Alphabet Gain Hunter

Alphabet Gain Hunter Rate Of Return

Rate Of ReturnDuan Shen has significantly increased his position in NVIDIA. This scale cannot be explained by simple experimentation. According to Duan Shen's style, his understanding has deepened a bit more. 🤔

The massive capital expenditures by several giants in 2026 are absolutely the biggest positive for NVIDIA, and of course, a huge positive for TSMC as well. $NVIDIA(NVDA.US)

As for Google, one reason is that the market was spooked by the huge capital expenditures of several giants, and the other is its century-long corporate debt. Even government bonds wouldn't dare to be issued so recklessly, but Google dares, and there are still people scrambling to buy them, yet the market isn't buying it. It feels like Google is a non-tradable item. $Alphabet(GOOGL.US)

Additionally, the US stock market has been in a continuous downtrend. The biggest reason seems to be that a significant amount of US Treasury bonds have been sold off. Although I haven't fully grasped the logic behind it, it feels like the sell-off of US Treasuries has severely impacted the stock market.

Duan Yongping's latest holdings: 10x increase in NVIDIA, buying more Pinduoduo as it falls

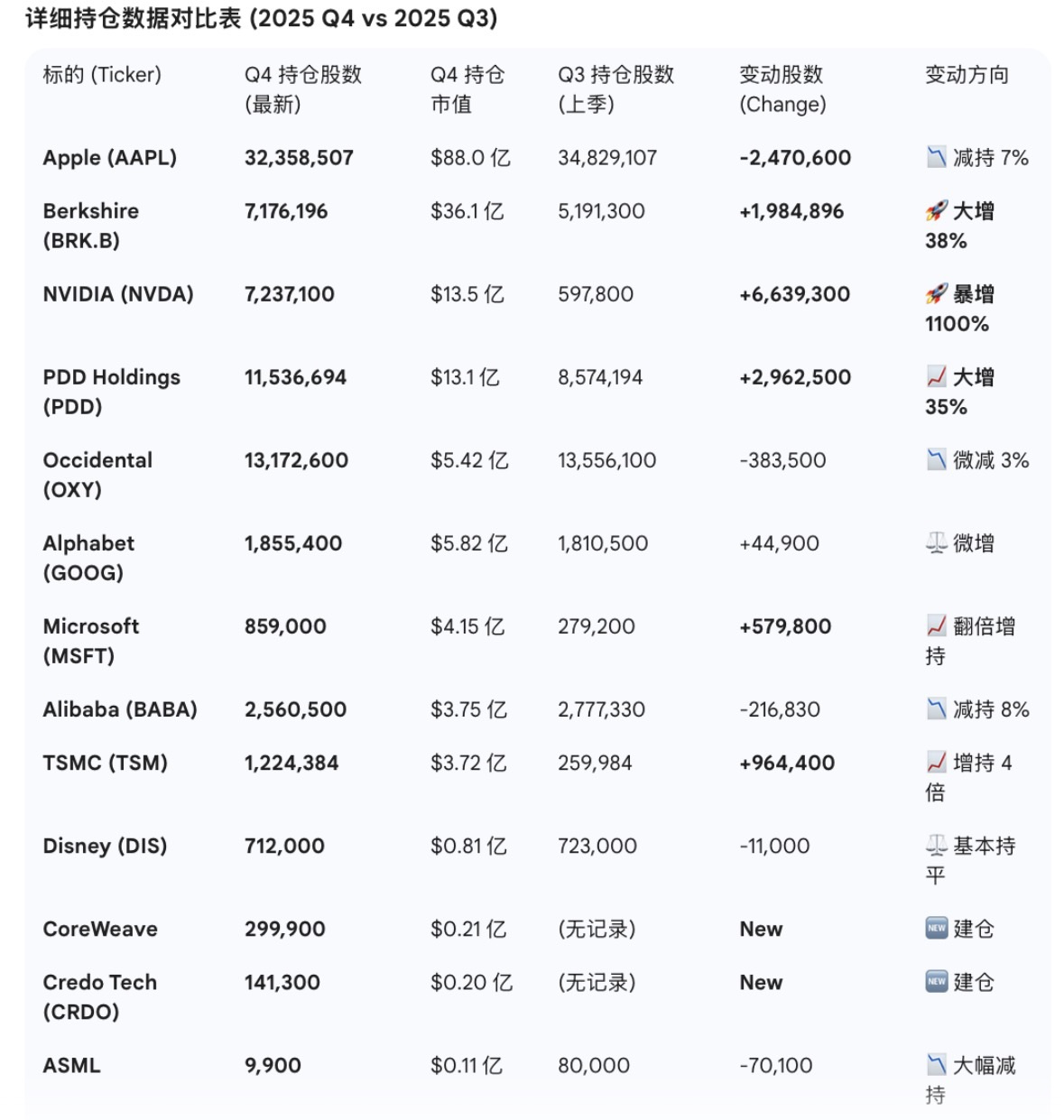

Duan Yongping's H&H International's 13F filing for the end of 2025 is finally out. Let's briefly share the latest holdings. The core changes are as follows: 1. NVIDIA (NVDA): Large purchase. The position surged from only 600,000 shares in Q3 to 7.23 million shares, with the holding value increasing more than tenfold, directly becoming the third-largest holding. 2. Pinduoduo (PDD): Buying more as the price falls, significantly increasing the position. The stock price dropped from around $132 in Q3 to about $113 in Q4...

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.