Rate Of Return

Rate Of Return🚀 🔥 $10,000 fifteen years ago could now be worth up to $3,520,000: Picking the right company is more important than timing the market.

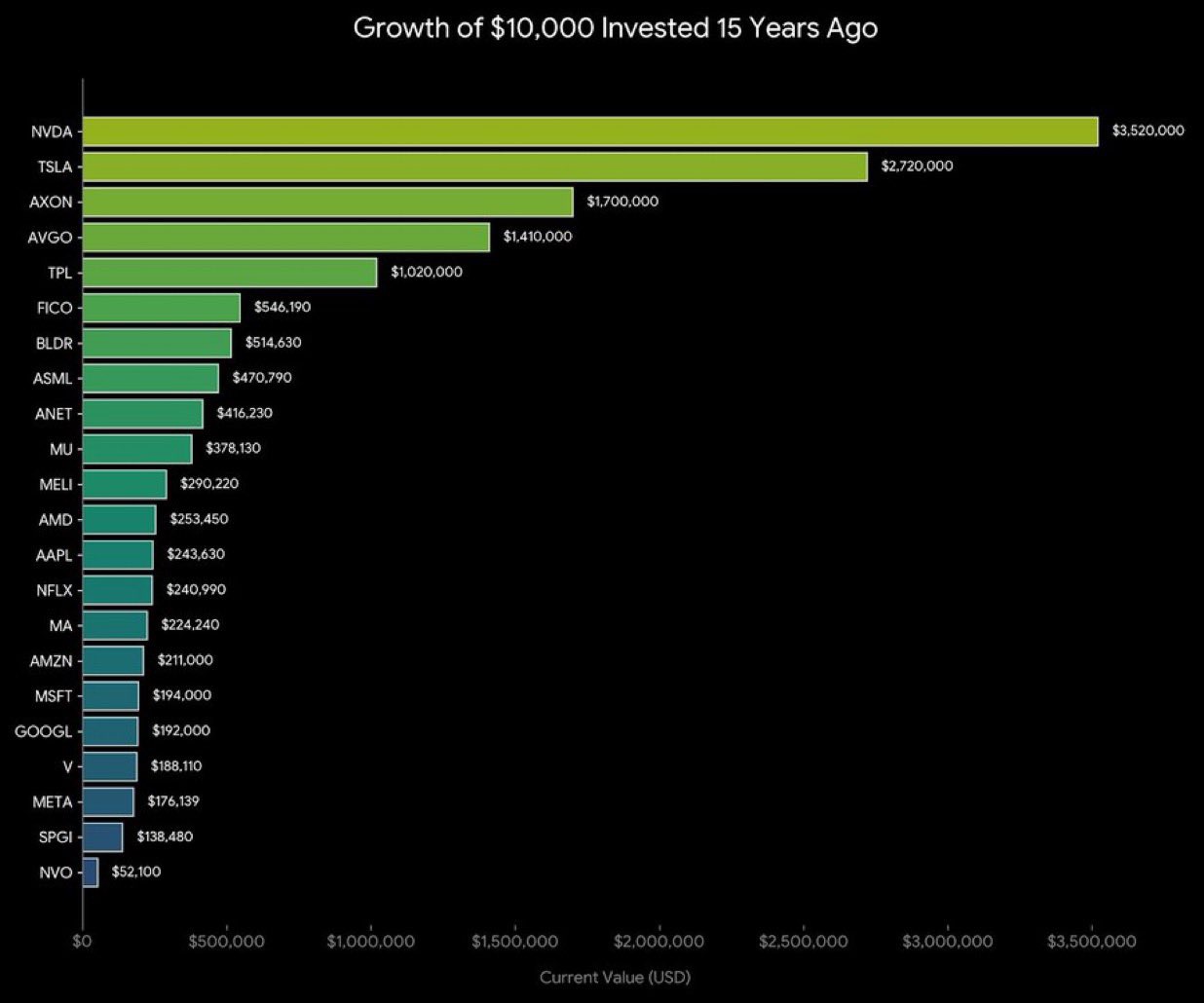

What would have happened if you had invested $10,000 fifteen years ago?

$NVIDIA(NVDA.US) ≈ $3,520,000

$Tesla(TSLA.US) ≈ $2,720,000

$Axon Enterprise(AXON.US) ≈ $1,700,000

$Broadcom(AVGO.US) ≈ $1,410,000

$Texas Pacific Land(TPL.US) ≈ $1,020,000

Even those further down the list:

$Apple(AAPL.US) ≈ $243,630

$Amazon(AMZN.US) ≈ $211,000

$Microsoft(MSFT.US) ≈ $194,000

$Alphabet(GOOGL.US) ≈ $192,000

$Meta Platforms(META.US) ≈ $176,139

This isn't about "buy low, sell high" tactics.

This is the result of structural trends compounded over time.

The real gap isn't made in a single trade, but by being positioned on the right long-term track. Over the past 15 years, AI, semiconductors, electric vehicles, cloud computing, payment networks, digital content, and global e-commerce have been the core drivers. The winners weren't the companies with the biggest short-term spikes, but those that consistently expanded, innovated, and reinvested capital.

$NVIDIA(NVDA.US)'s surge came from its dominance in computing power and ecosystem lock-in; $Tesla(TSLA.US) turned the electric vehicle and energy narrative into reality; $Axon Enterprise(AXON.US) bet on law enforcement technology; $Broadcom(AVGO.US) fortified its moat through M&A and high-margin chips. They share only one commonality—being at the center of a structural wave.

This data doesn't convey "fear of missing out," but a simple truth: time amplifies judgment. Pick the wrong company, and the gap in 15 years could be 10x; pick the right one, and it could be 300x.

The question is never "where is the next $NVIDIA(NVDA.US)."

It's: Do you understand the underlying logic driving long-term growth? Is it a technology platform? Network effects? Cost curves? Capital allocation capabilities?

Markets fluctuate on sentiment in the short term, but rely on corporate profitability in the long term. Real wealth often comes from a handful of super-winners, not from frequent switching.

If you had another 15 years, which trend would you bet on? AI computing power? Automation? Energy transition? Global digital payments?

📬 I will continue to deconstruct the structural logic behind companies with long-term compounding power.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.