美元下跌,但影響尚在

美元面临来自贸易政策、预算赤字和利率不确定性的压力,导致其在今年前六个月下跌,之后基本持平。分析师指出,政策的不确定性和市场波动促使交易者转向欧元、英镑和瑞士法郎。预计未来 12 个月内,去美元化趋势将持续,可能推动主要 G10 货币对美元汇率上涨。尽管与欧盟和日本达成的贸易协议消除了部分关税不确定性,但预算赤字和债务危机仍是美元面临的重大挑战。

概览

· 美元正面临来自贸易政策决策、预算赤字和利率不确定性的阻力

· 美元下跌主要发生在今年的头六个月里,自 7 月以来则基本走平

政策不确定性。赤字大增。经济增长疲软。以上是未来 12 个月可能对美元施加压力的部分关键因素,延续 2025 年大部分时间所呈现的美元下行趋势。

“今天要收关税,换一天又不收了,” 外汇咨询机构 Oanda 的分析师 Zain Vawda 说,“这种反复无常的政策变化正在损害美元。”

他表示,前所未有的市场波动促使交易者避开美元,转向买入欧元、英镑和瑞士法郎。

Vawda 表示,鉴于华盛顿今年可能进行两到三次降息,去美元化的趋势预计还会持续一段时间,这可能会推动欧元兑美元、瑞士法郎兑美元、加元兑美元等主流 G10 货币对的汇率上涨。

欧元作为与美元交易量最高的货币,可能会在欧洲经济走强、大规模经济刺激计划、市场预期降息幅度低于美国的形势下出现上涨。

7 月 27 日,美国与欧盟签署了一项期待已久的贸易协议,欧盟将为向美国出售的货物支付 15% 关税,远低于最初提议的 30% 税率。这一消息使得美元在当天上涨约 1.2%,尽管美元在今年整体上下跌了约 13%。

金融咨询机构 Riskdynamics 的 Mark Connors 认为,除非更为紧迫的风险得到解决,否则该协议以及 7 月 23 日与日本达成的贸易协议不会显著提振美元。

“这些协议消除了关税的不确定性,” Connors 说,“但我们仍然面临着巨大的预算赤字和债务危机。”

面对持续存着的不确定性,美元走势可能成为其他主流货币的不利或有利因素:

· 英镑:分析师表示,尽管英镑兑美元汇率在 6 月底几乎达到 1.4,但涨幅主要来自于美元走弱,而非投资者对英国经济的信心。Vawda 认为英镑在未来一年内将相对走平。

· 加元:截至 9 月中旬,加元兑美元汇率一直在 1.38 左右徘徊。Vawda 表示,如果渥太华能与华盛顿达成有利的关税协议,并在明年夏天对美墨加协定进行全面修改,加元将有望升值。这是因为油价有可能上涨,从而提振加拿大的主要出口,进而有望提振加元走势。

· 瑞士法郎:虽然瑞士法郎可能将继续受益于其避险作用,但大幅升值意味着该国央行可能会通过售出提振出口。

· 日元:日本达成的贸易协议包括对美出口将被征收 15% 关税,以及承诺在美国境内投资 5,500 亿美元。虽然这消除了关税的不确定性,但 Connors 预计在该国解决一系列宏观经济挑战之前,日元的不景气不会出现改善。

“日本仍面临着财政挑战、高通胀与低增长以及与美国的巨大贸易差额,” Connors 表示。该国的隔夜拆借利率为 50 基点,而美国则超过 400 基点。“除非日本央行会在近期内加息,且至少加息 25 基点,否则我不认为日元会显著升值。”

随着美元波动和全球外汇市场波动加剧,投资者纷纷选择将期货和期权用作投资组合的对冲工具。芝商所外汇期货和期权的独立用户数量同比增长 19%,合约持仓量在今年 3 月创下 378 万份的纪录新高,名义总值约达 3,580 亿美元。

尽管参与人数持续增长,但整个市场仍面临挑战。该市场高度分散,提供外汇交易的平台数量不断增加,使得投资者难以获得可靠的定价和流动性。此外,也有许多机构和小规模投资者在期货市场内可能少有人脉关系或清算权限。这就在能够获取相关流动性和无法获取相关流动性的参与者之间催生出了一个 “二级” 市场。

人民币同样受到投资者关注,一方面是因为中美两国目前的贸易局势紧张,另一方面则是因为人民币作为全球储备货币的地位在不断提升。

据德意志银行表示,该国作为全球第二大经济体,已逐步放开金融市场,提升人民币在亚太地区、欧洲和新兴市场的接受度。越来越多的机构正在使用人民币进行跨境贸易和投资融资。

