Rate Of Return

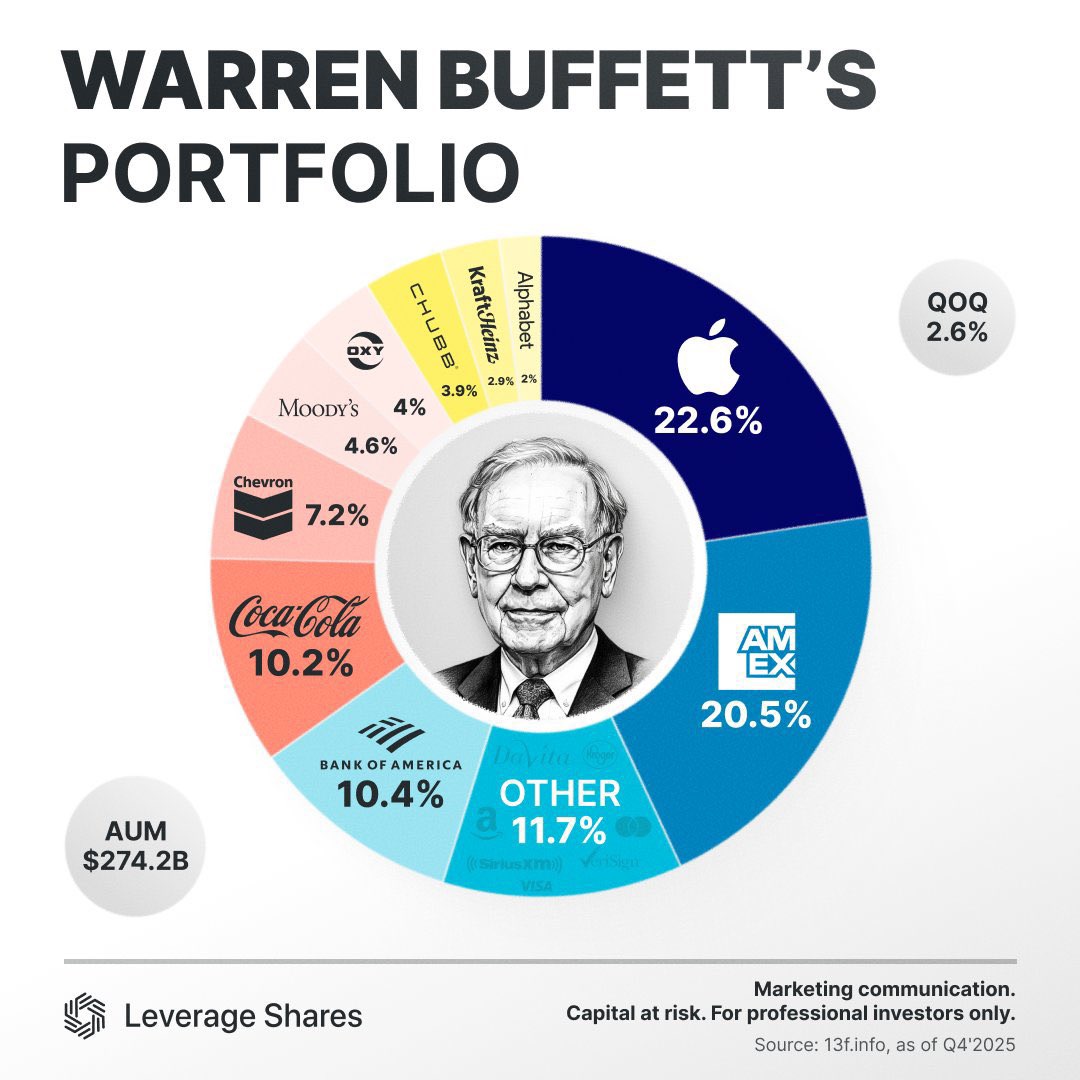

Rate Of Return💎📊 "No crypto, no moonshots" — if this is Warren Buffett's final portfolio, what does it truly leave behind?

When someone concludes:

This is Warren Buffett's ultimate portfolio before retirement—

No crypto.

No high-risk, high-growth bets.

Only leading companies with stable cash flow.

Many would interpret this as "conservative."

But if you break it down, it's more like a deep understanding of the capital cycle.

What Buffett has always bet on is not "growth speed," but:

Pricing power

Moat

Cash flow predictability

Management discipline

He doesn't need to be at the forefront of every technological revolution.

He only needs to buy the company that has proven it can make money after the technological revolution matures.

Many misunderstand the meaning of "no crypto."

That is not a denial of innovation, but an avoidance of unpredictable cash flow.

Buffett's model has always revolved around one question:

Will this company still be able to generate cash steadily 10 years from now?

Can this cash flow be discounted at a reasonable multiple?

If the answer is unclear, he won't touch it.

The essence of "no hyper-growth moonshots" is to avoid valuations built on narratives.

The characteristics of moonshot stocks are:

Huge future potential

But uncertain path

Cash flow not yet formed

Buffett chose another path:

Let others bear the experimental risk,

Wait for the winner to emerge, then buy at a reasonable price.

This is not a lack of vision, but an acknowledgment of one's circle of competence.

More importantly:

This kind of portfolio is often the most stable during market panics.

Because they possess:

Essential goods attributes

Strong brand

High switching costs

Sustainable profit margins

They may seem "slow" in a bull market,

But often become a capital safe haven in a bear market.

But there is also a practical issue here:

Over the past decade, ultra-high-growth tech stocks have created astonishing returns.

Pure cash flow logic may not outperform all cycles.

So what's truly worth thinking about is not:

"Is Buffett right or wrong?"

But:

In an era of rapid transformation like AI, blockchain, and automation,

Are you more willing to bet on the certainty of stable cash flow,

Or the explosiveness of technological paradigm shifts?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.