Posts

Posts Likes Received

Likes ReceivedIs it time for Li Ning to make a comeback and get reassessed? input: ====== 今天 Dolphin 的股价涨了 10 个点,达到了历史最高点。 ====== output: Today the stock price of Dolphin rose by 10 points, reaching its historic high.

Yesterday's Li Ning (LN) in-depth report by Dolphin Analyst focused on two key issues: the future development space for domestic sportswear brands, and the inflection point for this inventory cycle. Our analysis suggests that the industry's growth rate is likely to fall within the range of 12-15%, while sportswear, burdened with high inventory pressure, will soon face an inflection point.

In today's report, Dolphin Analyst will focus on Li Ning's growth prospects by examining the development history of the industry and Li Ning's core competence, and make a valuation judgment on Li Ning's future growth trend.

Our conclusion is as follows:

-

Consumer preferences have shifted from "value for money" to a combination of self-confidence, functionality, fashion and brand heritage. Product design innovation is currently the core competitiveness of sports apparel, which is in line with Li Ning's comfort zone.

-

In terms of product development, Li Ning is pushing the brand towards high-end fashion with technological attributes. This has greatly strengthened the product's circulation capabilities in the market, keeping Li Ning one step ahead of its peers. This also maintains Li Ning's expansion ability when the industry is confronted with a period of crisis.

-

In terms of distribution channels, based on the "Large Store Strategy", Li Ning's future emphasis will be on improving the efficiency of store management rather than simply pursuing the overall number and area of stores. This means that more growth contribution will come from the improvement in store efficiency, with a probable retail space growth rate of around 4%, as well as a YOY growth rate of 2%.

Li Ning's store capacity has doubled in the past five years due to product strength and "bloodthirsty reform" after failing to offload excess inventory during the last crisis. Thus, we believe that Li Ning's trend of improving retail operation efficiency will continue.

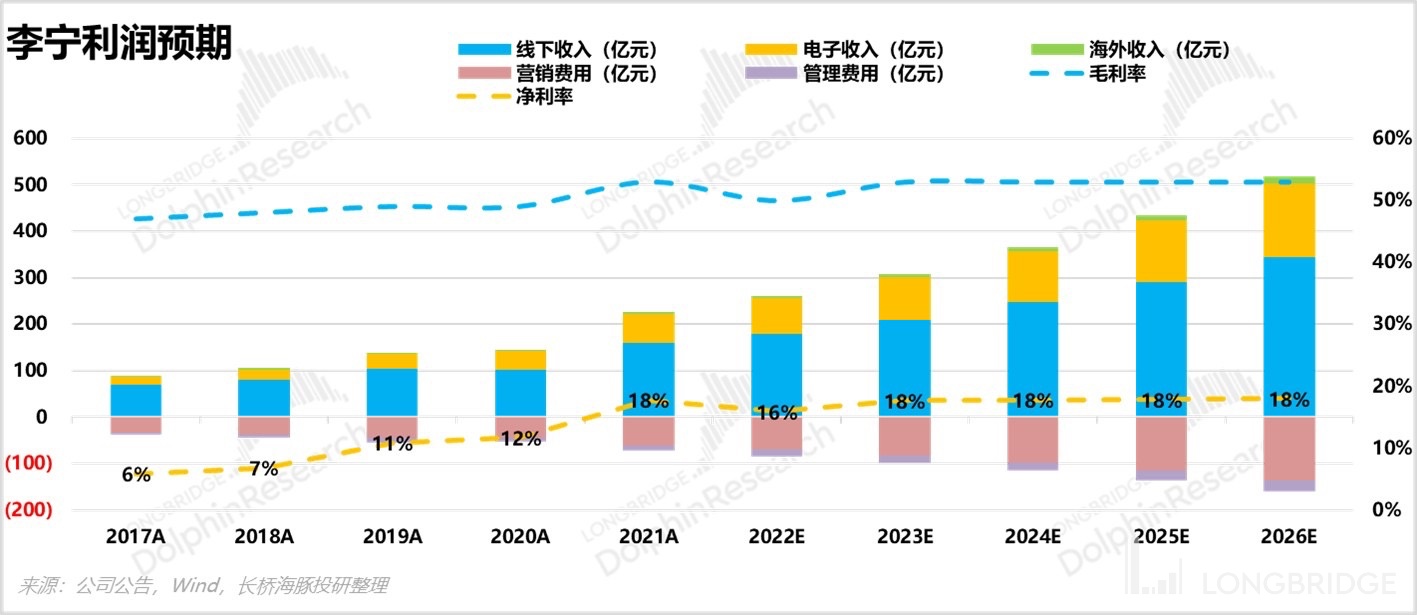

- Li Ning's revenue structure is dominated by offline business (over 60%), which largely determines the core hub of Li Ning's future overall growth rate. Based on the considerations for the future expansion space of channels and the efficiency improvement rate of individual stores, we believe that maintaining an opening rate of around 4% and efficiency improvement of around 13-14% is reasonable. Thus, we forecast an annual compound growth rate of around 18% from 2022 to 2026.

