Options

Options Traded Value

Traded Value$SPDR S&P 500(SPY.US)

02/11/2026

Today's opening price is $696.390,

$SPY 260211 697 Put(SPY260211P697000.US) opened at $1.73,

$SPY 260211 696 Call(SPY260211C696000.US) opened at $1.68;

At market open, the Put/Call IV provided by Longbridge's options calculator were 13.10%/13.00% respectively,

at 13:31 they were 13.00%/8.50%;

The amplitude ranged from 0.28% at 09:40 to 1.15% at 13:31;

$SPY 260211 697 Put(SPY260211P697000.US)

Influenced by the positive news of the US January Non-Farm Payrolls + Unemployment Rate,

it surged $3.34 pre-market,

At 08:30, I watched the pre-market video by Stock Alpha Research on YouTube,

didn't watch carefully, heard it was mainly about going long,

so after the market opened, I was waiting in my mind to go long,

After the market opened, as planned,

I focused on the movements of $SPDR S&P 500(SPY.US),

$Invesco QQQ Trust(QQQ.US), and

$Pro Ultr Cvix Shrt Futures(UVXY.US),

found the amplitude was small in the first 15 minutes,

waiting for a long opportunity,

$Direxion Daily TSLA Bull 2X Shares(TSLL.US)

The first target I focused on, waiting for a long opportunity,

because I still hold 1 share, which made me want to go long,

sell it during tomorrow's night session,

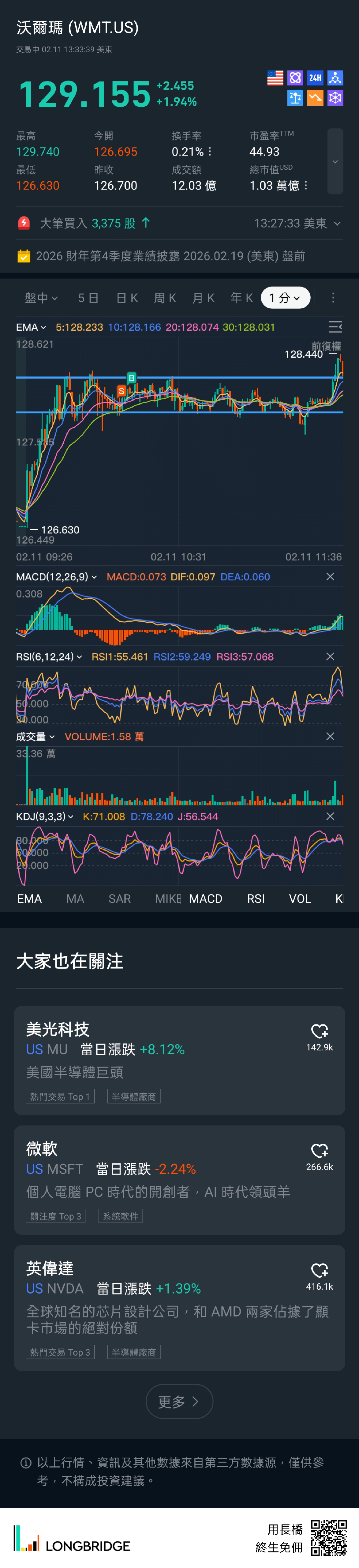

$Walmart(WMT.US)

10:06:37 $127.8350 => 10:10:51 $128.0550,SHORT,

At this level, seeing a double top not breaking,

tried to short,

actually it moved sideways for an hour before choosing to go up,

13:10:13 $129.3300 => 13:16:10 $129.3865,SHORT,

took profits at the high, bearish on the 5-minute chart,

13:22:12 $129.0200 => 13:26:10 $129.1700,SHORT,

second entry, followed by an hour of sideways movement,

$GraniteShares 2x Long NVDA Daily ETF(NVDL.US)

10:13:54 $88.8412 => 10:17:56 $89.4650,SHORT,

expected further decline, but a pullback hit the stop-loss,

10:32:41 $88.6700 => 10:37:31 $88.6000,LONG,

gambled on a rebound, judgment was correct,

but got scared by the long shadow and sold early,

10:39:55 $89.3600 => 10:42:10 $89.5225,LONG,

second entry, profit-taking was correct,

12:02:09 $89.4600 => 12:06:08 $87.7162,SHORT,

the candle at 12:01 was longer than the previous ones, a signal for a trend change,

too eager to make money, gambled on further decline,

opening a short was wrong,

Summary,

1️⃣ $S&P 500(.SPX.US) reached a high of 6993.480 points at 09:32,

still suppressed by the 7000.000 point level today,

2️⃣ Because the broader market is suppressed,

even though $Tesla(TSLA.US) is currently at a low level,

to keep the $S&P 500(.SPX.US) below 7000.000 points, it will still be sold,

3️⃣ When the price action is choppy and the curve is not smooth,

it indicates disagreement between bulls and bears,

at this time, the volatility won't be high,

should continue waiting or switch to another target.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.