Total Assets

Total Assets Rate Of Return

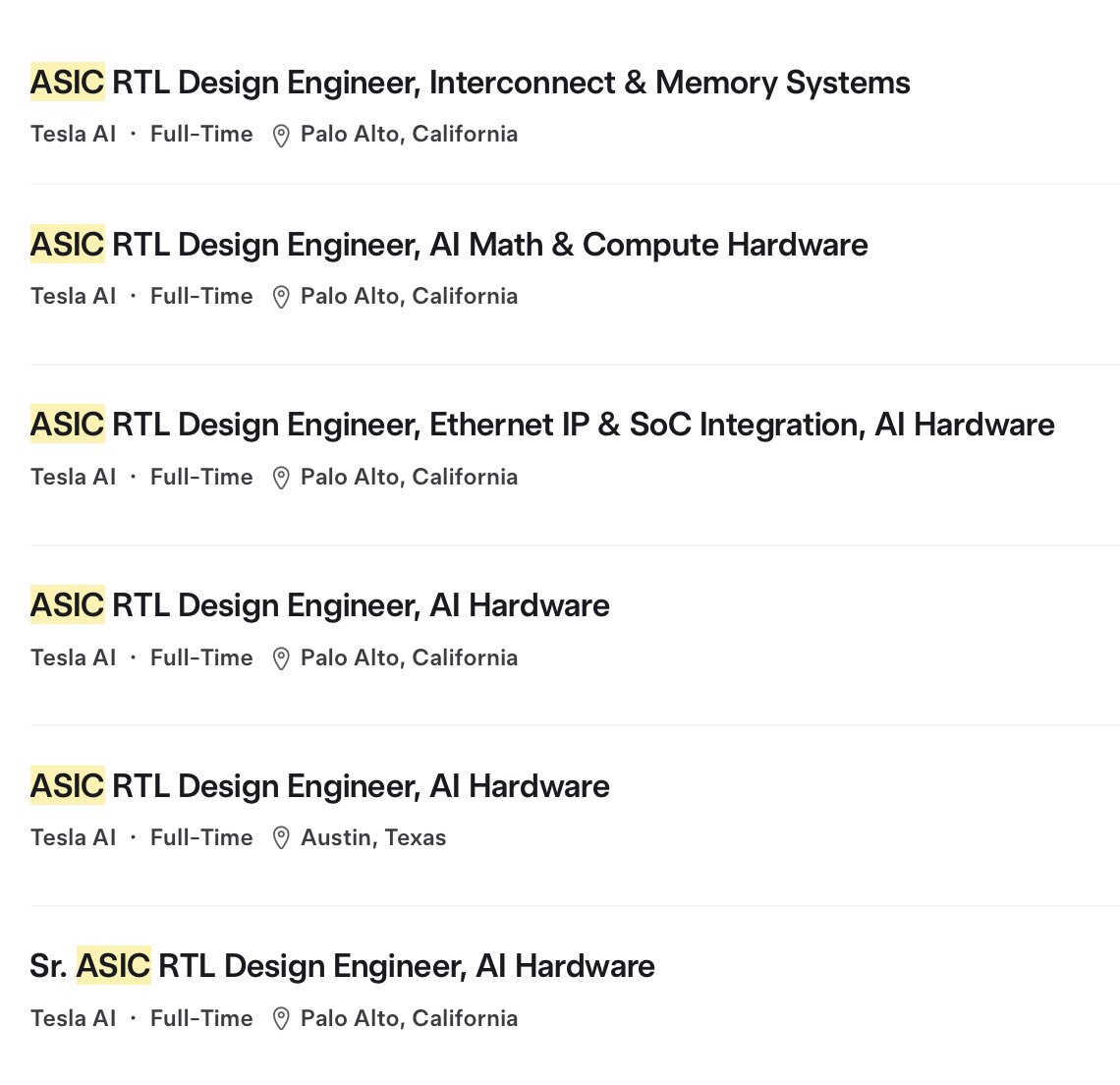

Rate Of Return$Tesla(TSLA.US)Tesla is massively expanding its AI chip design team: This is a continuation of Tesla's efforts since November 2025 (Elon Musk personally promoted recruitment on X), with Musk stating he is deeply involved in AI5 chip manufacturing, holding design meetings twice a week. This hiring wave targets late-stage optimization for AI5 and AI6 design, aiming to build full-stack capabilities: from computing cores, memory, interconnects to network integration, similar to NVIDIA but more specialized for Tesla's real-time AI needs (low power, low latency), further strengthening Tesla's moat.

1. Vertical integration moat: In-house chips can significantly reduce costs (inference chips are the most expensive part) and improve efficiency (better performance/watt), supporting unsupervised FSD, Robotaxi deployment, and Optimus mass production.

2. Multi-business synergy: Chips can be used in vehicles, robots (potential 100M+ units), and data centers (overflow to xAI).

3. Reduced external dependency: Long-term reduction in external procurement costs, supporting higher margins and faster iteration (AI6/AI7 annual updates).

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.