Posts

Posts Likes Received

Likes ReceivedWhen will "Xpeng", with mediocre performance, experience a new breakthrough?

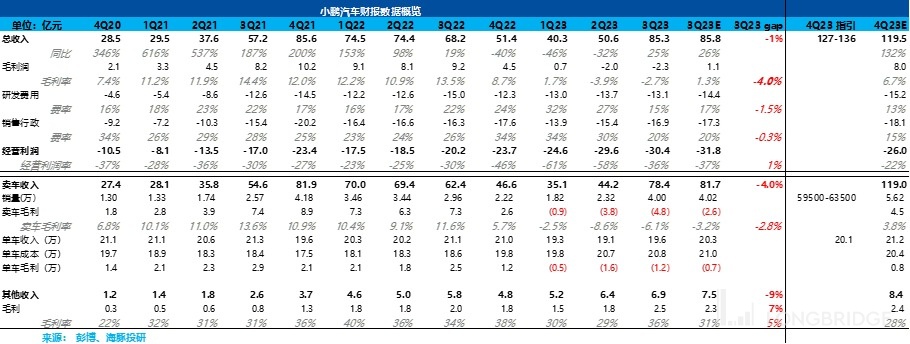

Xpeng released its third-quarter earnings report on November 15, 2023, after the Hong Kong stock market closed and before the US stock market opened. The gross profit margin and guidance for this quarter were as expected, without any surprises. Let's take a look at the key information:

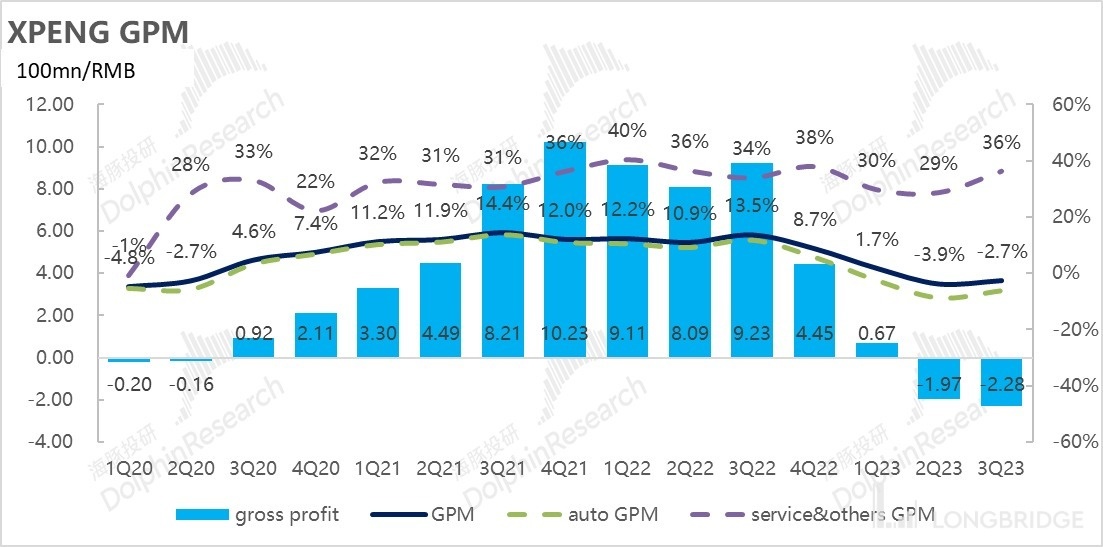

1) "Continued" Gross Loss: The gross profit margin of the car sales business in the third quarter was -6.1%, which improved compared to the previous quarter but not by much. It is still in a state of continued gross loss, but this was within Dolphin Research's expectations. After all, Xpeng had already mentioned in the previous quarter that it would make a provision for the impairment of G3i, which had a 2.9 percentage point impact on the gross profit margin for this quarter. Excluding this factor, the gross profit margin for car sales was -3.2%, which only improved by 1.1% compared to the previous quarter. The market originally expected an improvement to the range of -2% to -3% for this quarter, so the improvement was weaker than market expectations.