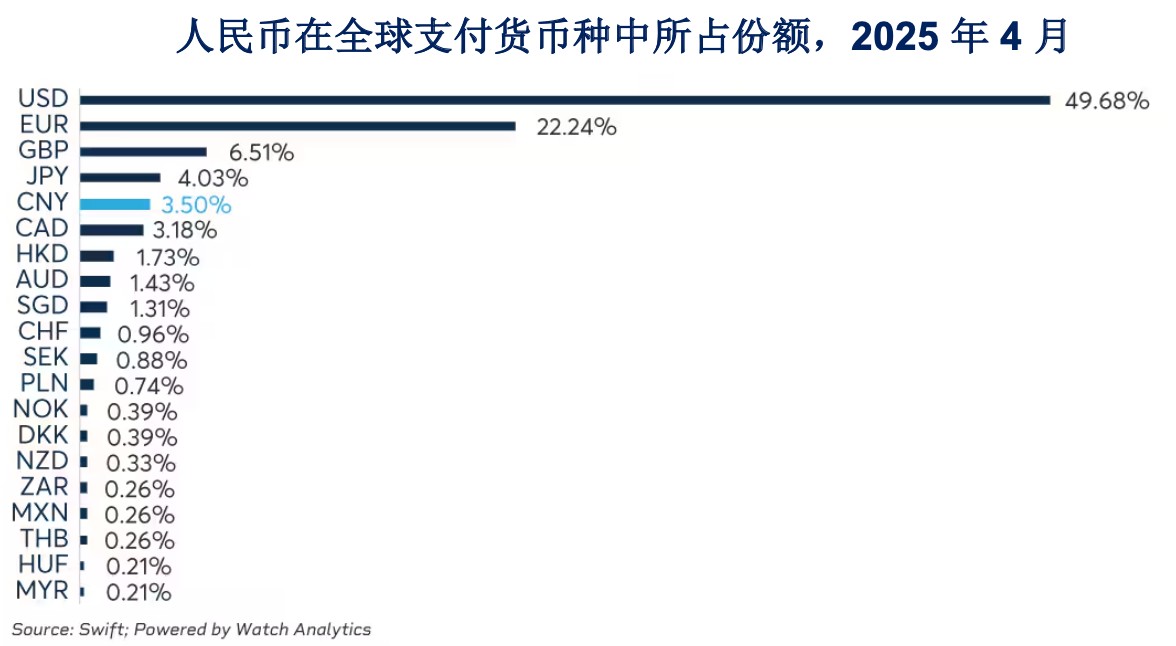

该行表示,截至 2025 年 4 月,中国在全球 SWIFT 支付市场所占份额已达到 3.5%,较 2023 年的 2% 录得上升。贸易方面,在 2024 年有 6% 的全球商业活动使用人民币结算,同样较 2023 年的不到 2% 有所上升。

德银还称,这标志着 “对币种的偏好发生了明显变化,特别是在新兴市场和主要的全球贸易走廊。”

AlphaSimplex 的首席研究策略师 Katy Kaminski 也认为,若当下的反美元叙事继续延续,人民币还可能进一步走强。

她指出:“尽管最近有多方做空人民币,但中国政府有可能推出新的刺激政策,可能会对其经济和货币起到提振作用。”

不过她也表示,即便如此,人民币也需要至少 10 年时间才能对美元的储备地位产生任何影响。

而在世界另一端,墨西哥比索正在面临着挑战,可能会令其在今年的大幅上涨后陷入停滞。由于特朗普在 7 月 31 日宣布对墨西哥的关税豁免期限延长 90 天,不确定性依然存在。特朗普团队的官员还表示,他们希望在明年 7 月美墨加拿大协定 (USMCA) 到期重审时重新谈判该协定的条款。

保德信 (PGIM) 量化解决方案的投资策略负责人 Jeff Young 较为看涨美元。

“尽管面临着关税、去年前所未有的政治事件和美联储大手笔降息等风险,美国经济增长依然稳健。” 他说,“这表明美国具备一些非常深层的韧性来源,甚至足以抵消关税这类因素(的影响)。”

他接着说道:“美国相关领域的基础增长趋势依然比欧元区略为坚挺。例如,人工智能领域在美国的发展远强于欧洲。每个人都想从人工智能题材中分一杯羹,而这就是美国这里的现况。所以美国仍然仍有巨大的活力,牢牢吸引着各方投资。”

Bokeh Capital 的 Kim Forrest 则不太担心美国例外主义正趋于式微。

“我们的经济结构依然卓越,” 她说,并补充道,美国的基准利率依然高于许多国家。“我们仍然是世界上最容易开办企业的国家,而且我们拥有定义明确的判例法,大家能对美国法庭的结果拥有明确的预期。”

根据 Forrest 的说法,美国期货和期权市场的流动性居于全球之冠,让投资者能够快速高效地抵消美元贬值带来的损失。

“你若在欧洲境内进行为期五年的投资,完全可以通过买入期货和期权来控制任何种类的跨币种风险。” Forrest 说,“这为美元化带来了巨大的便捷性优势。”