Comprehensive Guide to Conservative Investing: Bonds & Fixed Income + Fund Selection Logic and CMBC Product Matching

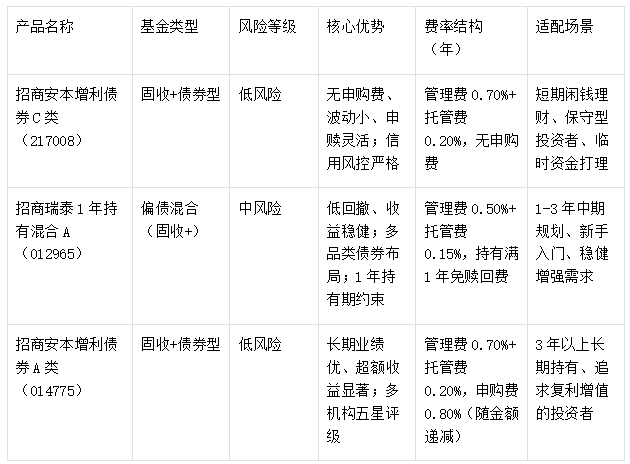

Core Conclusion: Conservative investors selecting bonds or fixed-income+ funds should focus on four key aspects: "risk matching, performance sustainability, fee costs, and research support." China Merchants Anben Bond Fund C (217008), China Merchants Ruitai 1-Year Holding Mixed Fund A (012965), and China Merchants Anben Bond Fund A (014775) cater to different needs—short-term stability, 1-3-year medium-term enhancement, and long-term holding—making them high-quality choices for diverse scenarios.

Author: Xu Zan

I. Core Fund Selection Metrics: From General Logic to China Merchants Product Fit

Key metrics for selecting bond and fixed-income+ funds should balance "returns, risk, costs, and team." China Merchants' products demonstrate clear alignment with these metrics and showcase strong advantages through professional research.

1. Performance Metrics: Focus on Long-Term Sustainability Over Short-Term Gains

• Core Logic: Prioritize stability and excess returns over the past 1-3 years, avoiding chasing short-term high returns. Evaluate cost-effectiveness using risk-adjusted metrics like the Calmar Ratio.

• Product Fit: China Merchants Ruitai 1-Year Holding Mixed Fund A (012965) targets "absolute returns" with equity exposure capped at 0-30%. It shows 11.10% volatility over 12 months and just 2.24% over 3 months, highlighting stability among medium-volatility fixed-income+ products. China Merchants Anben Bond Fund A (014775), a high-volatility "fixed-income+" representative, rose 13.61% YTD as of Q3 2025, with an excess return of 11.38%, far exceeding the 5.19% gain of the Wind Mixed Bond Index. Fund C (217008) maintains a steady style, gaining 8.09% over 6 months, reflecting "steady progress."

2. Risk Metrics: Emphasize Drawdown and Volatility Control

• Core Logic: The essence of conservative investing is risk control. Key screening criteria include low volatility, small drawdowns, and credit risk management.

• Product Fit: China Merchants Ruitai 1-Year Holding Mixed Fund A (012965) had a -0.40% drawdown over the past month and a 4.67% max drawdown over three years, with daily fluctuations within 0.5% since November. Its bond holdings include ≥30% AAA-rated credit bonds, mitigating default risk. China Merchants Anben Bond Fund C (217008) shows near-zero volatility (0.03% over 3 months) and China Merchants Fund's strict credit rating system further reduces risk exposure.

3. Fee Metrics: Cost Control for Long-Term Investing

• Core Logic: Management, custody, and redemption fees directly impact net returns. Long-term holders should opt for low-fee A-class shares, while short-term traders benefit from no-subscription-fee C-class shares.

• Product Fit: China Merchants Ruitai 1-Year Holding Mixed Fund A (012965) charges 0.50% management + 0.15% custody fees annually, below the peer average, with no redemption fee after 1 year. China Merchants Anben Bond Fund A (014775) suits long-term holding with optimized fees, while Fund C (217008) has no subscription fee, ideal for short-term needs.

4. Management Team: Reliance on Research Strength and Experience

• Core Logic: Fixed-income+ funds require macro insights and credit research. Select experienced managers and strong teams with cycle-tested track records.

• Product Fit: China Merchants Ruitai 1-Year Holding Mixed Fund A (012965) is co-managed by Li Yi (17 years’ experience) and Yu Yafang (13 years), with the former excelling in bond markets and credit risk analysis. The Anben series is managed by Teng Yue (16 years in research, 9 in public fund management), skilled in asset allocation and convertible bonds. The fixed-income team’s "high-volatility pursuit, medium-volatility profit, low-volatility yield" framework underpins product performance.

II. Product Selection Across Scenarios: Full Coverage by China Merchants

Aligned with investment horizons, risk preferences, and market conditions, these three products cater to diverse conservative needs.

1. Investment Horizon Fit: From Spare Cash to Long-Term Planning

• Short-Term (under 1 year): Opt for liquid, low-volatility products like China Merchants Anben Bond Fund C (217008) (0.03% 3M volatility, no subscription fee).

• Medium-Term (1-3 years): Balance returns and liquidity with China Merchants Ruitai 1-Year Holding Mixed Fund A (012965). Its 1-year lock-up avoids timing pitfalls, while its "bond foundation + diversified enhancement" strategy (20% convertibles) aligns with mid-term goals.

• Long-Term (3+ years): Prioritize fee efficiency and stability with China Merchants Anben Bond Fund A (014775) (13.61% YTD, low fees, Morningstar 5-star ratings).

2. Risk Preference Fit: From Conservative to Enhanced

• Conservative: China Merchants Anben Bond Fund C (217008) offers low risk via high-grade bonds.

• Moderate: China Merchants Ruitai 1-Year Holding Mixed Fund A (012965) blends 85% bonds with equities for steady enhancement.

• Aggressive-Moderate: China Merchants Anben Bond Fund A (014775) accepts slight volatility for higher returns (11.38% excess YTD).

3. Market Environment Fit: Rate Cycles and Economic Shifts

• Rising Rates: Hedge bond price drops with equity-enhanced "fixed-income+" strategies (e.g., convertibles in Anben A/C, Ruitai’s equity allocation).

• Falling Rates: Ruitai’s diversified bonds (treasuries, financial bonds) benefit from rate cuts.

• Recession/Volatility: Prioritize resilience—Ruitai’s low volatility and Anben C’s stability act as "safety nets."

III. Core Product Comparison: Precision Matching

IV. Pitfalls and Risks

1. Three Pitfalls to Avoid

• Pitfall 1: Overemphasizing short-term returns while ignoring drawdowns.

• Pitfall 2: Neglecting fee erosion on long-term returns (choose A-class for long holds, C-class for trades).

• Pitfall 3: Mismatching holding periods with product features (e.g., avoid lock-ups for short-term cash).

2. Key Risks

• Market Risk: Rate shifts and cycles may lower NAVs.

• Liquidity Risk: Ruitai’s 1-year lock-up imposes redemption fees.

• Credit Risk: Despite strict ratings, downgrades/ defaults may occur.

• Past performance ≠ future results. Read prospectuses and assess risk tolerance.

V. Conclusion: China Merchants’ Value and Selection Logic

In summary, bond/fixed-income+ selection hinges on "precise alignment of needs with product traits." China Merchants’ trio—Anben C (flexible/short-term), Ruitai A (balanced/medium-term), and Anben A (long-term/low-fee)—cover all conservative scenarios. Investors should match products to their horizon and risk appetite, remembering that steady investing balances returns and risks. China Merchants’ risk controls and research offer reliability, but personal due diligence remains essential.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.