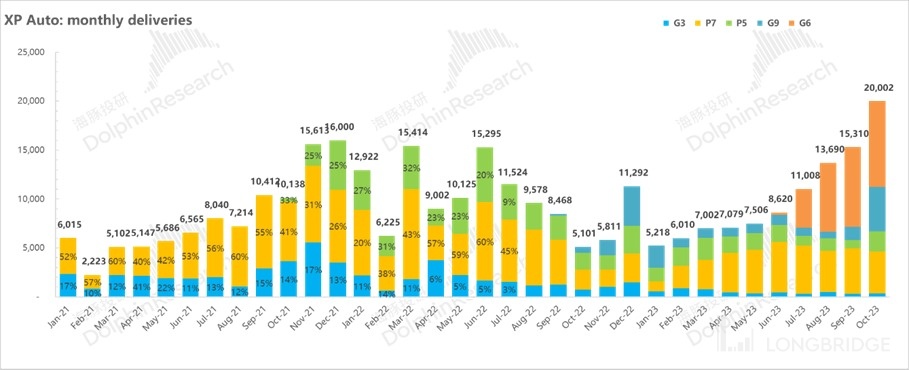

2) Flat Sales Guidance: After selling 40,000 vehicles in the third quarter, the sales guidance for the fourth quarter is 59,500 to 63,500 vehicles, higher than Bloomberg's expectation of 56,000 vehicles. However, Bloomberg's expectation is a lagging one. With monthly sales already exceeding 20,000 vehicles in October, this guidance implies an average monthly sales of 20,000 to 22,000 vehicles for the next two months, which means that the sales of G6 will only climb to around 10,000 vehicles in the next two months. The guidance is flat.

3) Revenue guidance for the fourth quarter is 12.7 to 13.6 billion RMB: Based on the sales guidance of 59,500 to 63,500 vehicles, the estimated average price per vehicle for the fourth quarter should be around 201,000 RMB, which is an improvement compared to the 196,000 RMB in this quarter. However, it is lower than the market's expectation of 212,000 RMB. The market originally expected that the increase in the proportion of sales of the redesigned G9 would drive the average price up by nearly 16,000 RMB.

4) Gross profit margin is expected to turn positive in the fourth quarter: With a price guidance of around 201,000 RMB per vehicle in the fourth quarter and the complete elimination of the impact of G3i inventory impairment, as long as the cost per vehicle continues to decrease by 1,400 RMB, the gross profit margin can turn positive. This should not be a problem for Xpeng, but it is expected to be lower than the market's original low single-digit (3%-5%) expectation for car sales gross profit margin.