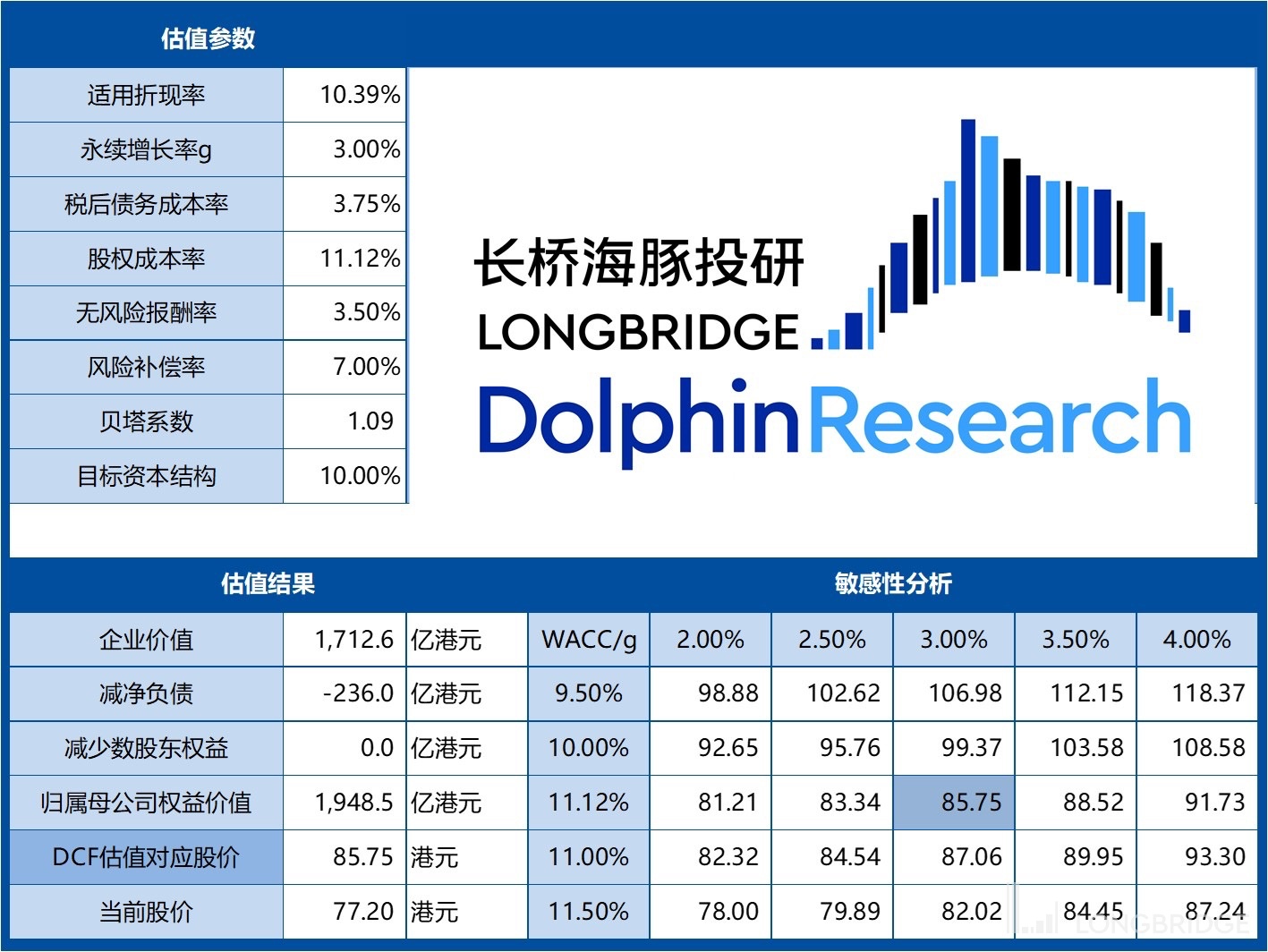

Based on Li Ning's brand positioning, any substantial change in product gross margin is unlikely to happen, and we predict that the annual compound growth rate of the net profit attributable to shareholders will be consistent with that of the revenue. 5) Using the DCF valuation method, assuming a WACC of 11.12% and a perpetual growth rate of 3%, Li Ning's reasonable valuation is HKD 85.75 per share, with a current upside potential of more than 11% (compared to the target price of HKD 71 per share, which had more than 20% upside potential when the consumer report "Two-year Battle Royale Ends, Consumer Sector Returns Stronger Than Ever" was published at the beginning of the year).

Dolphin Analyst is a research team that focuses on interpreting global core assets across markets for users to comprehend deeply the intrinsic value and investment opportunities. Interested users can add the WeChat account "dolphinR123" to join the Dolphin Analyst community and learn more about the investment perspectives on global assets together!

I. How to Be the King of Sports Apparel

So, why did we choose Li Ning given that there are already a bunch of sportswear companies on the market? Dolphin Analyst believes it's necessary to first provide a brief overview of the development of domestic sports brands over the past 30 years. This will help us better understand the genes of each company and how the leading company has won its position over the past three decades.

1.1 The Early Bird Loses the Nest Egg

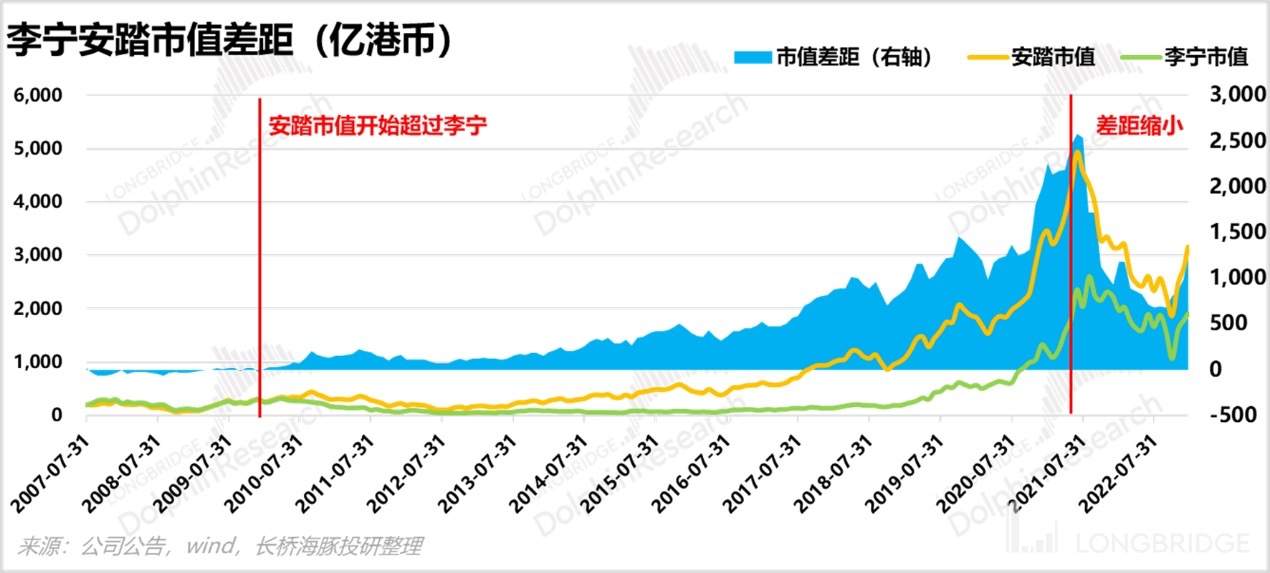

Li Ning got off to a great start with the enormous IP advantage of the "Gymnastics Prince" and capital support. Shortly after Li Ning was founded, it took the top position among domestic sports brands around 1995. Meanwhile, Anta was just a younger brother with a significant gap between it and Li Ning, as well as other domestic brands at the time.

