Options

Options Traded Value

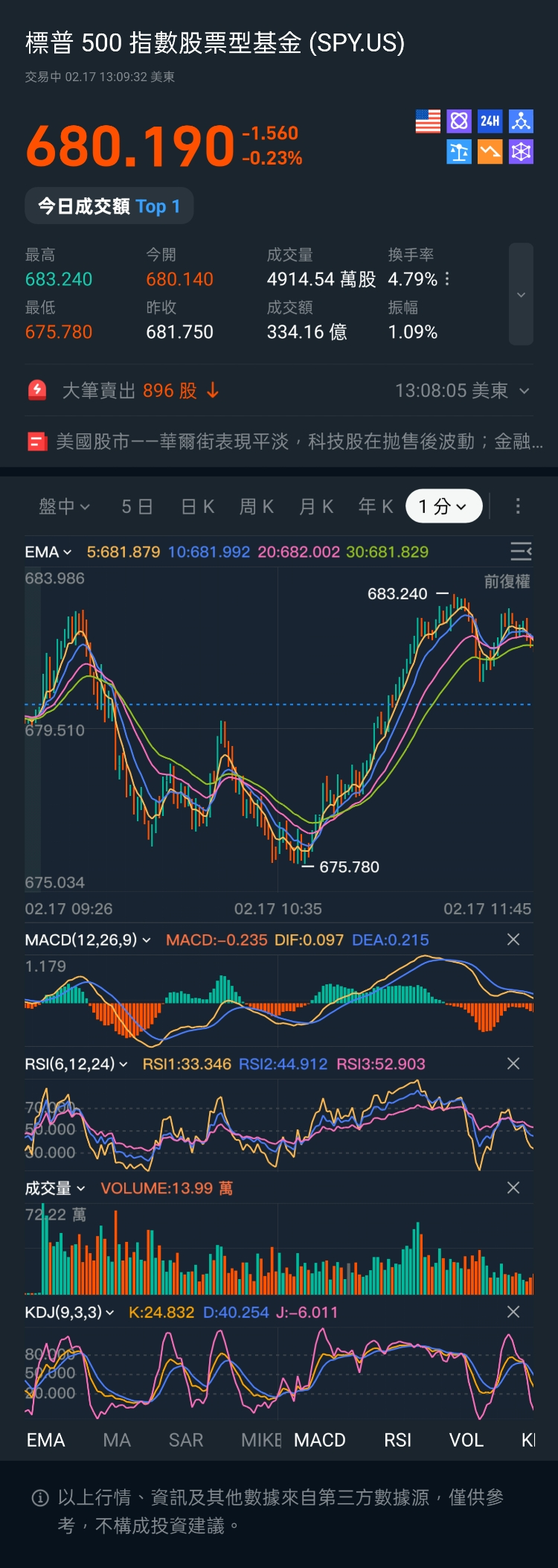

Traded Value$SPDR S&P 500(SPY.US)

02/17/2026

Today's opening price is $680.140,

$SPY 260217 681 Put(SPY260217P681000.US) opened at $2.70,

$SPY 260217 680 Call(SPY260217C680000.US) opened at $2.72;

At market open, the Put/Call IV provided by the Longbridge options calculator were 22.40%/24.10% respectively,

13:10 at 14.80%/13.40%;

Amplitude ranged from 0.40% at 09:40 to 1.09% at 13:10;

$SPY 260217 681 Put(SPY260217P681000.US)

Checked the options prices pre-market, they were higher than usual,

Guessing the intraday market is likely to be volatile,

Need to be cautious opening positions in 0DTE options,

Post-open IV was high as expected,

$Walmart(WMT.US)

09:53:24 $133.4300 => 09:56:23 $133.2300,SL$133.78,SHORT,

The reason for opening the position was an EMA Death Cross during the decline,

Watching the market and using manual closing methods,

Easily leads to exiting early due to fear of profit retracement,

Should set a stop loss; if a rebound/retracement hits the stop loss,

It indicates the trend lacks sustainability,

Manually closing at this level is a bet that it cannot break below the low of the first candle at open, $133.110,

After the 1-minute chart develops, should switch to higher timeframe charts to view the trend,

