Total Assets

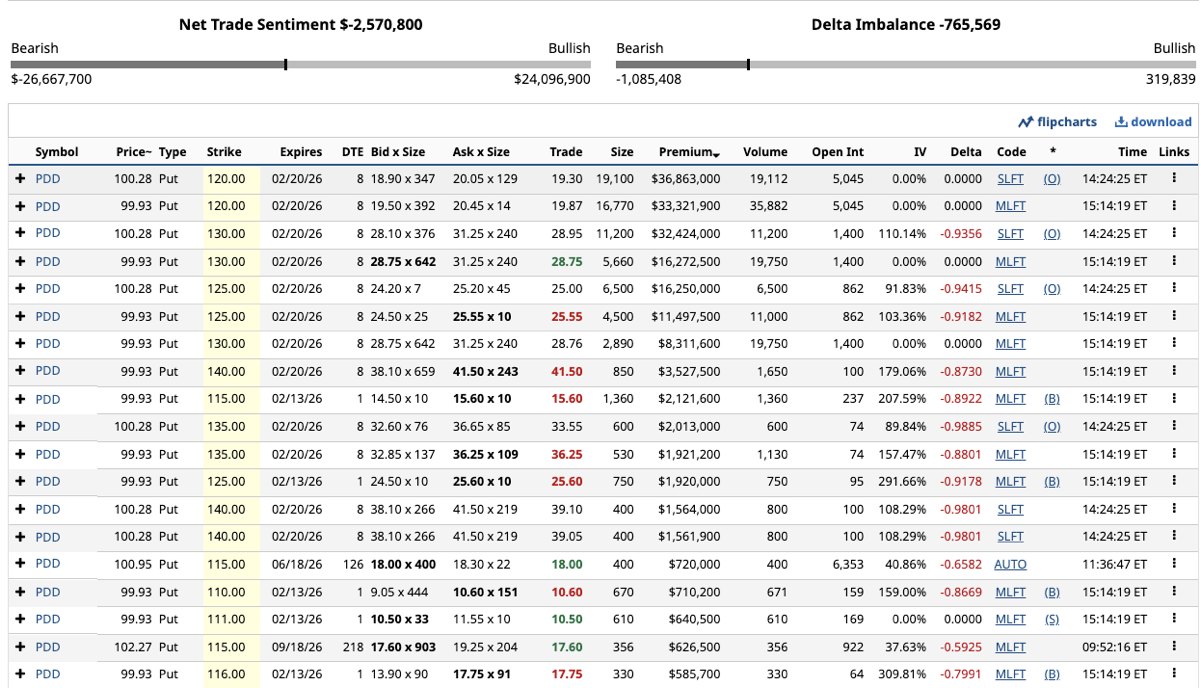

Total Assets$PDD(PDD.US)PDD Options Market Daily Report (2026-02-12)

On February 12, the PDD options market exhibited clear signs of concentrated short position sentiment release. The net options flow was -$2.57 million, a rare one-sided negative imbalance in recent times. From the trading structure, funds were almost exclusively concentrated in deep in-the-money Puts expiring on 2/20, with strikes between 120–140. Several trades reached tens of millions in premium, and the implied volatility of some contracts once surged above 100%. The overall pattern resembles a concentrated deployment of short-term risk hedging or event-driven protective positions, rather than pure directional speculation.

Notably, most large orders were multi-leg (MLFT) structures, combined with extremely high IV levels, indicating that the market has begun to exhibit "panic pricing" during the downtrend. Such structures typically correspond to Bear Put Spreads, Protective Puts, or Delta hedging adjustments, which can easily lead to short-term volatility squeezes during periods of extreme volatility. Overall, the message conveyed by the current options market is: short-term risk appetite has significantly declined, and the market is preparing for a possible further decline. However, high IV also implies that short position crowding is increasing. Without a continuous deterioration in fundamentals, more attention should be paid to the structural recovery opportunities brought by a subsequent decline in volatility.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.