However, Anta did two things right that helped it completely reverse the situation in 2010:

a. Polishing Its Products and Hitting Consumers' Pain Points

Anta catered to user needs, marketing high cost performance as its selling point. After the new millennium began, China gradually entered into a sports craze, but at that time, almost all sports fields in third and fourth-tier cities were outdoors. The high-end products with poor wear resistance were easily worn down on the rough cement fields. Anta took a different route, targeting consumers with an annual income of around RMB 5000, promoting its wear-resistant "cement killer," shaking off Nike and Adidas, and harvesting the sinking market that Li Ning failed to cater to.

b. Consolidating Resources and Launching Aggressive Marketing

In addition, Anta crazily consolidated sponsorship resources that Li Ning had given up, such as the Chinese Basketball Association (CBA), becoming its "exclusive designated partner." At the same time, Anta launched relatively aggressive marketing promotions, with the country's first "sports stars + CCTV advertising." At that time, Anta's net profit for the entire year was only a few million yuan, barely enough to support Kong Linghui's endorsement fees and CCTV advertising costs.

This put a lot of pressure on management's vision and courage, and the high marketing expenses faced opposition from many within the group. However, the founder persisted, and it was somewhat of a gamble. The changes in the competitive landscape over the past 20 years have resulted in ANTA receiving everything that Li Ning has given up. As competitors make progress and gradually catch up with themselves, Li Ning has now lost too much.

The fundamental reason is that Li Ning did not capture the most important factor influencing consumers at this stage. In an era where consumers' ability is still weak, compared with pursuing high-end upgrades, consumers need more practical products, "practicality" is more important than "aesthetics".

1.2 Misjudgment at a Critical Moment

In the past 20 years, as the gap between ANTA and its competitors gradually narrowed, Li Ning's counterattack was to implement brand reshaping and international reform, two strategies that ultimately led to its defeat.

Li Ning realized that the brand was aging and launched a brand reshaping campaign in 2010, positioning the brand image for the post-90s and beginning to raise prices, proposing to embrace young people's fashion. However, at this time, the post-90s were only 20 years old, and Li Ning's move directly excluded the main force of consumption, the 70s and 80s. What was even more serious was that the updated logo brought more inventory, longer turnover time, and reduced the brand's appeal to channels.

Another misjudgment was the premature international reform. For domestic brands, it is correct to upgrade the brand and increase product value, but it is not correct to choose the right time. After 2012, with the rapid development of e-commerce, the price of international first-line products has fallen. Although Li Ning's product image can indeed outperform other domestic brands, the product price is also skyrocketing. Consumers have not accepted Li Ning's early transformation, and Li Ning's market share has been declining, overtaken by competing products.

Under the same environmental background, different strategic thinking has led to a gradually significant gap in market share between Li Ning and ANTA. During these four years, Li Ning's management team changed frequently, and channel control gradually became powerless. In contrast, ANTA is agile in channel management. Faced with the inventory crisis in the industry in 2013, Li Ning spent more time licking its wounds.

1.3 Consumer Migration, "Trend Brand" Dominates, and Further Strengthening

As shown, the tide brand dominates consumer migration, which is a veritable fad. In 2015, against the background of huge losses, the company's founder returned to manage the company in person. What was more advantageous for the company was that consumers' preferences had changed. Sports products and collaborations with fashion brands set off a trend in streetwear. Li Ning seized the opportunity for a comeback and was unmatched in design among brands for the past twenty years.

Five years ago, Li Ning attempted to cater to the aesthetic of post-90s but failed, and now it was catching the consumers' eyes with the retro Chinese style. With its unique brand heritage and aesthetic background, Li Ning increased the added value of its products, which were well-received by consumers. At the same time, its neighbor, the red, white, and blue brand, seemed to have hit a wall in terms of aesthetics for the past few years.

1.4 The core of consumer goods

The changing history of Chinese consumer brand preferences is the most vivid history of the development of consumption upgrades and national mentality formation. As consumer goods, the key to winning is whether they can directly hit consumers' sore points. Among the three stages of Li Ning's development, the shift from deviating from consumers' preferences (neglecting cost-effectiveness and prematurely pursuing high-end products) to gradually readjusting and hitting consumer demands again (focusing on functionality, fashion, and brand heritage), largely reflects the process of changes in domestic consumer preferences.

