退到 “墙角” 的 “私募大佬们”

Net value is weak, when will the counterattack begin

When the market's frenzy sweeps in, a group of former "investment kings" quietly retreats to the corner of the stage.

Their net value curves run counter to the boiling market, as if they are in another parallel space-time.

Their views are still being followed, but gradually seem to have become the target of market "diss."

Those once-prominent names, products that were once chased by funds, have now gradually fallen to the bottom of the performance rankings of hundred billion private equity funds. Moreover, this has happened repeatedly over the past three years.

This not only surprised investors but also naturally sparked many skeptical voices.

The once-revered investment tycoons, those who shone brightly before 2021, have been swept into the corner by the tide of the market.

Can they, who are so "steadfast," recreate their past glory?

What happened to you, tycoons?

In December 1999, at the peak of the most frenzied internet stock market of the last century, Barron's published a cover article titled "What's Wrong with You, Warren (Buffett)," discussing Buffett's underperformance over the past year.

In that market dominated by internet stocks, a group of investors who stuck to their stock styles were "going against the trend," including Buffett, Tiger Fund's Robertson, and Quantum Fund's Soros (before the bullish turn).

A similar situation has occurred with some domestic investment tycoons, such as Lin Yuan and Dan Bin.

Looking back at the performance rankings of hundred billion private equity funds over the past year, several products from Lin Yuan Investment are at the bottom, seemingly unrelated to the market's frenzy.

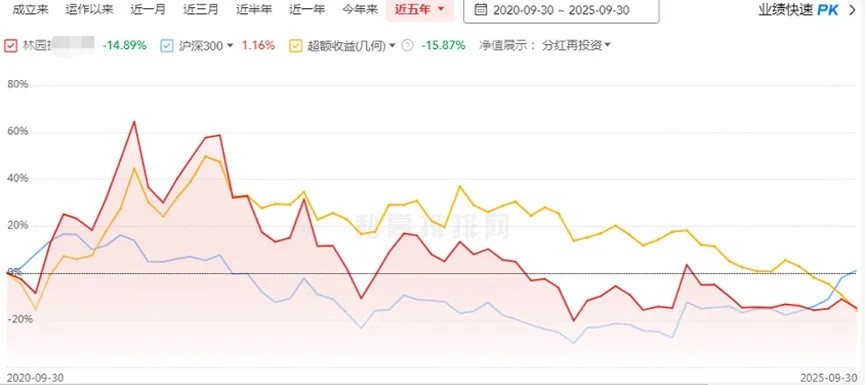

According to third-party data disclosure platforms, as of September 30, 2025, the CSI 300 Index rose by 15.50% over the past year. In contrast, the net value of Lin Yuan Investment's XX fund has seen a double-digit decline.

The gap between this positive and negative performance has widened by more than 30 percentage points.

Perfectly Missed?

From the perspective of net value trends, some of Lin Yuan's products have almost "perfectly" missed the market over the past year. Especially after the second quarter of this year, while popular stocks were trying to perform, the net value of Lin Yuan's products moved in the opposite direction.

This is not just Lin Yuan's "trouble."

Looking back at active equity private equity institutions with over 5 billion, they have generally moved in two directions over the past year.

Either they actively or passively followed the market trends—those good at consumer stock investments kept up with new consumption, those fond of cyclical stocks embraced the big tech cycle, and fell in love with robotics, AI, and semiconductors.

Or they stuck to their previous varieties and investment ideas—but faced a lot of pressure.

Lin Yuan undoubtedly chose the latter.

Heavily Invested in "Old Consumption"?

While major funds chase AI, semiconductors, and new energy, Lin Yuan's products still heavily invest in a few "old" consumer stocks, almost "turning a blind eye" to emerging technology fields.

This can be seen as a form of steadfastness, or it can be viewed as an obsession According to the quantitative analysis report of sales channels, the industries that have a "negative contribution" to the net value of Lin Yuan's products are precisely the traditional sectors such as food and beverage, pharmaceuticals and biotechnology, and retail trade, yet his heavily weighted stocks seem to be "nailed" in the traditional fields that Lin Yuan is familiar with.

Among them, the food and beverage companies that Lin Yuan is heavily invested in are particularly significant, becoming the most obvious drag on net value.

Additionally, channel analysis shows that although Lin Yuan's holdings in sectors such as utilities, electronics, steel, and banking have made a positive contribution to net value, the total returns from these industries are still insufficient to offset the losses suffered in the single food and beverage industry.