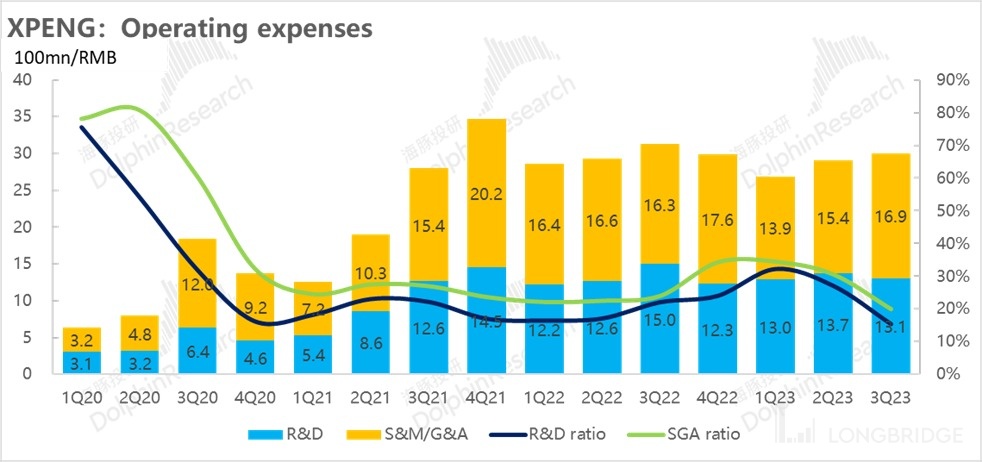

5) Cost reduction and efficiency improvement have achieved results: Xpeng's operational efficiency story was evident in this quarter and exceeded market expectations. Despite the accelerated expansion of XNGP, research and development expenses were still better than expected, and operating costs are expected to decrease in the future with the implementation of the "Jupiter Plan" (increasing the proportion of dealers).

Dolphin Research's overall view:

Overall impression: The gross profit margin performance in this quarter was below expectations, and the implied gross profit margin guidance for both sales and revenue in the fourth quarter was flat. The fourth-quarter gross profit margin is expected to barely turn positive, resulting in a performance that is neither surprising nor disappointing. And looking at the sales expectations for next year, Xpeng expects to sell over 280,000 vehicles next year, equivalent to a monthly delivery target of 23,000 vehicles. However, with current monthly sales already exceeding 20,000, there may be a lack of growth in G6 orders and limited contribution from new models.

This means that Xpeng may still be a beta stock driven by the market in the first half of next year, with low sales and gross margin expectations, as well as limited profit contribution from cooperation with Volkswagen. Its alpha may have to wait until the delivery of "Mona" in the second half of next year and the positive impact of accelerated deployment of autonomous driving.

I. Xpeng continues to operate at a gross loss

As expected by Dolphin Research, the gross margin for this quarter is still negative, but lower than the market's expectation for the car sales business gross margin of -3.2%.

The gross margin for the automotive sales business this quarter is -6.1%, with the loss from inventory purchase contracts related to G3i still reflected in the third quarter's financial report, resulting in a 2.9 percentage point impact on the gross margin. Excluding this impact, Xpeng's actual car sales gross margin for the third quarter is -3.2%, an improvement of 0.9% compared to the actual gross margin of -4.1% in the second quarter (also excluding the impact of G3i contract losses), but the improvement is not significant.

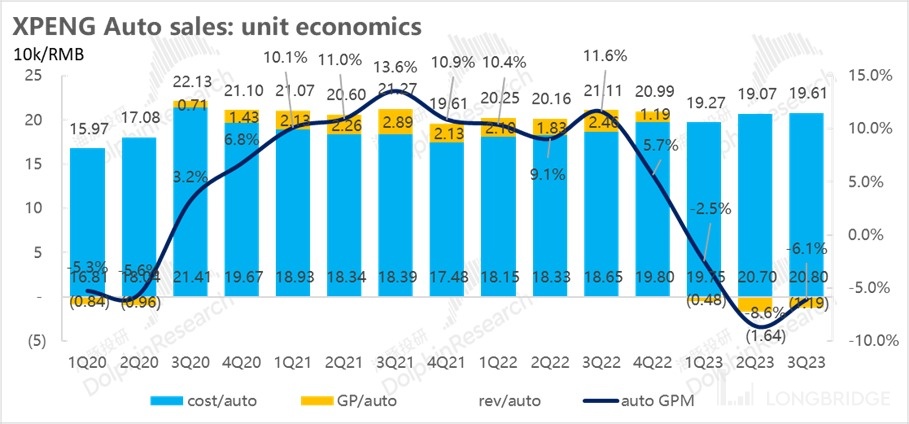

Next, Dolphin Research will analyze Xpeng's gross margin that has not turned positive this quarter from the perspectives of unit price and cost:

a) Average unit price:

