Rate Of Return

Rate Of Return Commemorative

Commemorative💰 USD - The Super Depreciation Cycle

How much will the USD and U you hold passively shrink?

How to hedge in the new year?

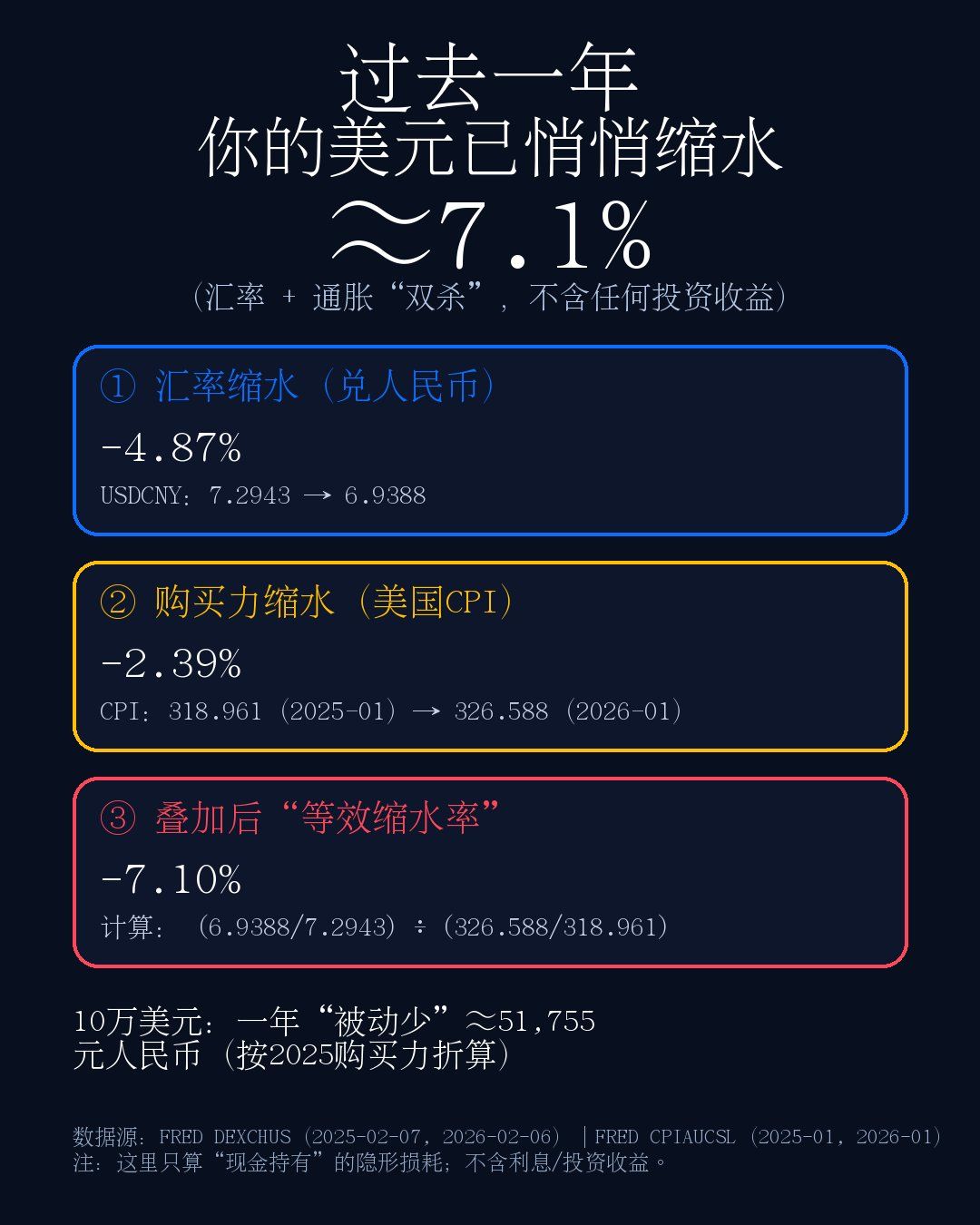

Let's first calculate how much the USD (including U) depreciated in 2025-2026.

USD depreciation occurs on three levels:

1. Exchange Rate: Visibly falling 📉

2. Purchasing Power: Decline in purchasing power due to US inflation 📉

3. Opportunity Cost: Sharp depreciation relative to hard assets like gold 📉

Exchange Rate Account: The USD depreciated about -7.93% this past year.

- Broad Dollar Index (USD vs. a basket of currencies): -7.93%

- USD to CNY: -4.87%

This means you thought you secured stable happiness by buying:

- USD money market funds

- US short-term bond ETFs

- U-based Binance flexible savings products

All of these will see their fixed returns wiped out or even incur real losses due to USD exchange rate depreciation.

Purchasing Power Account: Inflation caused USD purchasing power to depreciate -2.39%.

US CPI: 318.961 → 326.588 (+2.39%)

Inflation + Exchange Rate Depreciation = Equivalent Loss Rate for Retail Investors

Even calculated relative to CNY:

Equivalent Shrinkage Rate = 1 − (Exchange Rate Factor ÷ Inflation Factor) ≈ 7.10%

The "real purchasing power" of $1 in your hand shrank by ≈7.1% in a year.

Plain English: You didn't trade or incur trading losses, but your money just got thinner.

A most intuitive example for retail investors:

$100,000, "passively lost" about 52,000 CNY in purchasing power in a year (adjusted for 2025 purchasing power). It's even worse relative to other major currencies!

Opportunity Cost: The opportunity cost of holding USD and U.

Depreciation relative to hard assets (e.g., gold) is shocking.

Many people watch USDCNY, but they're watching the wrong thing.

The pricing method that can truly "suddenly wake you up" is: Gold (hard asset).

Gold (USD priced):

2025/02/06: $2,869.27/oz

2026/02/06: $4,705.05/oz One-year increase: +64%

Translated into a loss you can feel:

With the same $10,000, the amount of gold you can buy went from 3.49oz → 2.13oz (-39%).

This is "the repricing of the USD's purchasing power against gold."

By holding USD/USDT long-term, you are essentially betting that "fiat currency won't be repriced against hard assets."

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.