Where Does the "Obsession" Come From

However, Lin Yuan's actions naturally have their logic.

Looking at Lin Yuan's public statements this year, we can outline the internal logic behind his adherence to "old brands":

First, he has repeatedly emphasized the investment philosophy of "long-term heavy positions, buying without selling, and never selling."

This means that his investment framework is built on the underlying logic of "lifelong holding," with extremely strict selection criteria for holdings, but it may also overlook the cyclical changes in industry prosperity.

Second, he has clearly stated his optimism about the "elderly economy" track, such as traditional Chinese medicine, predicting that its growth rate will approach double digits in the next decade.

This means that the allocation in the pharmaceuticals and biotechnology sector is based on a judgment of long-term growth potential in specific sub-sectors, but this judgment is facing severe tests from market realities.

Third, he confidently pointed out that the liquor sector is still undervalued, believing that "the Chinese wine culture that has existed for thousands of years will not disappear because wine brings joy to people."

This means that his adherence to food and beverage has transcended financial analysis, rising to the dimensions of cultural confidence and human needs.

Fourth, he specifically mentioned the dividend yield advantage of A-shares, believing that funds will continue to flow into industries with stable dividend yields such as food and beverage (which he refers to as "mouth business") and utilities.

This means that his allocation thinking leans towards high-dividend, stable cash flow assets, contrasting sharply with the current market's preference for growth.

Fifth, Lin Yuan also mentioned this year that he has "no confidence" in investing in technology stocks, finding it difficult to predict future leading companies, stating, "It's not that I don't want to invest, but I can't make money from this."

This idea is actually very understandable; market styles will ultimately switch, just as bank stocks can also strengthen for two consecutive years.

At this time, changing direction could face greater challenges if the market style shifts.

Dilemma

However, such choices can also lead to significant pressure.

Especially if a single market style does not switch for a long time, the "situation" of the fund manager who insists on it will increasingly become problematic—until they are forced into a corner.

During the internet stock boom of the last century, the U.S. stock market brought a "painful" case, that of Robertson from Tiger Fund, who "liquidated" his hedge fund just months before the internet bubble—once one of the largest hedge funds in the market.

But just as he completed the liquidation process, the U.S. stock market style really switched.

So, this is a dilemma In addition to the dilemma, style may also be an issue.

Like many first-generation successful fund managers, Lin Yuan's investment system was established many years ago. They made significant investments in traditional sectors represented by consumer goods in the early years, capitalizing on their perception of the changes in China's economic structure from the 1990s to the 2000s, and earned astonishing returns in the tide of the times.

It is this "faith" derived from successful experience that has forged Lin Yuan's current "obsession": on one hand, there is extreme confidence in his "buy and hold" investment system; on the other hand, there is an instinctive alienation from the bustling new emerging sectors of the market.

This alienation is facing severe tests as structural market conditions intensify.

To some extent, Lin Yuan's products currently resemble ships sailing on old routes. While newcomers and veterans are singing and dancing on new routes, those who stick to the old routes are being pushed further away by the winds and waves.

Footnotes from Peers

According to a report by Private Equity Ranking, in the "reverse" ranking of hundred billion private equity products (over the past year), another "big figure" is closely following Lin Yuan with multiple products.

That is Dan Bin of Dongfang Hongyuan. This hundred billion fund manager has been shining in the past two years, not only winning the championship of hundred billion private equity last year but also becoming a "die-hard bull" in AI investment in mainland China.

However, the products managed by Dan Bin show differentiation. The products he ranked have yielded over 25 percentage points in the past year, while another product under his name has only yielded 12% during the same period, significantly lagging behind the CSI 300 Index.

The underperforming products of Dan Bin make investors feel that the heavy investment in the US AI sector is "light."

From the common sense of the private equity industry, a fund manager would not heavily invest all products in the highest-risk, highest-potential return sectors, but would consider the source of funds, clients' risk tolerance, and compliance requirements of cooperative channels.

In this light, the underperforming products of Dan Bin— which have been at the bottom alongside multiple products of Lin Yuan in the past year— may be a "sample" of Dan Bin's A-share portfolio, or perhaps a manifestation of his "traditional thinking."

After all, both Lin Yuan and Dan Bin made a fortune from early investments in liquor.

In 2000, Buffett, after enduring a period of "public diss," finally awaited a style switch. However, Robertson, constrained by funds, had to accept the "bitter wine" of "personal character." Where will the persistence of these big shots lead this time?