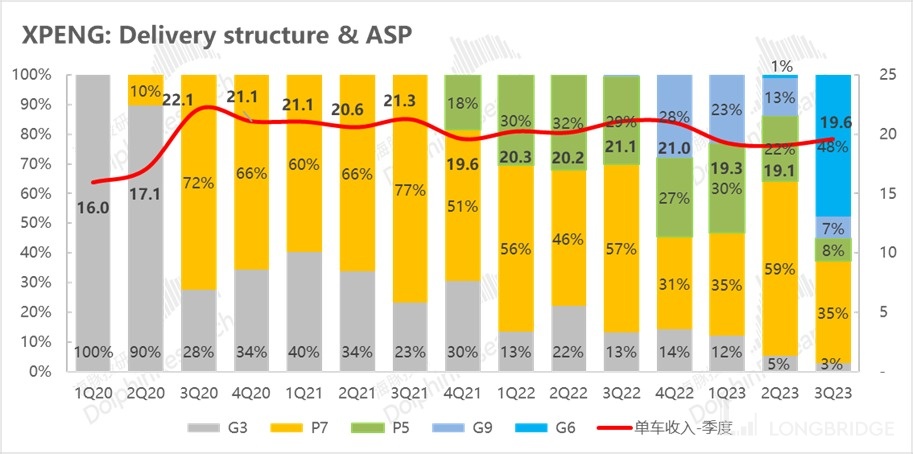

The average unit price for the third quarter is 196,000 yuan, which is 5,400 yuan higher than the second quarter, marking the first increase in unit price since the beginning of the year.

In terms of sales structure, G6 and P7 accounted for the majority of deliveries in the third quarter, with a combined share of 48% and 35%. Although the starting price of G6 is lower, the majority of shipments are the max version (+20,000 yuan) (according to market information, it has reached 70%), which has a certain impact on the unit price.

However, Xpeng launched a 10,000 yuan limited-time promotion for the old P7i model due to the release of the new P7i, resulting in an overall increase in the average unit price by 5,400 yuan.

b) Unit cost:

The unit cost for the third quarter is 202,300 yuan (excluding the impact of depreciation and amortization), which is an increase of 3,800 yuan compared to the previous quarter. Despite the strong sales of G6, there was no cost savings in unit cost due to depreciation and amortization of the car, and there was even an increase. Dolphin Research believes that this is because the gross margin level of G6 is lower compared to other models. After all, it is priced low but well-equipped, and it is acceptable for Xpeng to sacrifice gross margin to achieve high sales.

c) Unit gross margin:

With an increase of 5,400 yuan in average unit price and 3,800 yuan in unit cost, the gross loss per vehicle sold in the third quarter is 6,000 yuan, an improvement compared to the gross loss of 8,000 yuan in the previous quarter. The gross margin for car sales has improved from -4.1% in the previous quarter to -3.2% in this quarter.

II. Can the gross profit margin turn positive in the fourth quarter?

a) Fourth quarter car sales target: 59,500-63,500 units

After selling 40,000 vehicles in the third quarter, the sales guidance for the fourth quarter is 59,500-63,500 units, higher than Bloomberg's expectation of 56,000 units. However, Bloomberg's expectation is a lagging one. With monthly sales already exceeding 20,000 units in October, this guidance implies an average monthly sales of 20,000-22,000 units for the next two months, which means that G6 sales can only climb to around 10,000 units in the following two months, which is mediocre.

In terms of models, Xpeng continuously updates and improves its old models, while further reducing prices. Currently, there are three main models available: G6/P7i/G9:

- G6: Production capacity constraints have been basically resolved, and the official platform's delivery time has been shortened from 6-12 weeks when it was first launched to 2-6 weeks. It is expected to deliver an average of 10,000 units per month in November and December.

- P7i: The LFP version of P7i was launched in November. Although the range has been slightly reduced, the price has further dropped to 223,900-239,900 yuan. It is expected to deliver an average of 5,000 units per month in November and December.

- G9: The new G9 model, which has been reduced by 46,000-60,000 yuan compared to the original model, was launched in September and has been selling well. In the first 15 days of its launch, it has already received more than 15,000 pre-orders (October sales reached 4,593 units), with the max version accounting for over 80%. It is expected to deliver an average of 5,000 units per month in November and December.