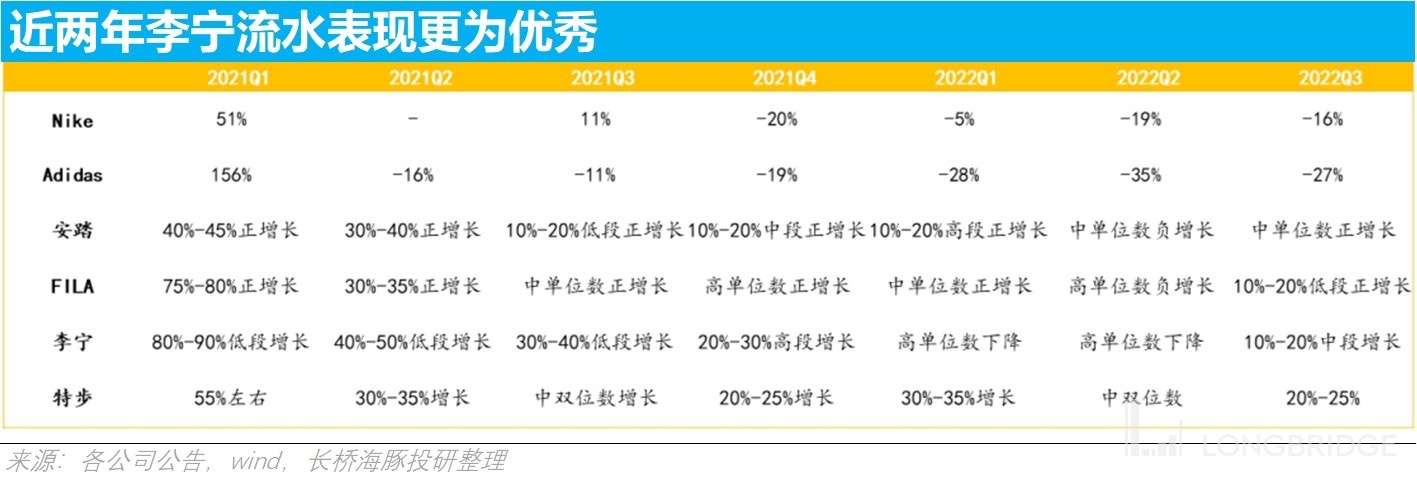

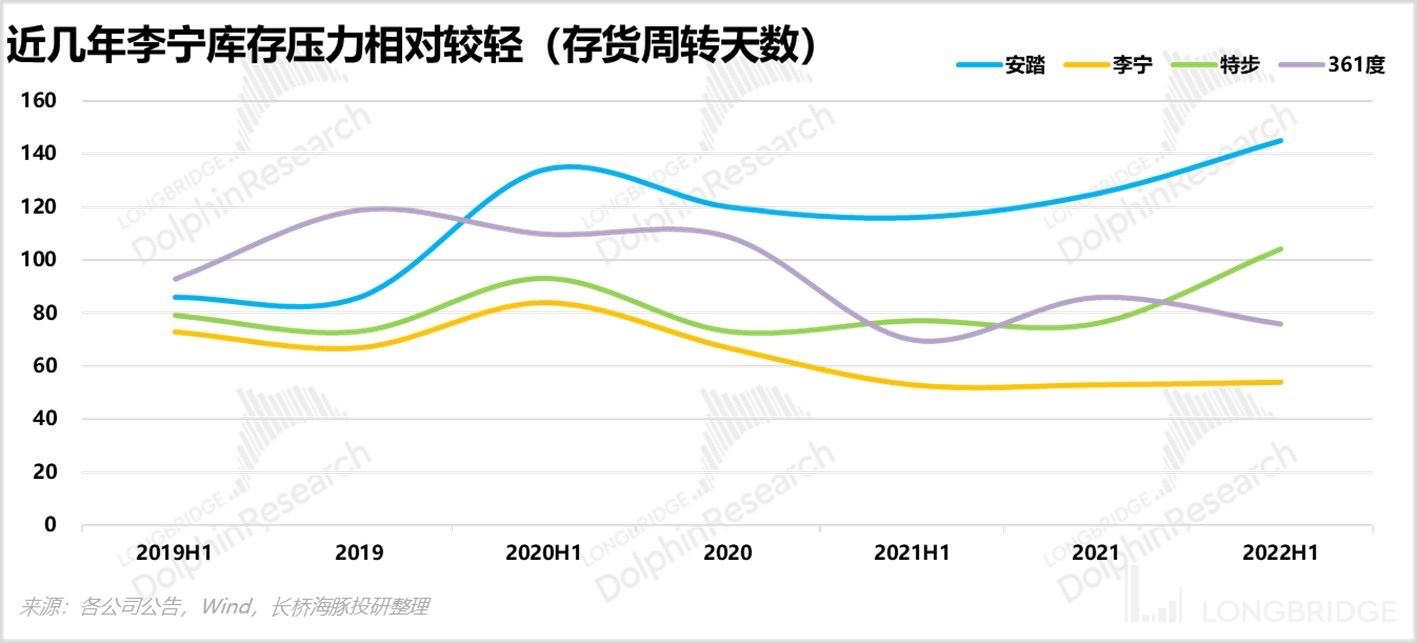

In recent three years, Li Ning has performed well. Not only has it widened the gap with its peers in terms of growth, but it has also maintained a relatively low inventory level. As mentioned earlier, Li Ning performed slightly worse during the last inventory crisis and took a long time to clear its stock, while Anta gradually accumulated inventory during Li Ning's reorganization from 2014-2018. Facing the sudden outbreak of the epidemic and under the early pessimistic expectations, the market naturally believed that Li Ning had a stronger resistance ability. Its stock price also performed outstandingly in 2019.

Consumers' purchasing power has been enhanced to the point that it's almost spiritual, and their aesthetic demands can switch styles but are not easily degraded. Quoting the view from "The Fourth Consumption Era," "even when the economy is under pressure and aesthetics switch to minimalism, the pursuit of beauty will not be abandoned." However, a company's design capability cannot be formed overnight. This is the reason why Dolphin Analyst pays more attention to Li Ning's current design capabilities. Li Ning has accumulated more than twenty years of product cultural innovation capabilities.

1.5 Occasionally making mistakes

However, there is now a quite tricky problem that even Dolphin Analyst feels powerless about, which is Li Ning's unstable design innovation capabilities. Sometimes Li Ning does not perform well in terms of design, such as the "Chasing Dreams Tour," which was severely questioned by netizens. Li Ning's public relations handling ability was also quite embarrassing. Small mistakes can be made, and consumers will give opportunities for forgiveness, but once it crosses the moral bottom line, it is a knockout blow with no chance of turning around.

The design problems also reveal flaws in Li Ning's management. Dolphin Analyst recalls how Li Ning lost its leading position and was stolen by Anta, also based on strategic failures. In this regard, Li Ning still needs further optimization. In the short term, the flaws can be ignored. If Li Ning can adjust in a timely manner and rely on its core innovative design capabilities, it can still walk steadily in the future.

Overall, Li Ning's design advantage can create a significant gap in the industry, but the remaining management defects of the company often lead to market controversy. Consumers' demand for sportswear has shifted from the cost-effective stage to the overall aesthetic stage. Design innovation, as the most core competitive ability, is the most prominent brand among Chinese brands.

