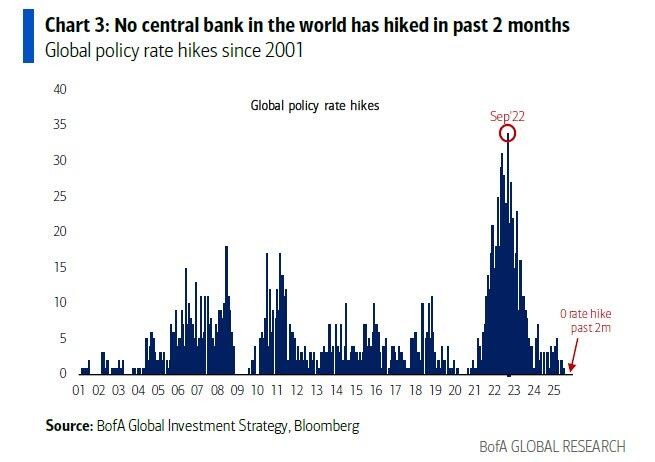

泡沫都是央行戳破的,而过去两月没有一家央行加息

美銀策略師 Hartnett 認為: 泡沫=繁榮=最好通過泡沫(人工智能)和廉價週期性資產(也就是今天的大宗商品,因為人工智能正在吞噬大宗商品)的組合來應對。價格走勢、估值、集中度、投機都泡沫化了,風險在於通脹的領先指標正在走高(ISM 服務價格上漲)……但歷史上的每一個泡沫都是由央行緊縮政策戳破的,而且世界上沒有一家央行在過去兩個月內加息過。

美銀策略師 Hartnett 認為:

泡沫=繁榮=最好通過泡沫(人工智能)和廉價週期性資產(也就是今天的大宗商品,因為人工智能正在吞噬大宗商品)的組合來應對。價格走勢、估值、集中度、投機都泡沫化了,風險在於通脹的領先指標正在走高(ISM 服務價格上漲)……但歷史上的每一個泡沫都是由央行緊縮政策戳破的,而且世界上沒有一家央行在過去兩個月內加息過。