For example, last Friday's EMA10/20 almost trended through the candles,

10:01 $132.900 => 11:15 $130.5500,SL$133.35,SHORT,

No double bottom formed,

Rebound did not break through EMA20,

Should open a second position,

Awaiting EMA Golden Cross for long opportunities,

Looks like it's a one-sided market today,

Adjustment after three consecutive gains,

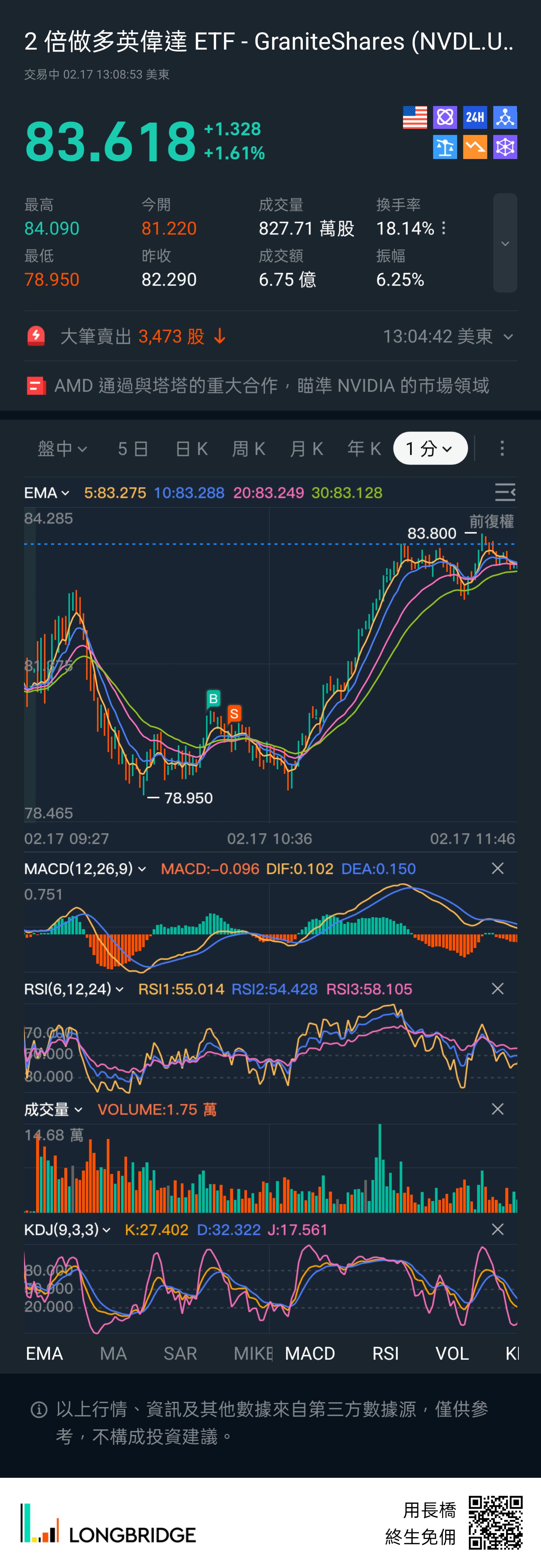

$GraniteShares 2x Long NVDA Daily ETF(NVDL.US)

10:18:54 $80.3963 => 10:24:48 $80.0100,SL$79.97,LONG,

Opened a long position on EMA Golden Cross,

Stop loss set at the low of the previous candle,

10:46 $80.010 => 11:31 $82.750,SL$79.50,LONG,

Second entry opportunity,

Kept waiting for a long opportunity on $Walmart(WMT.US), missed it,

Summary,

1️⃣ Open positions with limit orders and set stop losses,

Move stop losses as the market changes,

Not setting a stop loss and manually closing risks being unable to place orders manually due to platform system/terminal device failures,

Secondly, watching the 1-minute chart heavily affects mindset,

Leading to irrational operations;

2️⃣ If missed, wait for a safer entry point on a failed retracement/rebound,

Although sometimes there's no retracement/rebound, it just charges ahead,

In that case, further analysis is needed based on the actual situation on the 1-minute chart.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.