2. Where does growth come from?

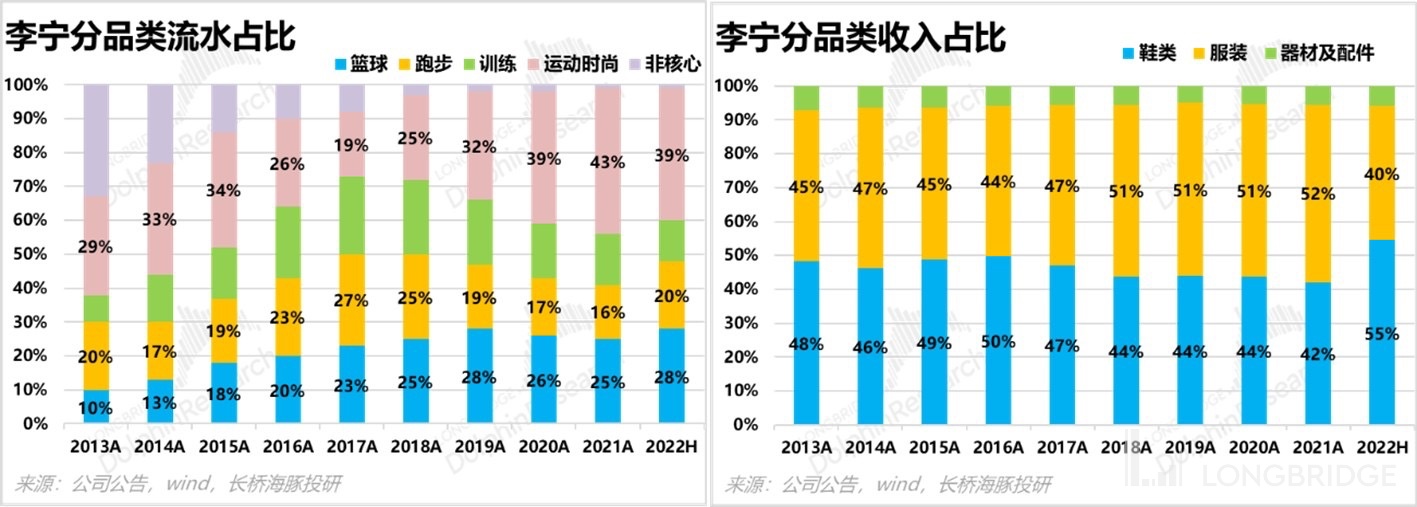

Since its inception, Li Ning has made several adjustments in its brand and category development. From 2006 to 2009, the group also adopted a multi-brand strategy and acquired multiple sports categories. This was a detour. After experiencing an inventory crisis, the company divested businesses that did not match its brand value, eventually forming a company strategy of "single brand, multiple categories, and multiple channels."

Starting in 2013, the company repurchased sports and focused its products on five categories: basketball, running, training, sports fashion, and badminton, reducing SKUs and increasing business focus. It also gradually divested other brands and categories, with the proportion of non-core businesses decreasing year by year.

Next, Dolphin Analyst will summarize the highlights of Li Ning's future development from the perspective of products and channels.

2.1 Products: How to maintain a high-end image?

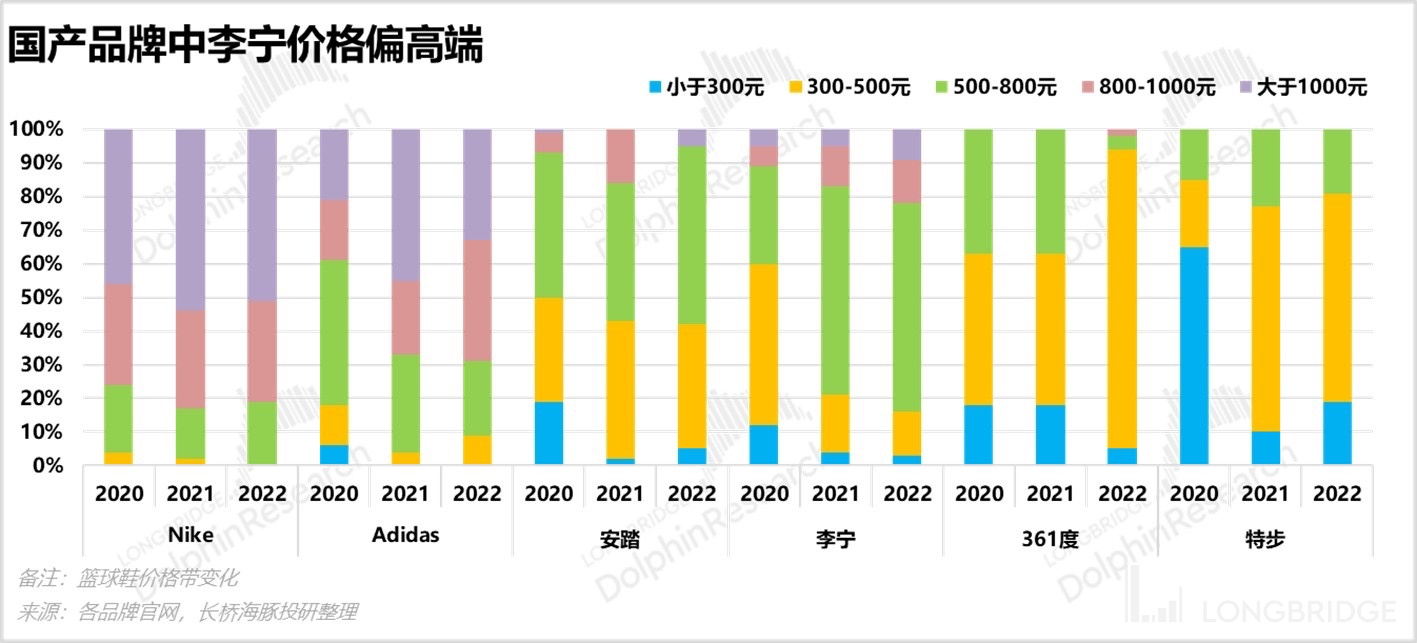

When it comes to the price of sportswear, consumers may feel that, among domestic original brands (excluding FILA), Li Ning's price range has always been the highest in the industry, and the company has always emphasized the technology and design of its products.

(1) Technological sense

For shoes, the midsole is usually the technical core of a pair of shoes. The midsole is the material between the shoe body and the sole that provides cushioning and adjusts foot feel. Different shoe types have different midsole technologies, and the foot feel can vary greatly.

From 2006, Li Ning has been independently researching and developing midsole technology and has iterated almost ten kinds of technology till this year to achieve strong shock absorption and lightweight products. Especially, the DriveFoam midsole technology jointly developed with BASF in 2018, which is a polar foam high-elastic material, with superior cushioning and rebound properties, makes its related products have a better reputation in the market than some of Nike and Adidas' products.

