今年收益 43%,東吳基金陳偉斌:貿易摩擦是情緒擾動,市場短期獲利調整,整體機會大於風險,把握 AI、創新藥兩條主線

東吳基金的陳偉斌在 10 月 13 日分享了對市場的展望,指出中美貿易摩擦對市場情緒有影響,但不具決定性。短期內市場可能震盪調整,但整體機會大於風險。他建議關注 AI 和創新藥兩個長期產業趨勢,認為 AI 產業仍處於早期階段,液冷技術有巨大市場潛力;創新藥方面,PD-1/VEGF 雙抗和 ADC 等細分領域值得關注。

當前中美貿易局勢緊張,未來市場將如何演繹?

10 月 13 日上午,東吳基金陳偉斌分享了對市場走勢的展望。

投資作業本課代表整理了要點如下:

1、全球貿易戰這一話題,實際上它並不具備決定性影響,更多是對基本面,尤其是對市場情緒可能產生一定影響。

這類消息實際上更多是情緒上的擾動。經歷了今年 4 月份全球貿易戰的 “黑天鵝” 事件後,最極端的衝擊可能已經過去。

2、短期來看,受到海外貿易戰的影響,我們認為市場可能存在通過震盪調整來消化獲利盤的內在需求。但調整結束後,只要流動性不出現問題,那麼對整個市場,我們仍維持機會大於風險的判斷。

3、在海外風險的背景下,建議投資者還是去關注具有長期產業趨勢的方向,我們梳理下來,一個是 AI,一個是創新藥。

4、AI 是一輪類似的、相當於 PC 互聯網革命的變革,以十年計算,現在才剛剛走了兩年多,大概率還是處於 AI 產業的前期。

5、AI 上游仍然有空間,但下游空間更大。

上游主要是算力基礎設施建設,包括光模塊、PCB、電源、液冷,我們認為未來液冷的空間會更大。

現在是液冷爆發元年,正處在一個爆發原點,它剛剛開始,明年才是第一個完整的年度,明年行業增速有可能達到 500%。

液冷今年全球的市場空間可能在一兩百億的量級,明年則有希望達到千億量級。

6、創新藥現在才走了兩三個季度,大概率還處於上半場。未來無論從時間還是空間上看,都還有潛力。

從細分板塊來説,我們建議大家關注:一個是 PD-1/VEGF 或 PD-1 plus 這類雙抗;其次是 ADC;還有就是上游的 CXO 等方向。

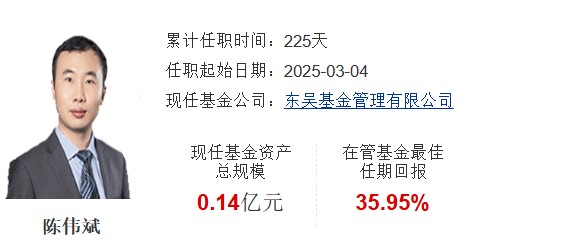

陳偉斌,東吳基金經理,管理基金經驗剛滿 7 個月,2020 年 8 月加入東吳基金,歷任高級行業研究員、研究策劃部總經理助理、投資經理,現任權益投資總部總經理助理兼權益研究部總經理、基金經理。2025 年 3 月 4 日擔任東吳雙三角股票型證券投資基金基金經理。

