AWS major reversal, has Amazon finally 'seen the light at the end of the tunnel'?

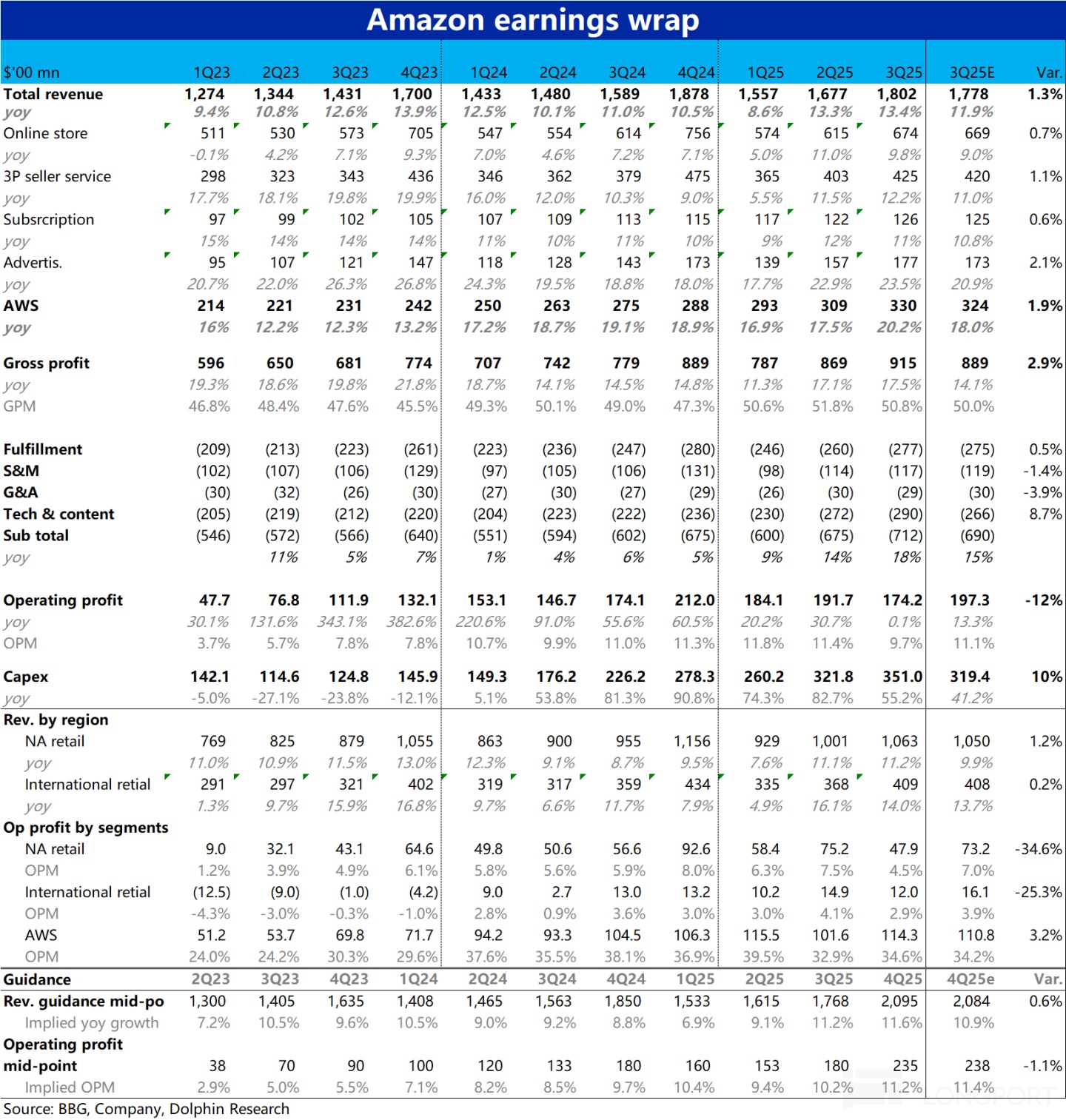

$Amazon(AMZN.US) announced its Q3 2025 financial results after the U.S. stock market closed on October 31, Beijing time. With the market's focus almost entirely on cloud business, this quarter's AWS finally achieved long-awaited accelerated growth beyond expectations, marking the biggest highlight and key signal of this quarter's performance. Aside from this, the company's retail business growth and profit performance were generally stable and in line with expectations. Specifically:

