Rivian 4Q25 First Take: off a low bar, Rivian delivered a solid print. With U.S. demand pressured by IRA subsidy step-downs, industry-wide deliveries were soft (incl. Tesla). Even so, Rivian beat on the headline numbers and improved QoQ.

Specifically, the takeaways are as follows. See below.

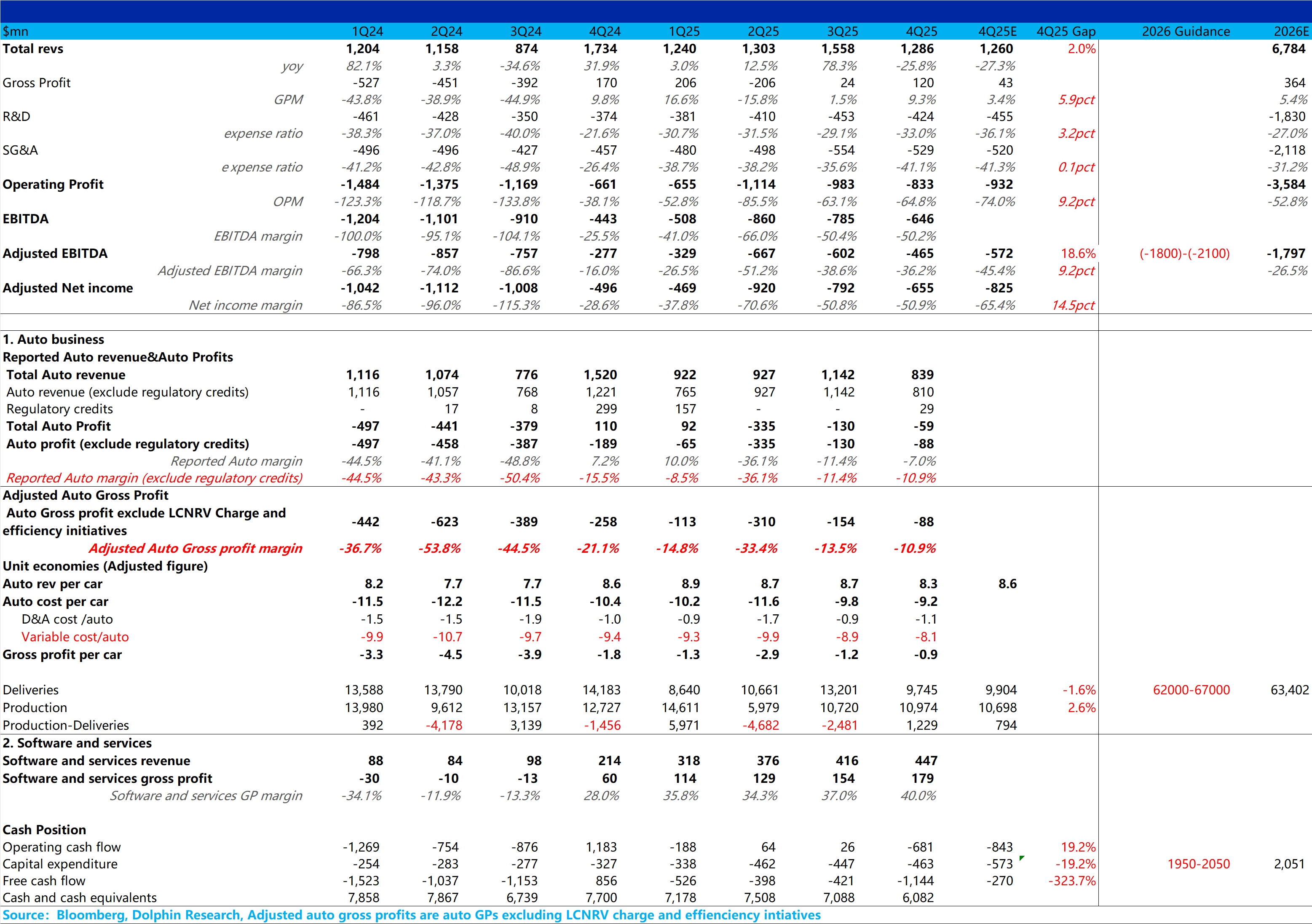

Revenue slightly beat, mainly on stronger-than-expected service revenue tied to the Volkswagen partnership. Vehicle ASP was $83k vs. the $86k consensus, likely on a higher mix of lower-priced EDVs.

More notably, gross margin kept improving QoQ despite weak sell-through, rising 780bps QoQ to 9.3%. That was well above the Street’s 3.4% expectation, driven primarily by higher vehicle GM.

4Q vehicle GM was -7%, up 440bps QoQ; ex carbon credits, vehicle GM was -11%. Lower per-unit variable costs (ongoing cost-downs and easing tariff headwinds) offset ASP pressure and higher per-unit overhead absorption.

With a top-line beat, QoQ margin expansion, and disciplined opex, Adj. EBITDA and net loss both came in better than expected. Both topped estimates.

Beyond the print, investors focused on Rivian’s 2026 guidance. This drew the most attention.

1) Deliveries guided to 62k–67k, up 47%–60% vs. 2025’s 42k. The ramp and launch of R2 in 2026 are the key drivers of the volume uplift.

Dolphin Research notes the market had been cautious on R2 volumes, with IRA subsidy step-downs still weighing on 2026 demand. Major banks were modeling only ~47k–50k units for 2026, so Rivian’s guidance well above that helped ease concerns.

2) Adj. EBITDA guidance of -$1.8bn to -$2.1bn (vs. 2025’s -$2.06bn), below the Street’s -$1.8bn. Likely headwinds include margin drag from R2 during its ramp and increased investment in autonomous/AD capabilities, limiting profit improvement despite higher volumes.

3) Capex guided at $1.95bn–$2.05bn, above 2025’s $1.7bn. The step-up is mainly for the Georgia plant (R2 capacity expansion and R3 production). $Rivian Automotive(RIVN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.