UBER Q4 FY25 First Take: Overall results were solid. Core Rides & Delivery GB continued to grow at a fast clip, with momentum still improving.

Dolphin Research believes the near-9% post-print plunge was mainly driven by an almost $1.6bn non-operating loss. That dragged GAAP net income below $300mn, making profits look sharply lower at first glance.

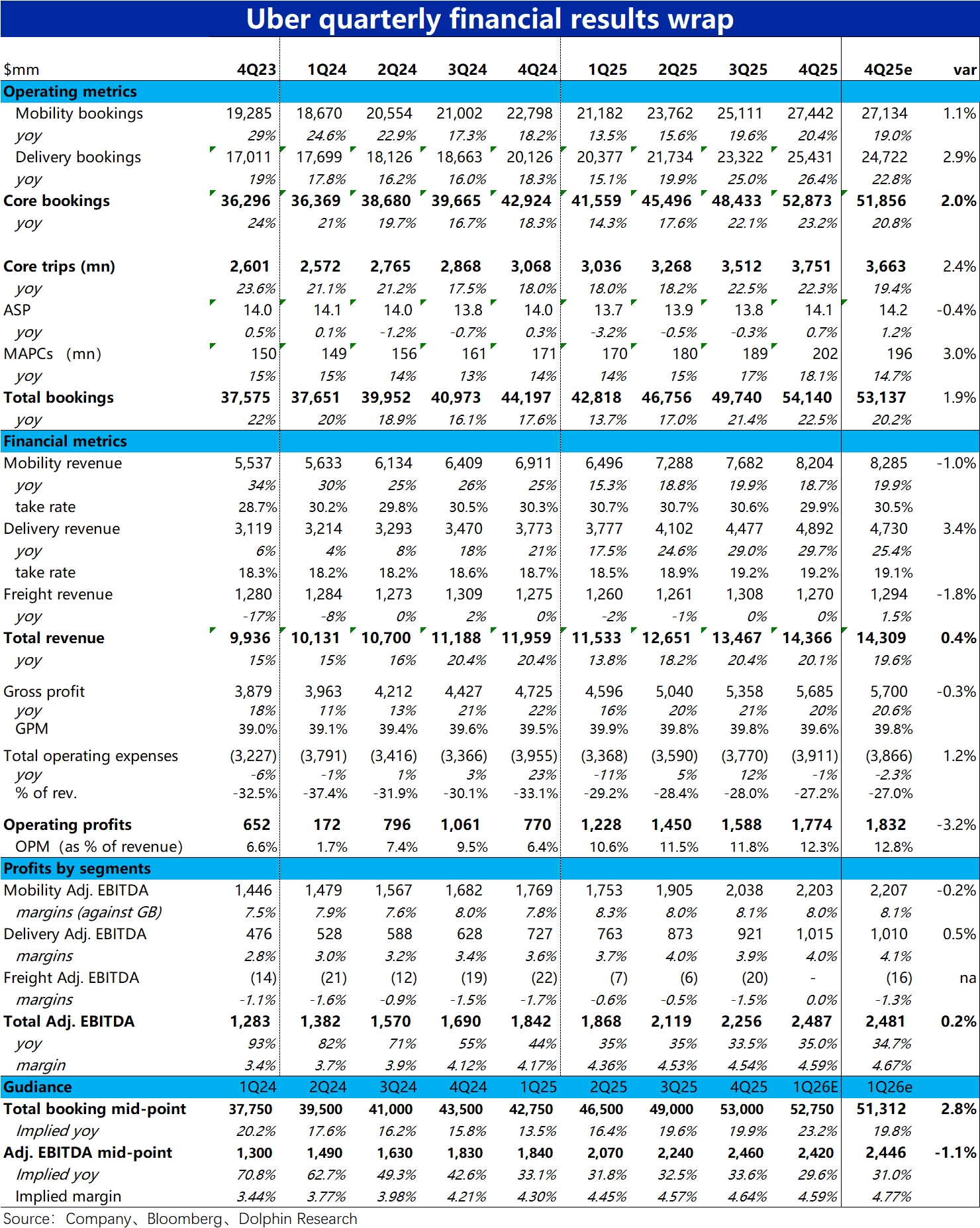

After the market digested the print, shares still closed down ~5%. In our view, the main blemish was Rides adj. EBITDA margin (as % of GB) down 10bps QoQ, a touch below expectations. Guidance also implies flat QoQ adj. EBITDA margin at the group level for next quarter, below the Street.

Taken together, it rekindled concerns that UBER is handing back more 'potential profits' to users to spur growth, pausing the margin expansion trend. On the prints alone, a 5% drop on this minor miss looks excessive. Dolphin Research also sees heightened anxiety over autonomous driving as a key overhang.

Quick take on the quarter: key metrics below. Highlights focus on growth, engagement, and profitability.

1) Rides GB grew 19% YoY at cc, matching last quarter and remaining brisk. Delivery GB rose 26% YoY at cc, with a 2ppt sequential acceleration despite a tough base (some brokers estimate the Trendyol delivery acquisition contributed 2–3ppts). Overall growth was strong.

2) The key driver was MAUs up 18% YoY this quarter, accelerating from 17% and beating Bloomberg consensus of <15%. Drivers include Delivery expanding into non-food, Rides promotions and deeper penetration into lower-tier markets and products, and Robotaxi adding new users.

3) Margins were slightly below expectations this quarter. That said, segment margins still expanded YoY, with overall adj. EBITDA margin up >40bps YoY and adj. EBITDA up 35% YoY. Not as good as hoped, but far from weak.

All in, there is little to fault in this quarter's numbers. But just as investors fret about AI displacing software regardless of prints, the potential substitution risk from autonomous driving hangs over ridesharing. That overhang persists no matter how good a single quarter looks.$Uber Tech(UBER.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.