At the same time, the new MPV X9 is expected to be delivered in December, but the complete delivery cycle will be in the next year, so it will not contribute much to the fourth quarter sales.

b) The issue of positive gross profit margin implied by the fourth quarter unit price is not significant

Xpeng's revenue guidance for the fourth quarter is 12.7 billion to 13.6 billion yuan. Based on the estimated other income of 790 million yuan, the unit price corresponding to the fourth quarter guidance is about 201,000 yuan, which is an improvement compared to the current quarter's 196,000 yuan, but lower than the market's expectation of 212,000 yuan. The market originally expected that the increase in the proportion of G9/P7i sales due to the updated models would drive the unit price up by nearly 16,000 yuan.

From the cost side, the continued increase in sales volume in the fourth quarter is expected to bring down the amortized cost, and the impact of G3's contract losses will completely disappear. As long as the per-vehicle cost continues to decrease by 1,400 yuan, the gross profit margin can turn positive, which should not be a problem for Xpeng. However, it is expected to be lower than the market's original low single-digit (3%-5%) expectation for car sales gross profit margin.

III. Revenue Up 25%, Slightly Below Market Expectations

In the third quarter, Xpeng achieved a total revenue of 8.53 billion yuan, a year-on-year increase of 25%, slightly below the market expectation of 8.58 billion yuan, mainly due to lower-than-expected bicycle revenue.

a) Automotive Sales Revenue: Automotive sales revenue in this quarter was 7.84 billion yuan, a year-on-year increase of 26%, with both sales volume and unit price rising

In terms of volume, Xpeng delivered 40,000 vehicles in the third quarter, a year-on-year increase of 35%, which is within the guidance range of 39,000 to 41,000 vehicles for the third quarter. This growth was mainly driven by the popular G6 model and the release of supply chain pressure on the P7i model.

In October, monthly sales volume exceeded 20,000 vehicles, ranking second among new energy vehicle companies. The production bottleneck of the G6 model has been basically resolved, and the price reduction of the G9/P7i facelift models has laid the foundation for further sales growth.

In terms of unit price, the market originally expected the third quarter unit price to increase by 12,000 yuan. However, due to the promotion of the old P7i model, the unit price only increased by 5,000 yuan. As a result, automotive sales revenue reached 7.84 billion yuan, a year-on-year increase of 26%.

b) Services and Others: The revenue from services and other businesses in this quarter was 690 million yuan, slightly below the market expectation of 750 million yuan. However, the gross profit margin of other businesses reached 36%, exceeding the market expectation of 31%, which may be related to Xpeng' growing autonomous driving services.

IV. Reasonable Control of Fixed Costs

Xpeng positions itself with intelligence as its core competitiveness, which means it needs to continuously increase research and development efforts in the field of intelligence to form and consolidate its advantages. At the same time, the company is also deepening channel reforms and continuing to use a "direct sales + authorized" dual-channel model to find a balance between marketing expenses and efficiency. However, in this quarter, the control of research and development and sales administrative expenses was relatively reasonable, and operating leverage was released to some extent.

1) From the situation of this quarter, Xpeng' research and development expenses reached 1.31 billion yuan, a decrease of 60 million yuan compared to the previous quarter, significantly lower than the market expectation of 1.44 billion yuan. The control of research and development expenses exceeded expectations during the accelerated landing of XNGP.

Xpeng mainly invests in the field of intelligence. In terms of intelligence, the company is currently focusing on the competition in autonomous driving, rapidly deploying city NOA (Navigation on Autopilot) in the widest range, and obtaining diverse real driving data. By iterating data and algorithms, Xpeng aims to establish a positive cycle, promote sales through user reputation, and build new moats. Xpeng has the same first-mover advantage in intelligent driving as Tesla. The NOA (Navigation on Autopilot) has the fastest deployment speed, covering 25 cities by the end of November this year in no-map mode, and 50 cities by the end of December. The plan is to open 200 cities by 2024.