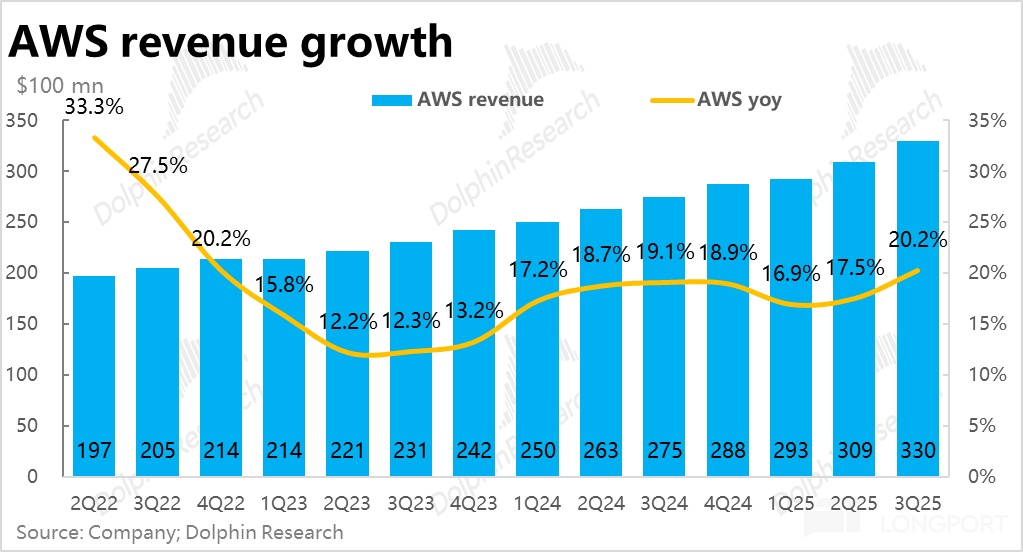

1. The long-awaited AWS acceleration has finally arrived: Currently, the growth rate of cloud business has almost become the single indicator that determines success or failure. AWS revenue this quarter grew by 20.2% year-on-year to $30.9 billion, with a significant increase of 2.7 percentage points compared to the previous quarter. The long-awaited AWS growth acceleration has finally arrived.

Although before the earnings report, some sellers and investors believed that AWS growth would improve this quarter, setting the expected growth rate at 18%~19%. However, this view was not a consensus, and the actual performance exceeded this expectation, providing a genuine surprise beyond expectations. Based on pre-earnings analysis, this outperformance is attributed to the alleviation of AWS computing power supply bottlenecks and the contribution to computing power demand from cooperation with Anthropic.

