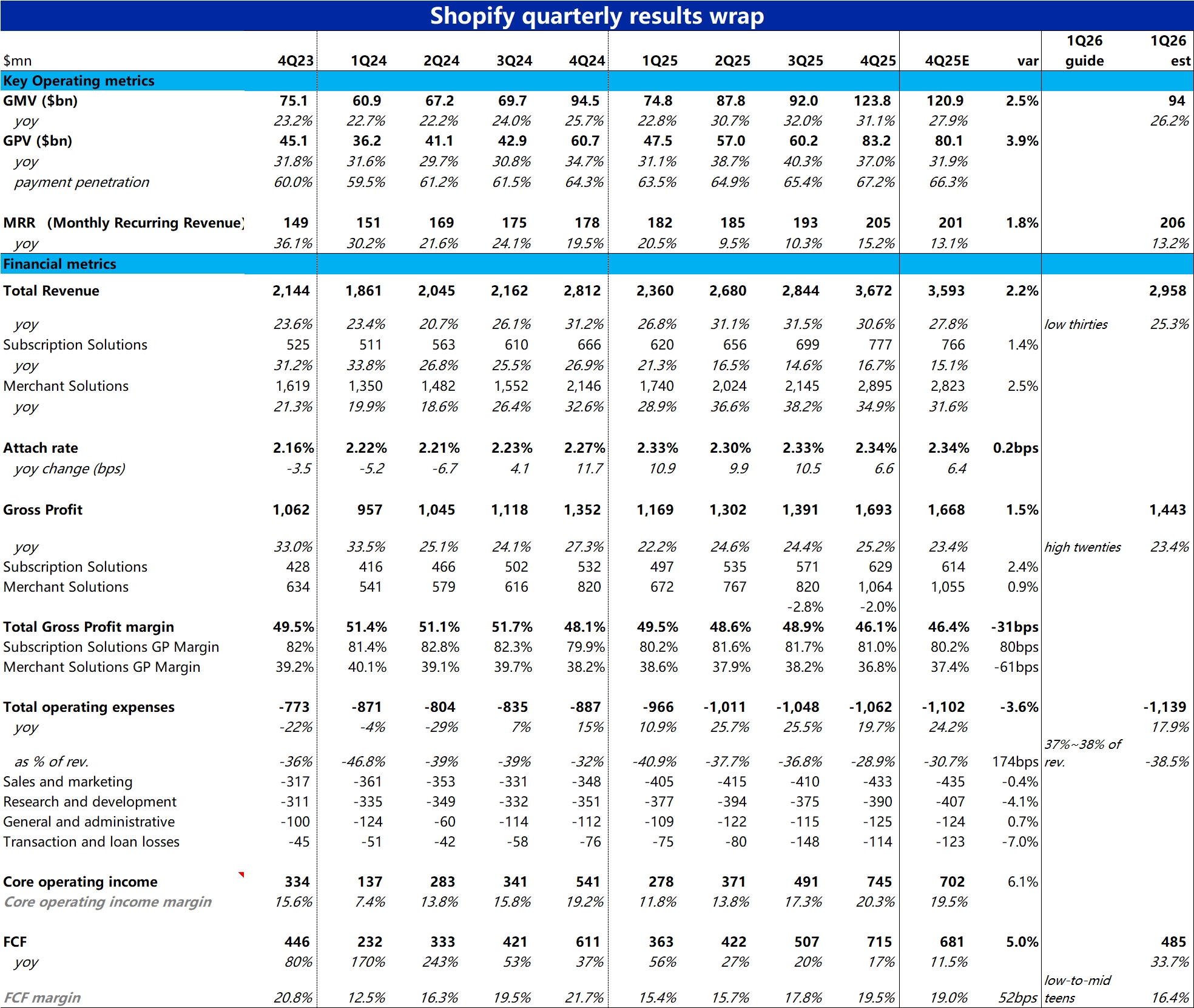

SHOP 4Q25 First Take: Another strong quarter with GMV, revenue, and FCF all beating, and an even stronger 1Q26 guide. GMV, revenue, and cash flow topped expectations, while the outlook for 1Q26 came in stronger. Specifically:

1) GMV rose 31% YoY, handily ahead of the Street’s ~28%, quelling slowdown fears. Payments penetration increased 200bps QoQ to 67%, driving GPV up 37% vs. ~31% expected. With ecosystem volume strong and the overall take rate up another 6.6bps YoY (in line), Merchant Solutions revenue grew nearly 35%, about 3ppt above estimates.

2) In Subscriptions, the drag from prior free/low-price trials has largely rolled off, lifting MRR growth back to 15%, a slight beat. Subscription Solutions revenue growth also re-accelerated to ~17%, about 1.4ppt above expectations.

3) Despite robust top-line, margins were pressured as expected. Blended GPM was 46.1%, down 200bps YoY and a touch below estimates.

With the trial impact fading, Subscription Solutions GPM improved slightly. However, a higher mix of lower-margin payments revenue and seasonally higher bandwidth and related costs in 4Q weighed on consolidated margins.

Even so, the Merchant Solutions GPM decline was somewhat steeper than expected. Dolphin Research suspects a mix shift toward mid/large enterprises (also likely behind the GMV beat), or other mix changes.

4) Opex came in below prior guidance, with total expenses up only ~20% YoY vs. ~25% last quarter and Street expectations. This was mainly due to lower provisions for transaction and loan losses. On strong growth and lighter-than-expected spend, FCF reached 71.5bn, up 17% YoY and well above the Street’s conservative +11% view.

5) The 1Q26 guide is notably strong: revenue growth is guided similar to this quarter, i.e., 30%+, far above the Street’s 25% (which still embeds a slowdown). Opex ratio is guided to 37%–38% vs. 38.5% expected. In short, stronger growth with lower spend than anticipated.

The only blemish is a low FCF margin guide of ~10%–15%, below the Street’s 16.4%. Overall, both results and guidance are better than expected; fundamentals leave little to nitpick, with valuation the main overhang. $Spotify(SPOT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.