From 2006, Li Ning has been independently researching and developing midsole technology and has iterated almost ten kinds of technology till this year to achieve strong shock absorption and lightweight products. Especially, the DriveFoam midsole technology jointly developed with BASF in 2018, which is a polar foam high-elastic material, with superior cushioning and rebound properties, makes its related products have a better reputation in the market than some of Nike and Adidas' products.

Then, in 2019, Li Ning continued to launch three core technologies: LightFoam, JANG, and Beng. Beng is currently Li Ning's top midsole technology, mainly using a nylon elastic material with a popcorn-like shape, molded by supercritical foaming technology, which makes the sneakers have lighter weight, better rebound, stronger rebound recovery ability, as well as anti-aging, and yellowing resistance.

The company's annual R&D expenditure can also be seen, with R&D expenditure rates maintained at 2-3% in recent years. This is also among the highest in China's sports shoe and apparel brands.

In terms of Li Ning's design, its performance in basketball shoes is particularly outstanding. In the past decade, the company's basketball products' share in the category flow has increased from 10% to nearly 30%. This brings us to Li Ning's two high-end series products - Way of Wade and Yu Shuai.

In 2012, the company signed NBA superstar Wade who was at the peak of his career, and jointly created the product series "Way of Wade". Against the backdrop of a stock crisis, Wade's signing laid a solid foundation for the company's basketball business development. Leaving the sports technology aside, the more eye-catching color matching at that time was quite explosive among similar products and gained the recognition from fans.

In the later replacement of "Way of Wade" designers, more bold elements and color matching were integrated into the design, adding Li Ning's "Beng technology", directly pushing the product price of this series to the range of 1500 yuan.

If "Way of Wade" has the marketing advantage of using Wade's IP, "Yu Shuai" highlights the influence of designers on products while binding with popular basketball stars. "Yu Shuai" integrates a large number of Chinese elements into its design, such as "Tiger Charm," "Pottery," "Bamboo Pieces," and "Dragon Scales." These elements lay a unique Chinese style foundation. Moreover, the replacement of several designers for "Yu Shuai" also reflects that Li Ning's design innovation ability does not only depend on a designer but also on the company provided creative environment for free play. Innovative and original design sets Li-Ning apart from other domestic brands, instead of following international big brands. Dolphin Analyst believes that this plays a great leading role in the creation of Chinese style fashion.

In the past, Li-Ning always touted its high-end image, which did not give it much advantage in the rapid growth of the sports shoes and clothing market (early on, cost-effectiveness and channels were key). However, the long-term results of combining technology with design have indeed gained recognition and praise for the popularity of their products. In 2022, according to Brand Finance's "Global Top 10 Strongest Clothing Brands", Li-Ning ranked ninth and was the only Chinese brand included in the list.

According to Li-Ning's official flagship store statistics, Li-Ning's new products sold out rate has increased from 30% in 2013 to 60% in the past three months, and the new product sold out rate has increased from 50% in 2013 to 80% in the past six months.

In the previous article "[How Long Will Li-Ning's 'Cyclical Disaster' Last?] (https://longportapp.cn/topics/3908391)", Dolphin Analyst summarized for us that in the past two years, Li-Ning's inventory pressure has been relatively light compared to its peers, which actually reflects that Li-Ning's products have good circulation in the market. In addition, from the perspective of devaluation, except for the last inventory crisis, the company has more inventory reserves. In recent years, the situation of inventory reserves has been relatively normal and has not caused great difficulties for the company.

Overall, in terms of products, Li-Ning is strengthening the research and development of new technologies and materials in the field of shoes, improving the professional sports properties of shoes, and promoting the proportion of high-end products. On the other hand, in the field of clothing, it combines fashion elements with products and strengthens the layout of different segmented scenes such as skiing, skateboarding, and women's wear. This dual approach forms a high-end image of its products in the consumer's senses.

2.2 Channels: Continuous store openings, is there still room for growth?

Li-Ning's main source of income is still domestic, and the e-commerce channel has grown rapidly over the past few decades, accounting for 30%, but the larger proportion still comes from opening offline stores, either through direct sales or agency. As of the 2021 annual report, the company has more than 7,000 stores (including Li-Ning Young), of which the proportion of franchised stores is close to 80%. The impact of the revenue from offline stores mainly comes from the number of stores opened and the efficiency level of the stores. (1) Is there any room for continuous store expansion?

Historically, 2011 was the peak of Li Ning's channel expansion, with over 8,000 dealer stores. This was followed by a stock crisis, as the company proactively recovered some of the inventory from dealers and cleared it through factory stores to solve the inventory backlog caused by the change in branding. Starting in 2012, the new management team launched the "Channel Revitalization Plan," which increased the closure of inefficient stores and transformed the company from a wholesale to a retail business. After years of cleaning, the growth trajectory gradually returned to normal.

However, compared with its peers, Li Ning's channel coverage still has some gap. Li Ning's product prices are lower than those of Nike and Adidas but higher than those of Anta (excluding FILA), which is more suitable for first-tier and second-tier cities. However, Li Ning's layout in first- and second-tier cities is only one-third to one-half of its peers'. From this perspective, Li Ning still has room for improvement to catch up with top brands in the future.

In addition, in terms of entering shopping malls, Li Ning's total number of stores is still one-third behind industry leaders Nike and Adidas, and the gap is even wider if only China Li Ning's high-end stores are counted. The expansion of high-end channels can still contribute to Li Ning's growth in the future.

From the overall number of stores, including FILA and Anta Kids, Anta's number of stores has reached nearly 12,000, while Li Ning is still at the level of 7,000. It seems that there is still a 40% potential market growth compared to the industry leader. But in reality, this proportion may not be feasible.