The management plans to reduce the cost of XNGP by 50% through technological innovation next year, which means that XNGP is likely to be equipped on the 150,000 A-level model "Mona" to be released next year, achieving full standard configuration across the entire series. This will successfully bring intelligent driving into the market below 200,000 yuan.

At the same time, Xpeng has further research and development in intelligent cockpit, powertrain system, and integrated die-casting to achieve cost reduction through technology. The management expects an overall cost reduction of 25% next year, further increasing the gross profit margin.

2) In terms of sales and administrative expenses, it reached 1.69 billion yuan this quarter, an increase of 150 million yuan compared to the previous quarter, but lower than the market expectation of 1.73 billion yuan.

Unlike Lixiang, Xpeng includes the sales discount given to dealers in the sales expenses. This quarter, due to the strong sales of the G6, the sales discount given to dealers was reduced from 8% in the first half of the year to the current 4%-6%, further reducing the sales expenses.

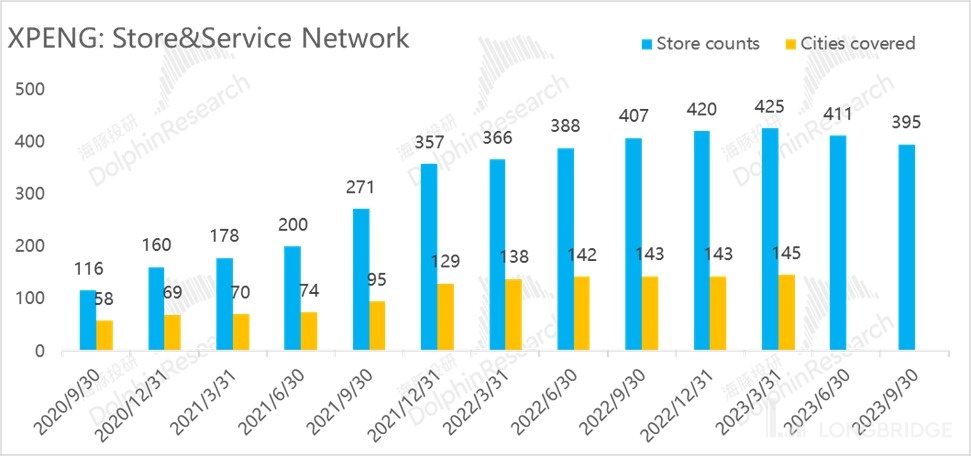

At the same time, Xpeng has also initiated channel reforms. In the third quarter, the number of Xpeng stores decreased from 411 in the second quarter to 395, eliminating dealers with poor sales performance, improving store efficiency, and increasing the monthly sales volume per store from 19 in the second quarter to 33 in the third quarter.

In the third quarter, Xpeng also launched the "Jupiter Plan" channel transformation program, increasing the proportion of authorized stores, expanding the distribution model to quickly expand into lower-tier markets, expanding the coverage of stores in lower-tier cities, and further reducing operating costs.

Due to the increase in sales volume compared to the previous quarter due to the strong sales of the G6, and the relatively reasonable sales, administrative, and research and development expenses this quarter, the rigid expenses were diluted by the leverage effect, and the expense ratio of the company decreased. These two expense ratios accounted for 35% of the revenue, a significant decrease from 57% in the second quarter.

The operating loss rate for this quarter reached -36%, which means that the company's revenue of 8.5 billion yuan resulted in a loss of 3 billion yuan. This is mainly due to the fact that the gross profit margin has not turned positive yet.

In terms of net profit, the loss for this quarter was 3.8 billion yuan, which is 700 million yuan more than the operating loss, and the loss has expanded compared to the previous quarter. The main reason is that the company made a provision of approximately 970 million yuan for the fair value change of financial derivative liabilities, which is related to the fair value change of the forward equity sales agreement associated with Volkswagen's strategic investment. However, this provision is a one-time item, so the focus should be on operating profit.