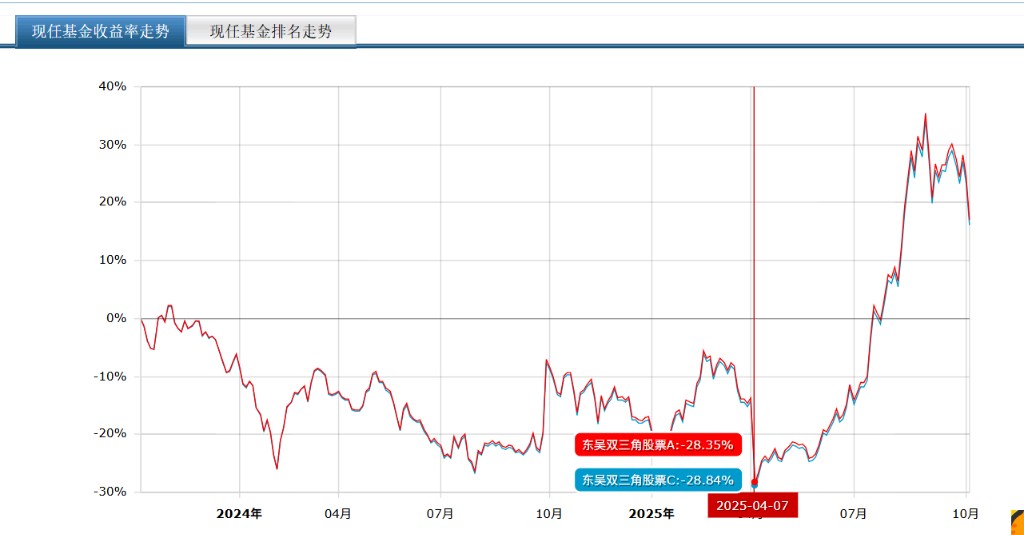

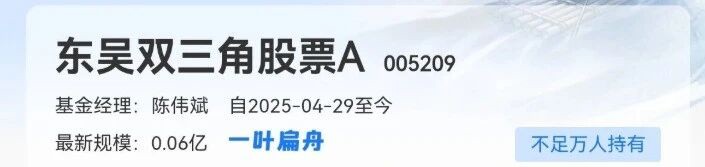

其管理規模僅 0.14 億元,只管理一個基金——東吳雙三角股票,以東吳雙三角股票 A 為例,今年來收益 42.5%,雖不及今年前三季度公募基金前 20 名收益均翻倍,但業績也尚可。

從上圖中可見,東吳雙三角股票 A 和東吳雙三角股票 C 均在今年 4 月陳偉斌管理後,收益率急速上漲。

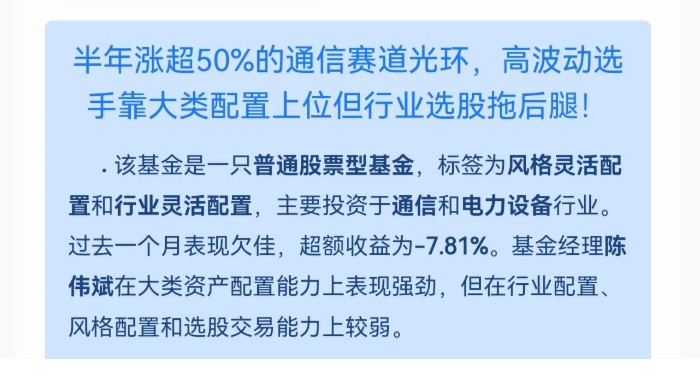

作業本航海指數認為,東吳雙三角股票 A 雖然過去一個月表現欠佳,但陳偉斌在大類資產配置能力仍表現強勁。

該基金未來表現會如何?可點擊文末閲讀原文,查看作業本航海指數分析。

以下是投資作業本課代表(微信 ID:touzizuoyeben)整理的陳偉斌分享的精華內容,分享給大家:

市場短期震盪調整,但整體機會大於風險

週末討論比較多的全球貿易戰這一話題,實際上它並不具備決定性影響,更多是對基本面,尤其是對市場情緒可能產生一定影響。

我們在之前的直播中也跟大家講過,短期來看市場可能會出現震盪,但長期來看,市場仍是機會大於風險。

短期市場出現震盪,實際上更多是由於經歷了最近幾個月市場的連續上漲之後,積累的獲利盤較多。

在當前這個位置上,市場本身也存在通過一定波動、通過震盪調整來消化獲利盤的需求。市場大概率會通過震盪方式來進行整體調整。

在這種情況下,我們看到假期期間的海外風險事件,以及全球貿易戰的呼聲——根據公開新聞媒體報道,美國總統特朗普提出要對進口商品加徵百分之百的關税——這類消息實際上更多是情緒上的擾動。

因為類似的貿易戰擔憂在今年 4 月份已經發生過一次。我們之前提到,在風險偏好方面,經歷了今年 4 月份全球貿易戰的 “黑天鵝” 事件後,最極端的衝擊可能已經過去。

下半年即使有所反覆,其衝擊力度大概率也要比今年上半年 4 月份的衝擊要弱。

這就是我們之前在直播中已經向投資者分享過的類似觀點。現在只不過是對我們之前觀點的一次驗證。

總結一下,對於整個市場,我們認為還是機會大於風險,最核心的是要把握住流動性這個關鍵變量。只要流動性不出現問題,那麼對整個市場,我們仍維持機會大於風險的判斷。

短期來看,受到海外貿易戰的影響,我們認為市場可能存在通過震盪調整來消化獲利盤的內在需求。但調整結束後,後面大概率還是機會大於風險。這就是我們對整個市場的整體看法。

關注兩條主線:AI 和創新藥

再回到大的板塊層面,在這個時間點,很多投資者會思考,在海外風險的背景下,我們應如何把握未來這段時間的主線?我們整體的看法是,建議投資者還是去關注具有長期產業趨勢的方向。

