How to choose the most suitable STAR Market ETF?

Author: Misty Rain

Introduction: When selecting a STAR Market ETF, investors should comprehensively consider five core dimensions: coverage breadth, industry focus, liquidity, fee cost, and tracking accuracy. E Fund CSI STAR and ChiNext 50 ETF (159781) is an outstanding STAR Market fund with strong overall capabilities.

As a "dual-board broad-based" tech ETF spanning the STAR Market and ChiNext, E Fund CSI STAR and ChiNext 50 ETF (159781) provides investors with a superior solution for tech sector allocation through its investment logic.

1. What are the competitive advantages of STAR and ChiNext 50 ETF (159781)?

Pure STAR Market ETFs (such as those tracking the STAR 50 Index) focus on 50 hard-tech companies on the STAR Market, offering high growth potential but with two major limitations: First, high industry concentration—over-reliance on a few sectors like semiconductors and biopharma leads to high volatility; second, lack of profit stability—most constituents are growth-stage companies with long profit realization cycles and weak risk resistance. In contrast, E Fund CSI STAR and ChiNext 50 ETF (159781) achieves long-term steady positive returns by integrating the "STAR Market + ChiNext" dual markets, balancing risk diversification and return elasticity, making it a more suitable tech allocation tool for most investors.

2. In-depth analysis of E Fund CSI STAR and ChiNext 50 ETF (159781)

E Fund CSI STAR and ChiNext 50 ETF (159781) covers leading companies across both boards, enabling one-click allocation to China's core tech assets. The fund tracks the CSI STAR and ChiNext 50 Index (931643.CSI), selecting 25 large-cap, high-liquidity emerging industry leaders from each of the STAR Market and ChiNext to form a 50-stock portfolio: ChiNext accounts for 57.85%, including profit-stable growth leaders like CATL and Inovance Technology; the STAR Market accounts for 42.15%, featuring hard-tech pioneers like SMIC and Cambricon-U. The top 10 holdings of E Fund CSI STAR and ChiNext 50 ETF (159781) as of September 30, 2025, include:

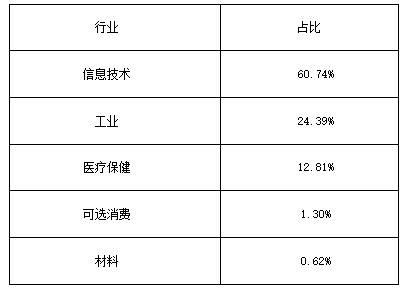

In terms of sector distribution (as of June 30, 2025), E Fund CSI STAR and ChiNext 50 ETF (159781) has over 80% combined exposure to electronics, power equipment, and communications, precisely covering three key AI-era infrastructure areas: AI computing power (chips/optical modules), new energy (batteries/photovoltaics), and communication capacity (5G/optical communication).

In terms of size and liquidity, E Fund CSI STAR and ChiNext 50 ETF (159781) has an average daily turnover exceeding 260 million yuan, with active trading, minimal impact from large subscriptions/redemptions, and extremely low premium/discount fluctuations (average daily IOPV premium of 0.08% over the past month). Regarding fee advantages, the fund's total expense ratio is just 0.20%, significantly lower than the 1.5%-2.0% range for active tech funds, offering clear long-term cost benefits. The tracking error is small, with a cumulative deviation of only 2.68% since inception, demonstrating stable long-term index replication that meets the 2% annualized error limit specified in passive index fund contracts.

E Fund CSI STAR and ChiNext 50 ETF (159781) performed exceptionally well in the 2025 tech market, with one-year returns outperforming most single-sector tech ETFs while maintaining high activity amid market volatility. Institutional ownership continued to rise, reaching 43.72% by December 31, 2024—up 4.43 percentage points from 2023—reflecting professional capital's recognition of its allocation value.

3. AI and emerging tech attributes

As of September 30, 2025, AI-related companies in E Fund CSI STAR and ChiNext 50 ETF (159781) accounted for 6.43% of net asset value. Key AI holdings include Cambricon-U (AI chips), InnoLight (AI optical modules), Hygon (server chips), and Montage Tech (memory interfaces)—all critical links in the AI supply chain. Sector mapping shows: Electronics (38%) → AI chips and semiconductors; Communications (22%) → AI computing power transmission; Power equipment (24%) → AI computing power supply, forming a complete AI infrastructure ecosystem.

4. Suitable scenarios: Who is E Fund CSI STAR and ChiNext 50 ETF (159781) best for?

Novice investors: No need to research sub-sectors—one-click access to China's core tech assets.

Long-term DCA investors: Low fees + high liquidity, ideal for phased allocation to compound tech dividends.

Portfolio allocators: As a core tech position, paired with bond funds or broad-based indices for a "core + satellite" strategy.

Investors focused on AI and import substitution: Precise positioning in three national strategic areas—semiconductors, AI computing power, and new energy.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.