币圈 “血流成河” 前夕,神秘 “巨鲸” 精准做空,30 分钟狂赚 2 亿美元!

一個神秘的「巨鯨」賬户在 Hyperliquid 上建立了鉅額的比特幣和以太坊空頭頭寸,市場崩盤後一天之內就獲利近 2 億美元。巨鯨賺得盆滿缽滿的背後,是市場的屍橫遍野。24 小時內,全網槓桿倉位蒸發了 191 億美元,刷新了歷史記錄,總共有超過 162 萬人被強制平倉,血本無歸。

就在特朗普宣佈關税政策前半小時,一個神秘的「巨鯨」賬户在去中心化交易所 Hyperliquid 上,建立了鉅額的比特幣和以太坊空頭頭寸。政策消息一出,市場應聲崩盤,這個地址一天之內就獲利近 2 億美元。

鏈上數據與市場慘狀共同指向的信息,不由地引發市場反思:在加密貨幣這個被譽為 “去中心化” 的金融前沿,權力和信息似乎正以一種更隱蔽、更高效的方式被重新中心化。

而超過 160 萬名投資者,淪為了這場盛宴的燃料。

巨鯨盆滿缽滿,市場屍橫遍野

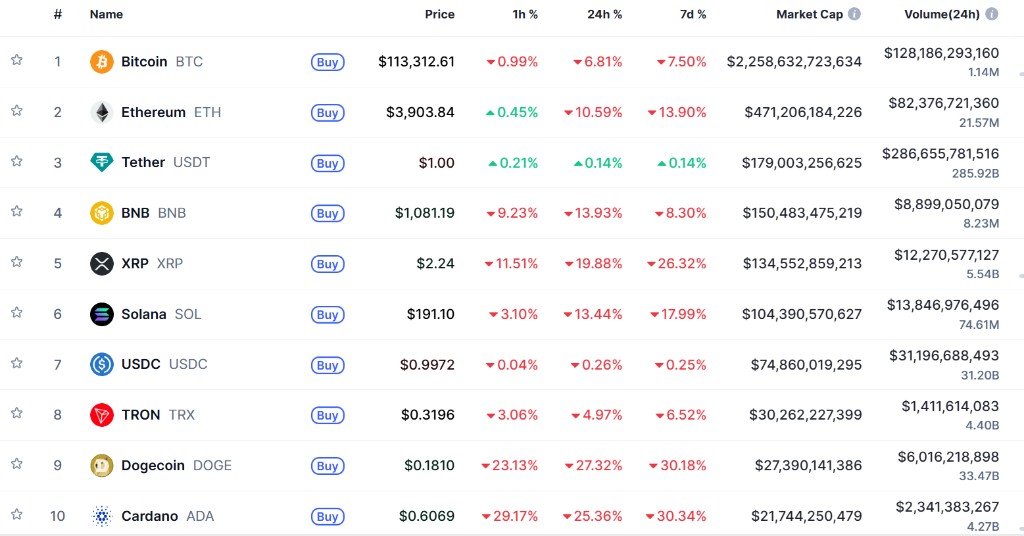

美國東部時間 10 月 10 日,受特朗普關税威脅影響,加密貨幣市場大幅下跌。

然而,就在消息公佈前,一位神秘巨鯨在去中心化交易所 Hyperliquid 上,精準地建立了規模龐大的空頭頭寸。

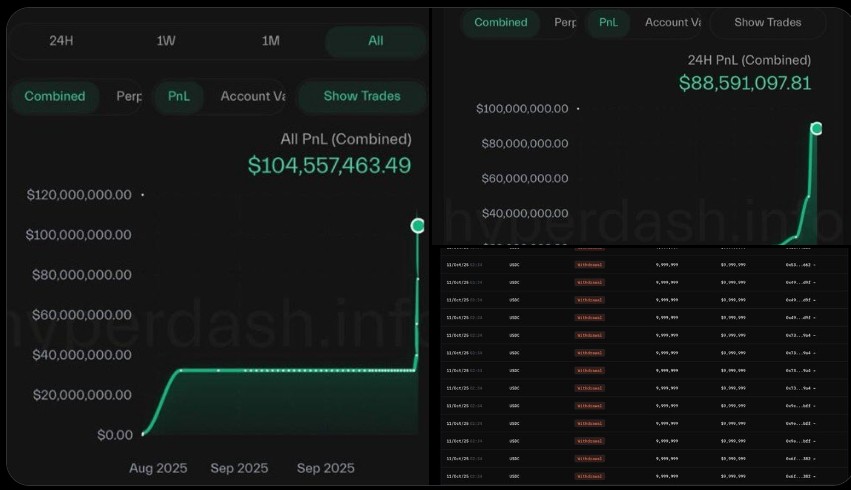

僅 Hyperliquid 這一個平台公開的鏈上數據,就證實了這位 “先知” 在短短一天內,攫取了超過 1.9 億美元的利潤。

而這,可能還只是 “先知” 們鉅額盈利的冰山一角,鏈上分析賬户 mlmabc 評論稱:

“這還只是在 Hyperliquid 上公開的,想象一下他在中心化交易所(CEX)或其他地方做了什麼。我非常確定這傢伙在今天發生的事情中扮演了重要角色。”

巨鯨賺得盆滿缽滿的背後,是市場的屍橫遍野。

24 小時內,全網槓桿倉位蒸發了 191 億美元,刷新了歷史記錄,總共有超過 162 萬人被強制平倉,血本無歸。

整個加密市場的總市值,在一天之內蒸發了超過 10%。

完美 “收割系統”

一次精準的預判,或許可以歸功於卓越的分析能力。但當這種 “預判” 與政策發佈的時間點嚴絲合縫,並最終導致一方鉅額盈利和另一方鉅額虧損的極端結果時,其背後的運作機制就值得深思。

這起事件的邏輯,總結起來並不複雜,用 Sleepy.txt 的話來説:

“政策一經發布,市場劇烈震盪。核心圈層平倉離場,獲得暴利;散户投資者成為接盤俠,或被清算出局。SEC 視而不見,國會拒絕調查,法律形同虛設。”

這套結構性的、高效運轉的系統,主要由以下幾個部分組成:

- 信號源: 重大的、能引發市場劇烈波動的公開政策(如關税),成為博弈的發令槍。

- 信息優勢方: 能夠提前獲取信息或精準解讀高層意圖的 “核心圈層”,得以從容佈局。

- 收割工具: 高槓杆的金融衍生品,成為放大信息優勢、實現利潤最大化的終極武器。

- 監管真空: 本應扮演監督角色的機構(如 SEC)和立法機構(國會)被指 “視而不見”、“拒絕調查”,使得法律形同虛設。

這個系統的運轉幾乎無懈可擊。它不需要秘密會議,不需要地下交易,一切都在陽光下進行,但沒有人能夠阻止。

於是,故事循環往復。下一次關税,下一次政策,便是下一次收割。