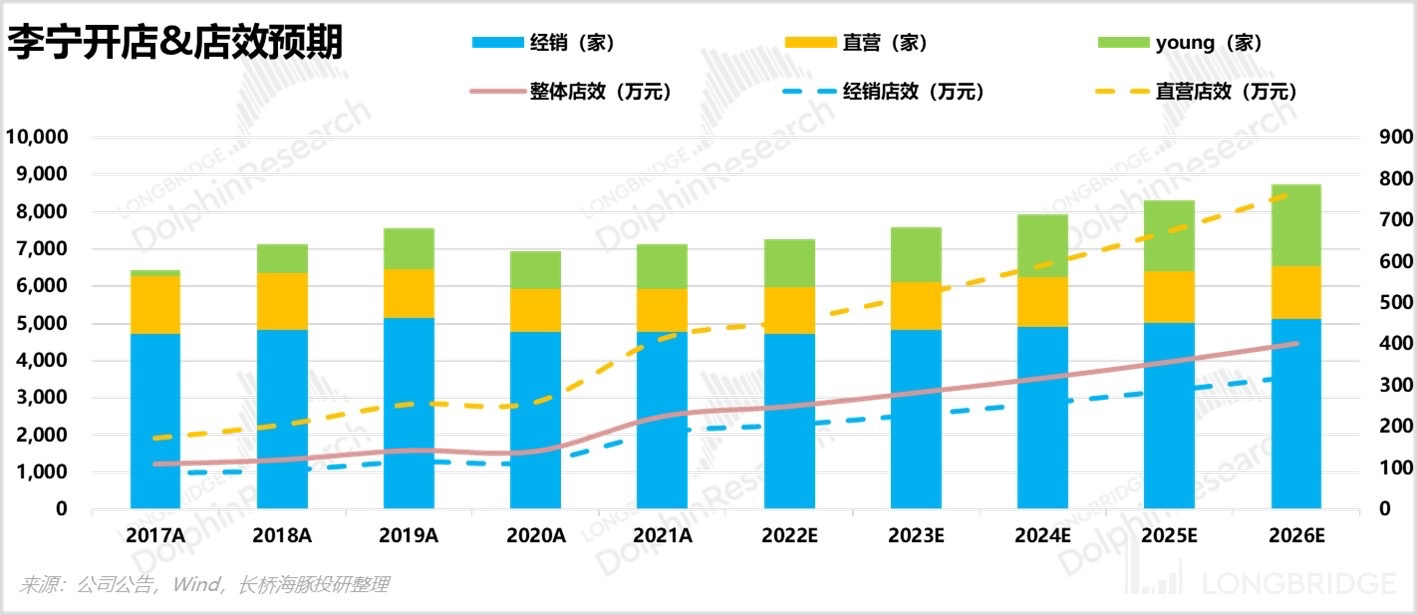

Starting in 2017, Li Ning proposed the strategy of big stores and no longer pursued the overall number and size of storefronts but focused more on the operating efficiency of each store. Therefore, in the current economic environment in China, Li Ning's expansion of storefronts should not be too aggressive.

In practice, from 2017 to 2021, the number of Li Ning's dealer stores increased by 20%, while the number of directly-operated stores decreased by 20%. However, the proportion of directly-operated stores is relatively small. Overall, in the past five years, Li Ning's total number of stores has only increased by 10% (with a five-year CAGR of 2%), but this does take into account the impact of the pandemic.

Based on Li Ning's store growth performance before and after the epidemic, it is expected that Li Ning's annual compound growth rate in stores should be within 5% in the future (higher than 2% but not too high). The majority of the growth contribution will still come from the improvement of store efficiency.

(2) What is the potential for improving store efficiency?

Overall, there is a lot of room for Li Ning to improve store efficiency from multiple aspects. The implementation of the new retail framework and digital transformation can effectively improve the quality of customer service, product development, supply chain, and marketing, providing a growth engine for Li Ning's future development.

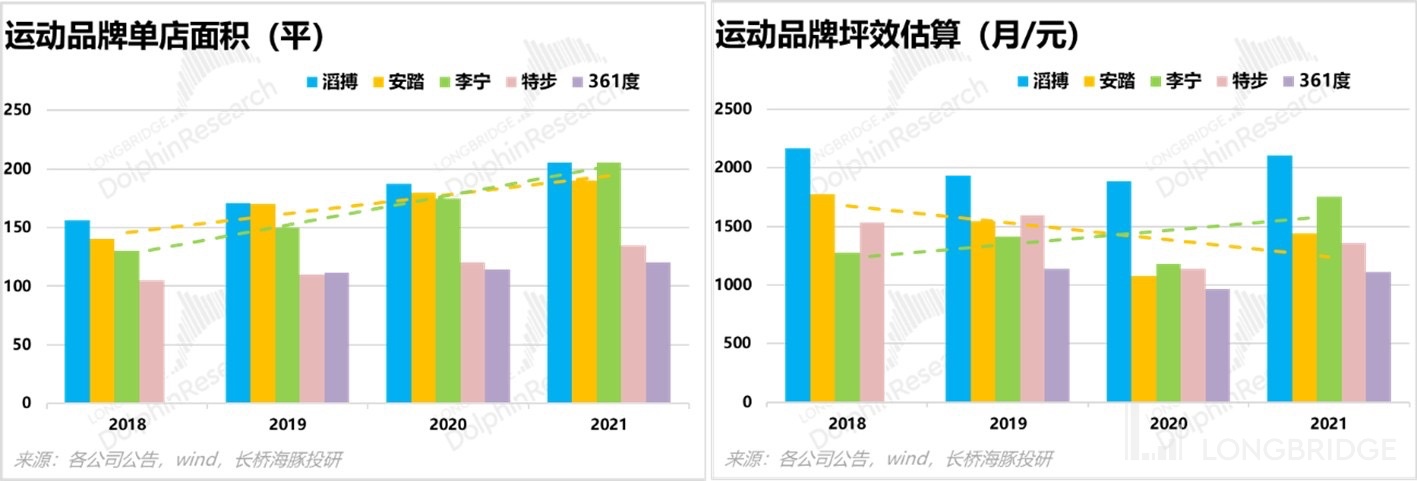

From the perspective of the store layout, the proportion of first-tier cities' stores accounted for an increase from 16% to 27% from 2017 to 2021. The average single-store area has increased from approximately 130 square meters to 180 square meters, which is in line with the trend of increased efficiency in store operations among most of its peers.

From the perspective of product structure, Li Ning is striving to optimize its product structure and expand market share in mid-to-high-end products. By 2020, the proportion of mid-to-high-end products had increased from 47% to 54%, and the proportion of high-end products had increased from 9% to 14%, showing the company's determination to move towards high-end brands.

In terms of supply chain, Li Ning is constantly optimizing the supply chain system. The company has built new and upgraded existing supply chain facilities to meet the demand for new orders generated by market expansion and support product innovation.

