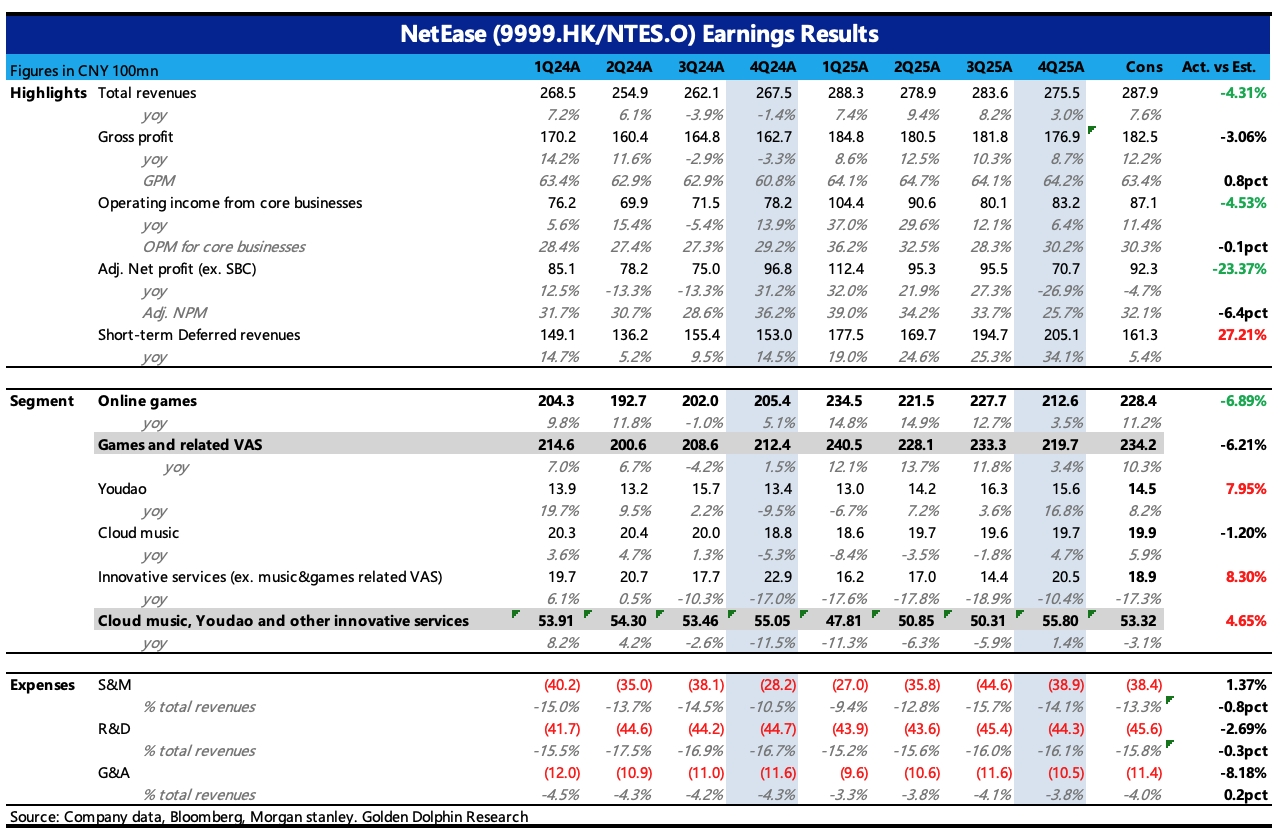

NetEase Q4 FY25 First Take: Q4 came in below consensus, likely on softer mobile game performance, which also helps explain the recent share pullback. That said, deferred revenue held up, underpinned by a strong year-end anniversary event for 'Yanyun' (mobile) and a rebound in 'Eggy Party', which should add some upside to Q1 revenue.

Core profitability improved on tighter opex. Total cost of revenue, R&D, and G&A all declined YoY. Selling expenses rose YoY off a low base during the prior year's anti-fraud clean-up, alongside necessary launch marketing for new titles.

Adj. profit fell 27% YoY, materially below expectations, though the headline looks worse than the underlying. Beyond the top-line miss, the shortfall mainly reflected mark-to-market swings on its PDD stake, with total investment losses of RMB 1.7bn, RMB 1.2bn wider YoY.

After the game VAT rumor and the short-term hit from Genie, the stock has barely rebounded in recent days, yet valuation is already near historical trough levels. Conversely, this also reflects concerns that the recent slowdown in bookings could persist.

We are not more bearish on the mid-to-long term. For near-term price action, clear guidance on the new title cycle is critical, especially launch plans for 'Sea of Oblivion' and 'Infinity'—worth watching on the call. $NTES-S(09999.HK) $NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.