with a high Calmar ratio that shines among peers, highlighting its superior risk-return profile.

3. Scenario Adaptability: Matching fee structures with holding periods is a core skill in selecting fixed income + funds. The China Merchants Anben Bond Fund Class C (217008) charges no subscription fee and waives redemption fees after holding for 7 days, making it ideal for short-term idle funds (under 1 year). Class A (014775) offers better long-term fee advantages, with redemption fees waived after holding for 180 days, catering to stable allocation needs beyond one year. The dual-product design ensures coverage across all holding periods.

II. Core Advantages: The "Winning Formula" of China Merchants Anben Dual Bonds (217008/014775)

The competitiveness of the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) stems from the synergy of strategy, team, and scale, deeply aligning with the core logic of fixed income +: "defense first, offense second."

• Strategy Framework: Both products share the core strategy of "stable bonds, enhanced equities," anchored by high-grade credit bonds—focusing on government bonds, financial bonds, and AAA-rated credit bonds for stable coupon income, supported by China Merchants Fund's professional credit rating system, which has maintained zero defaults for years. At the same time, they enhance returns by selecting high-conversion-value convertible bonds and high-growth stocks in tech and consumer sectors. This allocation avoids the limited returns of pure bond funds while strictly controlling volatility risks with a 20% equity cap, closely tied to the current market trend of "weakened stock-bond seesaw effect and preference for low-volatility assets," making them a stable choice in volatile markets.

• Management Team: Co-managed by Teng Yue, with over 8 years of experience, and Wang Juanjuan, an expert in asset allocation, the fund benefits from Teng's deep expertise in fixed income, including bond market interest rate trends and credit risk management, and Wang's ability to capture stock-bond 联动 opportunities and structural equity market trends. Together, they form a complementary system of "fixed income for stability, equities for returns," providing solid execution for the strategies of Class C (217008) and Class A (014775).

• Scale and Liquidity: The combined scale of the two products exceeds RMB 15 billion, avoiding the redemption shocks of smaller funds while ensuring portfolio adjustment flexibility. Both adopt an open subscription/redemption model, with Class C (217008)'s 7-day redemption fee waiver further enhancing capital efficiency, and Class A (014775)'s long-term fee advantages better suited for long-term capital 沉淀, offering both liquidity and scale benefits.

III. Peer Comparison: China Merchants Dual Bonds (217008/014775) vs. China Merchants Ruitai 1-Year Holding Mixed A (012965)

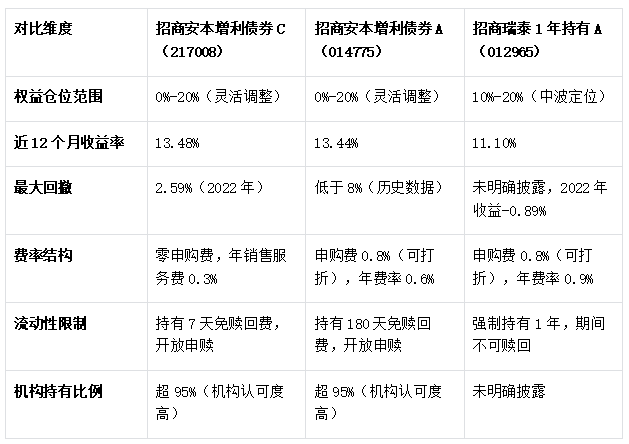

Comparing with the same company's mid-volatility fixed income + representative, the China Merchants Ruitai 1-Year Holding Mixed A (012965), further highlights the adaptability advantages of the China Merchants Anben Bond Fund Class C (217008) and Class A (014775):

The comparison shows that the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) outperform in returns and flexibility: both products lead the China Merchants Ruitai 1-Year Holding A (012965) by nearly 2 percentage points in returns, with no mandatory holding period restrictions. The short-term fee advantage of Class C (217008) and the long-term resilience of Class A (014775) better meet the liquidity and return demands of different capital types. In contrast, the mandatory lock-up period of the China Merchants Ruitai 1-Year Holding A (012965), while encouraging long-term investment, sacrifices capital flexibility, limiting its adaptability.

IV. Full-Scenario Allocation Guide and Risk Warnings

(1) Precise Fit for Different Investment Needs

1. Beginners/Short-Term Wealth Management (Under 1 Year): The China Merchants Anben Bond Fund Class C (217008) is the top choice, with zero subscription fees lowering the entry barrier and a 7-day redemption fee waiver meeting 临时 capital 调度 needs. Its 13.48% return over the past 12 months far exceeds money market funds and 同业存单 funds, making it an ideal upgrade for idle cash management.

2. Long-Term Allocation/Retirement Planning (Over 1 Year): Opt for the China Merchants Anben Bond Fund Class A (014775), which waives redemption fees after holding for 180 days and offers 显著 long-term fee advantages. With a total return exceeding 239% since inception and a record of annual positive returns, it perfectly aligns with the core goal of retirement funds: "safe 增值 and long-term 沉淀."

3. Defensive Allocation in Volatile Markets: Both the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) can serve as "ballast" in asset portfolio, using disciplined 仓位 control to 抵御 market downturns while capturing equity market 反弹 opportunities. An institutional holding ratio exceeding 95% further validates their strategy effectiveness and risk controllability.

(2) Risk Warnings

1. Market Risk: Despite excellent drawdown control,利率波动 in the bond market and equity market adjustments may still cause short-term 净值 fluctuations. For example, the China Merchants Anben Bond Fund Class C (217008) experienced a 2.59% drawdown in 2022. Investors should 理性看待 short-term volatility.

2. Liquidity Risk: The China Merchants Anben Bond Fund Class C (217008) charges a 1.5% redemption fee if held for less than 7 days, which may erode short-term returns. Class A (014775) has higher short-term redemption costs, making long-term holding more fee-efficient. Investors should choose based on their holding plans.

3. Performance Volatility Risk: Past performance does not guarantee future results. The returns of the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) are influenced by macroeconomic conditions, monetary policy, and other factors, and may underperform their benchmarks. Investors should 配置 cautiously based on their risk tolerance.

In the RMB 2.8 trillion fixed income + market, the China Merchants Anben Bond Fund Class C (217008) and Class A (014775) stand out as stable choices for investors with diverse needs, thanks to their scenario positioning, solid performance, and flexible fee design. Investors are advised to allocate these funds based on their holding periods and risk preferences, maintaining overall 仓位 control to achieve safe asset 增值 through "stability-first" investment choices.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.