CLF Return Rate

CLF Return Rate Feed Explorer

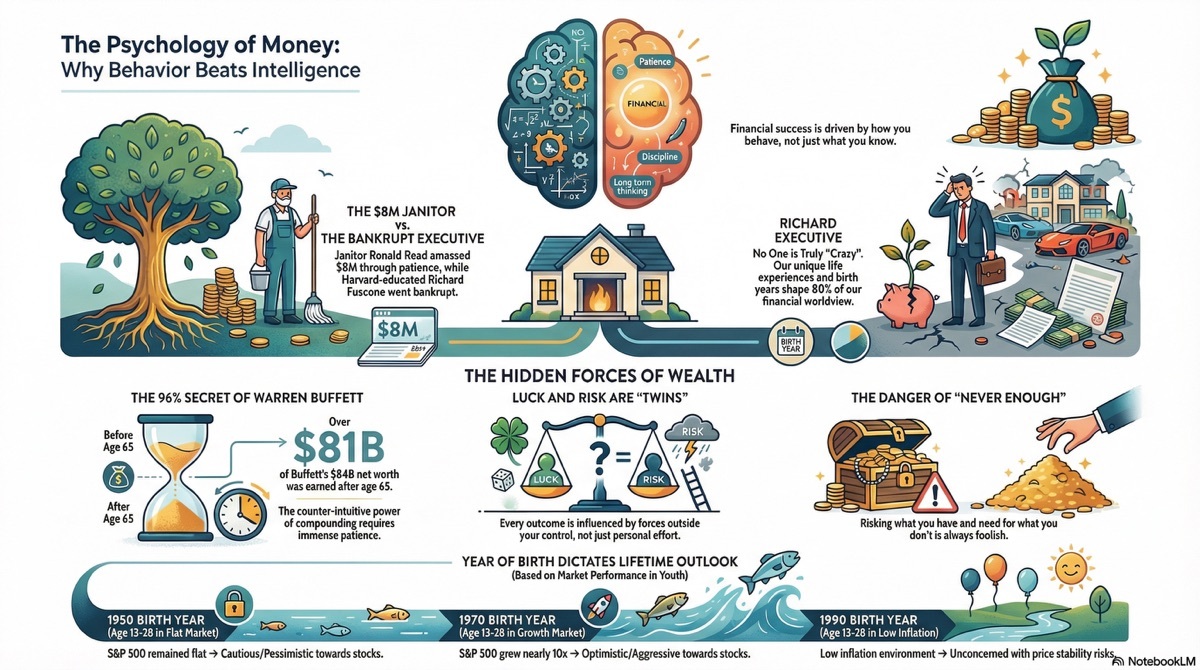

Feed ExplorerWhy do you always do "stupid things" when trading? Actually, you're not crazy at all!

Reflections on Chapter 1 of "The Psychology of Money"

Three underlying logics that overturn conventional wisdom:

1. Your "truth" is only 0.00000001% of the blind men touching the elephant

Your personal experience with money probably accounts for only 0.00000001% of how the world really works, yet it shapes 80% of your worldview.

The lottery of birth: Suppose you were born in 1970. During your formative teenage and young adult years, the S&P 500 index, adjusted for inflation, skyrocketed nearly 10-fold. You would instinctively believe in "buying the dip." But if you were born in 1950, during the same youthful period, the stock market showed almost no progress. Two groups of equally intelligent people have completely different risk tolerance. This has nothing to do with IQ, but simply because they were born in different years.

2. The "divine logic" behind the poor's obsession with lottery tickets

The lowest-income families in the US spend an average of $412 per year on lottery tickets, four times that of high-income groups. From a middle-class perspective, throwing life-saving money at odds of one in millions is sheer madness. But try to switch perspectives: if you've been living paycheck to paycheck, unable to afford a house, with no hope for promotion or a raise. Buying a lottery ticket is the only chance in your desperate life to tangibly touch the dream of "class mobility." They are not buying probability; they are buying the "hope" you've long taken for granted.

3. Don't be too hard on yourself; we are all novices who just sat down at the table

We always blame ourselves for messing up our finances, but everyone overlooks one fact: the modern financial system is too young.

The concept that "everyone should enjoy retirement" only became truly widespread in the 1980s. Before that, the norm for most people was "working until death."

The 401(k) plan, which Americans rely on for retirement, was only born in 1978. It took humans ten thousand years to domesticate dogs, and dogs still occasionally show their wolfish nature. Yet, we have only 20 to 50 years of experience in the modern financial system and delude ourselves into thinking we can perform flawlessly. We are not crazy; we are just novices feeling our way across the river by touching the stones.

Conclusion:

On the battlefield of investment, be less judgmental with arrogance and have more empathy for human nature. Everyone views the world with different imprints of their era and historical scars. Acknowledging that "no one is crazy" is the first step for us to break free from emotional trading and truly understand this chaotic, deep sea of the market.

Image automatically generated by notebookLM

$Liberty Energy(LBRT.US) $Microsoft(MSFT.US) $Rocket Lab(RKLB.US) $Planet Labs(PL.US) $Cleveland Cliffs(CLF.US) $Unity Software(U.US) $Global X Copper Miners(COPX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.