新股消息 | 千里科技遞表港交所 在智能駕駛場景中實現端到端 RLM 模型大規模部署

千里科技已向港交所提交上市申請,中金公司為獨家保薦人。該公司專注於智能駕駛和智能座艙解決方案,致力於提供 AI+Mobility 的閉環解決方案。千里科技在智能駕駛領域實現了端到端 RLM 模型的大規模部署,預計未來將推動公司增長。

智通財經 APP 獲悉,據港交所 10 月 16 日披露,重慶千里科技股份有限公司 (簡稱:千里科技 (601777.SH)) 向港交所主板提交上市申請書,中金公司為獨家保薦人。

招股書顯示,千里科技是顛覆性創新技術的引領者,為全球戰略性客户提供 “AI+Mobility” 的閉環解決方案,主要包括智能駕駛、智能座艙、Robotaxi 解決方案。憑藉公司的 AI 原生能力及車輛工程的專業知識,公司已建立一套全面的智能駕駛解決方案組合。公司的產品組合包括垂直 AI 模型、軟件、硬件及閉環數據系統,以在複雜交通場景中實現 L2 至 L4 級自動駕駛。

千里科技的智能座艙解決方案由專有的多模態交互模型及 AI 原生 AgentOS 提供支持。因此,公司提供自然用户交互 (NUI) 體驗—一種直觀的交互系統,使用户能夠透過語音及視覺等自然模態與車輛進行交流。透過整合 L4 級自動駕駛、智能座艙解決方案及綜合營運支持平台,公司為 Robotaxi 運營商提供端到端 Robotaxi 解決方案。於往績記錄期間,公司尚未自該等解決方案產生收入,不過預期有關解決方案為公司未來增長的重大推動力。

千里科技已具備領先的垂直 AI 模型能力,構成了公司解決方案的基礎。例如,公司已就智能駕駛開發出獨特的 RLM(強化學習 - 多模態) 模型。根據灼識諮詢的資料,千里科技是首家在智能駕駛場景中實現端到端 RLM 模型大規模部署的公司。此外,公司已開發先進的多模態交互模型,憑藉對真實世界的通用理解、基於 AI 的個性化推薦及車內情緒識別,實現豐富的多模態交互。公司已開發出業界首個 AGIL3 智能體級別的智能座艙系統。

憑藉數十年的經驗,千里科技已累積經驗證的工程及製造能力。多年來,公司設計及營運汽車及摩托車生產設施,維持嚴格的品質、安全及效率標準。公司已進一步提升新能源汽車的製造能力,並已發展強大的自主汽車設計及工程能力,涵蓋車輛設計及平台、換電解決方案、電驅系統及智能網聯等關鍵領域。此外,公司的汽車及摩托車產品一直穩定增長,預期將繼續是公司未來增長的重要驅動力。於往績記錄期間,公司已銷售 19.69 萬輛汽車及 130 萬輛摩托車。於往績記錄期間,公司的收入主要來自汽車及摩托車的製造及銷售,佔往績記錄期間各年度╱期間總收入 85% 以上。

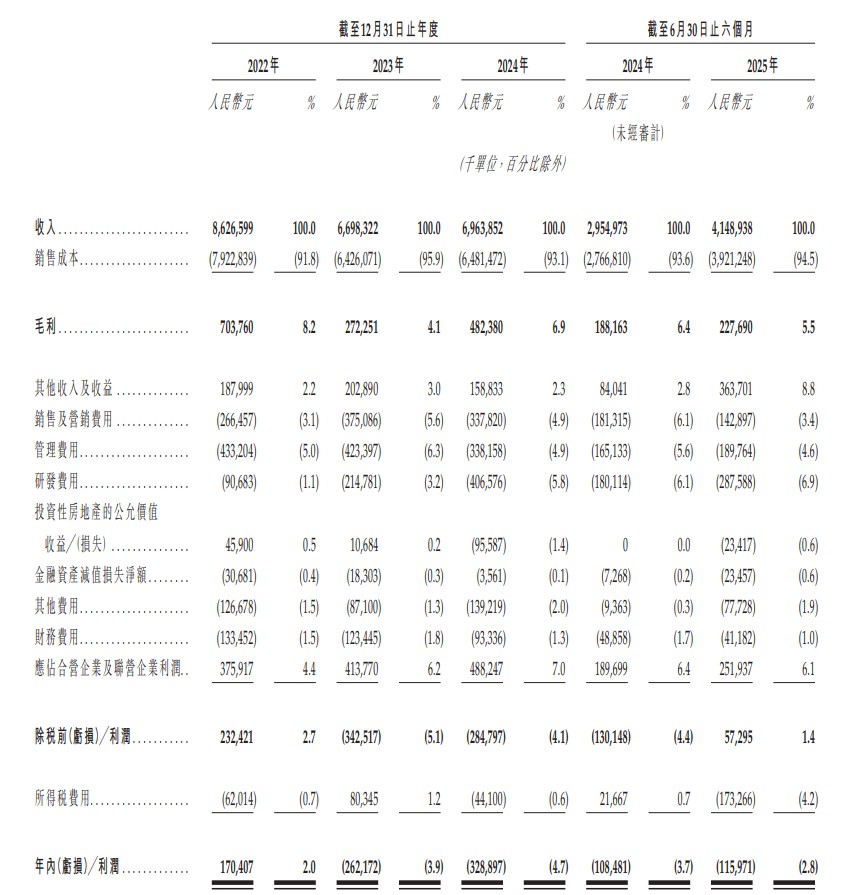

業績方面,2022 年度、2023 年度、2024 年度、2024 年及 2025 年截至 6 月 30 日止六個月,千里科技實現收入分別約為 86.27 億元、66.98 億元、69.64 億元、29.55 億元、41.49 億元人民幣;同期,年/期內利潤約為 1.70 億元、-2.62 億元、-3.29 億元、-1.08 億元、-1.16 億元人民幣。