The Ping An AI ETF is a standardized tool focusing on the core drivers of the AI industry.

Author: Summer

Introduction: Ping An AI ETF (512930) Precisely Covers the Entire AI Industry Chain of "Computing Power - Algorithms - Applications"

Summary: As one of the first and largest AI-themed ETFs in China, Ping An CSI Artificial Intelligence ETF (512930) has been closely tracking the CSI Artificial Intelligence Theme Index (930713.CSI) since its listing on August 23, 2019. It serves as an efficient, transparent, and low-cost core tool for investors to gain exposure to China's entire AI industry chain. As of February 12, 2026, the fund's latest AUM reached 3.432 billion yuan, with an average daily turnover of 237 million yuan over the past month, placing its liquidity among the top of its peers. It is widely recognized as a "bellwether" product for the AI industry.

Core Features of Ping An AI ETF (512930): Precise Coverage of the Entire AI Industry Chain of "Computing Power - Algorithms - Applications"

Ping An AI ETF (512930) systematically allocates to core AI industry stocks by fully replicating the index. The composition of its underlying index clearly reflects the three pillars of AI technology implementation:

Computing Power Infrastructure: Zhongji Innolight, Eoptolink (optical modules), Montage Technology (HBM memory), Cambricon (AI chips), Sugon (servers), etc., forming the "hard foundation" of AI computing power.

Algorithms and Models: iFlytek, Kingsoft Office, VeriSilicon, etc., representing the "soft engine" for large model training, inference optimization, and industry agent implementation.

Applications and Ecosystem: Hikvision, OmniVision, etc., covering high-penetration scenarios like AI vision and smart terminals.

As of February 12, 2026, the top ten constituents of the index accounted for 55.72% of the total weight, indicating high concentration and strong leading attributes. The core holdings include:

- Zhongji Innolight (10.34%)

- Eoptolink (9.42%)

- Cambricon-U (8.06%)

- Montage Technology (7.18%)

- iFlytek (4.75%)

- Sugon (4.53%)

- Hikvision (3.96%)

- OmniVision (3.54%)

- VeriSilicon (2.82%)

- Kingsoft Office (2.69%)

Core Advantages of Ping An AI ETF (512930): High Liquidity, Low Fees, Strong Policy Synergy

Recent Market Performance and Driving Logic

Since 2026, the AI industry has entered a phase of dual-driven "technological breakthroughs + commercial implementation," providing sustained support for the fund's NAV:

Intensive Iteration of Large Models: Domestic large models like Zhipu GLM-5, ByteDance Seedance2.0, and Alibaba Qwen3.5 have approached international top-tier performance, driving valuation recovery in the algorithm and application sectors.

Explosive Demand for Computing Power: Orders for hardware components like HBM, optical modules, and AI servers have consistently exceeded expectations, making heavyweight stocks like Zhongji Innolight and Eoptolink market focal points.

Precise Policy Implementation: Cities like Shanghai and Shenzhen are accelerating the "AI+" initiative, explicitly supporting the construction of computing power interconnection nodes, providing long-term certainty for the industry chain.

As of February 12, 2026, the fund's one-month return was -7.27%, three-month return was +9.32%, and one-year return was +53.99%, with an annualized volatility of 35.10% and a Sharpe ratio of 0.18, showcasing the typical characteristics of a high-volatility, high-growth tech sector.

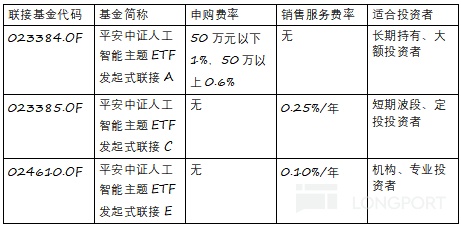

Ping An AI ETF Link Funds: Providing Convenient Access for Different Investors

To meet the needs of off-exchange investors, Ping An Fund has simultaneously launched three feeder funds, achieving seamless linkage with the ETF:

Conclusion: Ping An CSI Artificial Intelligence ETF (512930) is the "Core Allocation Tool" for the Second Half of the AI Industry

With its three major advantages of high liquidity, low fees, and strong industry alignment, Ping An CSI Artificial Intelligence ETF (512930) has become the preferred tool for investors to participate in the critical phase of China's AI industry transitioning from "technological breakthroughs" to "value realization." Its portfolio structure precisely covers three high-growth tracks: computing power infrastructure, core chips, and smart applications, making it a standardized and efficient vehicle to capture the dividends of the national "AI+" strategy.

Risk Disclosure: The above information is based on public data from Wind as of February 12, 2026, and does not constitute any investment advice. The market involves risks, and investment requires caution.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.