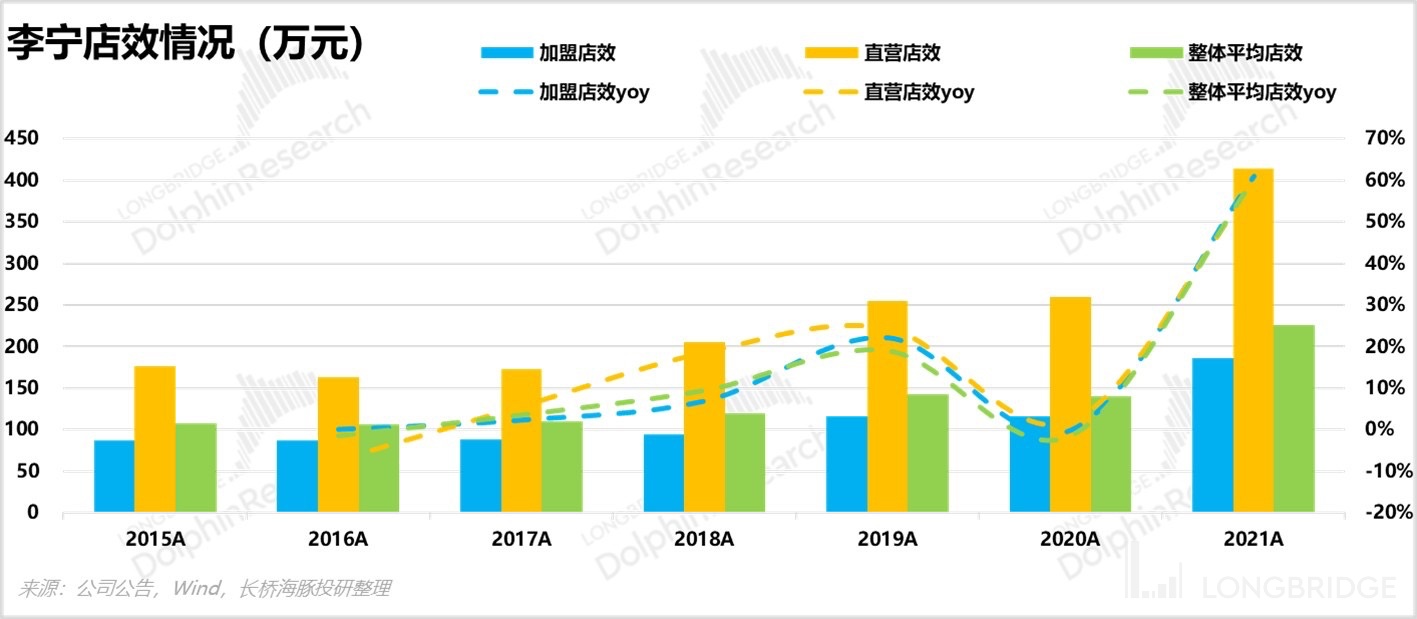

From the marketing perspective, the brand endorsement of Dolphin has made Li Ning more appealing to young consumers and expanded the brand's influence while maintaining its core customer group. Meanwhile, Li Ning also adopted a diversified marketing approach, such as collaborating with popular TV shows and sports events, to strengthen its brand exposure. Since the company implemented its large store strategy, it has been continuously renovating or closing stores, leading to an annual increase in average store efficiency. From 2017 to now, although Li Ning's number of stores has only increased by 10%, its average store efficiency has increased by 40% to 50%, which is very significant.

Even compared to peers in the industry, Li Ning's single store efficiency is impressive. From 2018 to now, various sales channels in China have seen different levels of increase in average sales per unit area, among which Li Ning's improvement is particularly significant. Moreover, in terms of sales per square foot, Li Ning's improvement is the most outstanding.

Therefore, overall store efficiency for Li Ning has seen a significant improvement in the past two years. This improvement is of good quality, not only resulting from management optimization of flagship stores, but also from franchise stores demonstrating the same effect. Li Ning's Co-CEO Qian Wei once stated that in the future, "we will not be obsessed with KPIs for store numbers, but will focus more on building efficient, profitable, and high-quality stores as our expansion direction." Based on the current trend, it is expected that Li Ning's direct-operated and franchise stores will achieve a compound growth rate of 13% to 15% for store efficiency in the next three years (with a CAGR for store efficiency from 2017 to 2021 of 16%).

III. Performance & Valuation Estimation

3.1 What is the offline business growth rate?

Combined with yesterday's report, the industry growth rate falls between 12% to 15%, on this basis, Li Ning can basically keep up with a 4% to 5% increase in store openings and an improvement in store efficiency of around 13%. That is to say, the offline business can maintain a growth rate of around 18%, which is slightly lower than the company's compound annual growth rate of 19% for offline business from 2017 to 2021, but higher than the industry's expected growth rate.

Assuming that the offline business growth rate is at 17-18%, and given the very small size of overseas business, as well as the relatively rapid growth of e-commerce, it is expected that the company's revenue will exceed RMB 50 billion by 2026, and the CAGR for revenue from 2022 to 2026 will reach 18%.

At the same time, due to the impact of the epidemic last year, the gross profit margin has slightly declined, but considering the trend of changes in gross profit margin in past years and the fact that the company's product prices are currently in the high-end market in China, it is expected that the gross profit margin will maintain a stable high level for the next four years with little variation in net profit margin except for 2022. It is expected that the CAGR for net profit from 2022 to 2026 will reach 18.3%, with a net profit that is slightly higher than revenue growth by 0.3%.

3.2 Valuation calculation:

In the end, based on our assessment and prediction of Li-Ning's core business (mainly offline business) as previously discussed, the Dolphin Analyst used the DCF valuation method this time, assuming a WACC of 11.12% and a perpetual growth rate of 3%. It is estimated that Li-Ning's reasonable valuation is HKD 85.75 per share, corresponding to 29 times P/E for 24 years. Currently, there is still more than 11% upside potential (compared to the target price of HKD 71 per share with more than 20% upside at the time the article《两年大逃杀结束,大消费 “卷土重来”》was published earlier this year).

Related readings:

January 31, 2023 Deep Report: "How long does Li-Ning's 'cycle robbery' last?"

January 4, 2023 Consumer Summary: "The return of big consumption after the two-year great escape"

Risk disclosure and statement of this article: Dolphin Research Institute Disclaimer and General Disclosure.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.