我們可以觀察權益市場的走勢,尤其是在權益市場牛市期間,大概率會有幾條主線,這些主線可能是貫穿整個市場的主線,當然也有階段性的主線。

在這一輪權益市場行情中,我們建議大家關注長期產業趨勢的方向。這類方向我們梳理下來,一個是 AI,一個是創新藥。這兩大產業趨勢目前從基本面上來看是沒有問題的。

AI 仍處於產業革命前期,上游還有空間,但下游空間更大

我們認為 AI 是一輪 5 到 10 年的產業革命,目前才走了兩年多,不到三年,大概率仍處於前期階段。

從產業鏈來看,分為上游算力、基礎設施建設和下游 AI 應用。上游還有空間,但下游空間更大。

上游算力基礎設施建設中,我們提出了 “算力四大金剛”:光模塊、PCB、電源和液冷。

我們認為未來液冷的潛在機會可能會更大。主要原因之一是它明年的行業增速有望達到 500%。這個增速是高於光模塊、PCB 等其他算力環節的。

其次,它明年的行業空間也足夠大,我們測算液冷明年的全球行業空間有望達到 1000 億元人民幣。這個行業空間規模,有望超過 AI PCB 的行業空間,並接近 AI 光模塊的行業空間,所以行業空間也是比較大的。

再者,從時間上來看,明年是液冷爆發的第一個完整年度,並非已經演繹了好幾年。

液冷今年是元年,明年是爆發的第一個完整年度。基於這些原因,我們建議大家關注這種具有長期產業趨勢的方向。

另外,下游方面,可以看到有 AI 軟件、AI 硬件等。AI 硬件中又分為智能駕駛、AI 機器人和 AI 眼鏡、AI 端側設備等。這些也是未來形成大空間、潛力較大的方向,同樣值得各位投資者研究和關注。

創新藥是 2-3 年的向上產業趨勢,關注三個方向

接下來,我再簡要分享一下對另一個方向——創新藥的看法。

創新藥其實從七月份以來,尤其是八、九月份,整體處在一個橫盤震盪的過程中。很多投資者可能之前也關注過創新藥,但在這種橫盤震盪中,逐漸失去了耐心,進而擔憂創新藥行情是否已經結束。

我們這裏再簡要闡述一下對創新藥的看法。創新藥這一輪同樣是一個向上的產業趨勢,我們預計這輪向上的產業趨勢大概率可能會持續兩到三年。現在其實才剛剛走了兩三個季度,大概率還處在這一輪向上趨勢的前半場。

我們做出這個判斷的主要依據,是看到海外跨國藥企正面臨專利到期,即 “專利懸崖” 的問題。

海外跨國藥企的這一輪專利懸崖集中出現在 2025 年到 2028 年。為了防止專利到期後銷售收入大幅下滑,它們需要提前儲備下一代的創新藥大單品。

這就是這一輪國內創新藥企 BD(業務發展)出海的主要催化劑。

中國創新藥企經過多年的厚積薄發,已經取得了長足的進步,能夠以更低的成本、更短的時間,提供更優質的創新藥在研管線。而海外跨國藥企剛好在這兩三年期間,存在儲備下一代創新藥大單品的強烈需求。

因此,它們來到中國進行 “買買買”。雙方的需求恰好能夠一拍即合,實現完美的對接。

所以我們説,這一輪的催化劑就是中國創新藥企的 BD 出海。海外跨國藥企在專利到期前,存在集中採購和集中儲備的需求,雙方剛好能夠實現比較完美的契合。

關於創新藥的主線,這裏以腫瘤創新藥為例,我們看到一個方向是單抗的升級。例如 PD-1 單抗的升級方向就是 “PD-1 plus”,包括 PD-1/VEGF,以及PD-1/IL2等。

因此,像 PD-1 plus 或者 PD-1/VEGF這類雙抗,就是值得我們在創新藥領域中關注的一條主線。

另一個方向是化藥的升級,其主流方向就是 ADC(抗體偶聯藥物),即將一個毒素通過連接子連接到抗體上,使其具備靶向性,這也是大家可以去關注的一個方向。

再者就是上游產業,創新藥在整個醫藥產業鏈中偏下游,它的上游是 CRO、CDMO 等 CXO 領域。這也是大家可以在創新藥產業鏈中關注的一個方向。

所以對於創新藥這邊再總結一下:

這一輪創新藥行情大概率是一個 2 到 3 年的向上產業趨勢,現在才走了兩三個季度,大概率還處於上半場。未來無論從時間還是空間上看,都還有潛力。

從細分板塊來説,我們建議大家關注:一個是 PD-1/VEGF 或 PD-1 plus 這類雙抗;其次是 ADC;還有就是上游的 CXO 等方向。

來源:投資作業本 Pro,作者王麗

更多大佬觀點請關注↓↓↓