V. Sufficient Cash Security, Incremental Growth in "Mona" and Autonomous Driving Explosion Next Year

In the third quarter, Xpeng's cash and cash equivalents rose to 36.5 billion yuan, an increase from the previous quarter's 33.7 billion yuan. Considering the company's quarterly loss of 2-3 billion yuan, Xpeng will have at least nearly 3 years of time. The cash flow security is sufficient.

Looking ahead to 2024, Xpeng plans to release two new models in the second half of 2024, covering the price range of 150,000 to 350,000 yuan. At the same time, Xpeng's new MPV X9 will also contribute to the incremental growth next year. According to a report by 36Kr, Xpeng expects to sell over 280,000 vehicles next year, equivalent to a monthly delivery target of 23,000 vehicles. The market's general expectation is around 230,000 to 250,000 vehicles. However, both Xpeng's and the market's expectations are not very high, possibly indicating weak growth in G6's subsequent orders and limited contribution from new models.

In terms of gross margin, Xpeng expects to increase the commonality rate of components through the FOA architecture and reduce overall costs by 25% through technological cost reduction. The market's expectation for next year's gross margin is in the high single-digit range (7%-9%), but it is still far below the ideal gross margin of 20%.

Currently, Xpeng has the most solid foundation among new forces, having formed alliances with Volkswagen and Didi. Next year, Xpeng and Didi will launch a 150,000 yuan A-class electric vehicle "Mona" targeting the Volkswagen market, with a focus on the B-end and supplemented by the C-end. It is expected to start mass production in the third quarter of 2024, with planned annual sales of 100,000 to 180,000 vehicles. However, it may not be consolidated until the second half of next year.

In terms of intelligent driving, Xpeng plans to reduce the BOM cost of XNGP by 50% through technological innovation, making it possible for even the 150,000 yuan level models to be equipped with autonomous driving. At the same time, it will accelerate the progress of XNGP's deployment and promote algorithm iteration to build new moats.

Next year, Xpeng will also start receiving technology transfer service fees from Volkswagen. Dolphin Research estimates that Xpeng will bring in about 100 million yuan in incremental profit in 2024, which will have a limited impact. It is not until 2026 that Xpeng will truly benefit from it.

Longbridge Dolphin Research's in-depth research and tracking comments on Xpeng include:

Earnings Season

August 18, 2023, Earnings Review: "Xpeng's Gross Margin Plunge? The Last 'Embarrassment' Before Rebirth"

August 18, 2023, Conference Call: "The Impact of G3i Residuals Will Continue in the Third Quarter, Gross Margin Expected to Turn Positive in the Fourth Quarter"

May 24, 2023, Earnings Review: "Xpeng: Performance Has Cooled Down, When Will It Recover?"

- May 24, 2023 conference call: Xpeng's Battle Plan: Monthly Sales of 20,000 in Q4 (Summary)

- March 17, 2023 conference call: Xpeng's 2023: Reform, Cost Reduction, and New Product Launches (22Q4 Conference Call Summary)

- March 17, 2023 earnings report review: Xpeng: Under Attack, Can it Survive the Crisis?

- November 30, 2022 conference call: Nearly 50% Surge Overnight, What Did Xpeng Say in the Conference Call? (Summary)

- November 30, 2022 earnings report review: Poor Performance but Still Rising? Xpeng Still Needs to "Rebuild Its Foundation"

- August 24, 2022 conference call: G9 and B-Class "Model Y," Xpeng's Last Effort? (22Q2 Conference Call)

- August 23, 2022 earnings report review: Xpeng is Far from "Profitability" and Still Has a Long Way to Go

- May 24, 2022 conference call: Xpeng: Q3 is the Quarter to Reflect Price Increases and Significant Gross Margin Rebound (Meeting Summary)

- May 23, 2022 earnings report review: Sales Leader, Loss King, Will the Market Still Buy Xpeng's Story?

- March 29, 2022 conference call: Rapid Channel Expansion Opens Up Growth Potential for Xpeng's Vehicle Deliveries (2021 Annual Report Conference Call Summary)

Risk Disclosure and Statement in this Article: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.