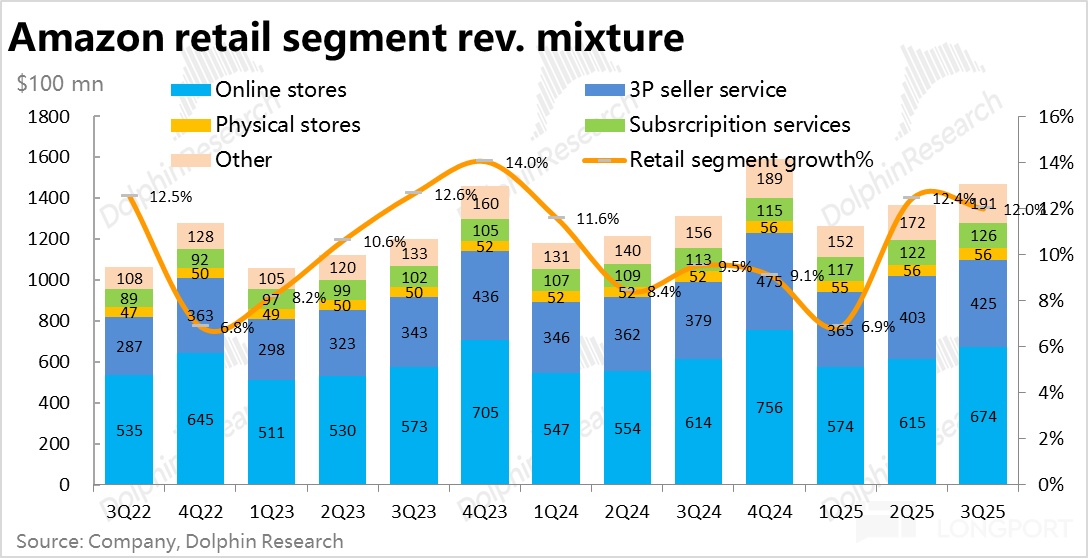

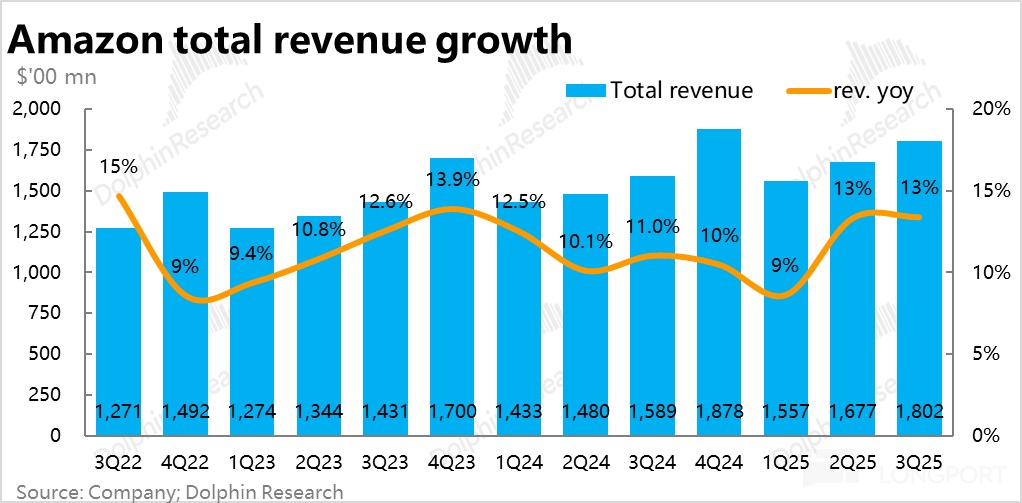

2. Retail remains resilient, profits better than feared: In contrast, the general retail segment growth this quarter was quite stable. Total revenue was $147.2 billion, up 12% year-on-year, roughly consistent with the previous quarter.

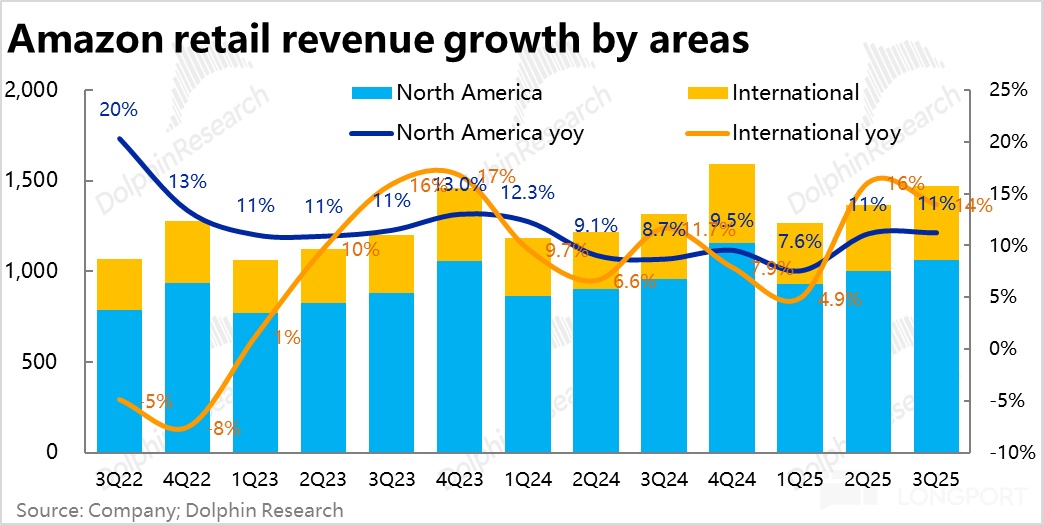

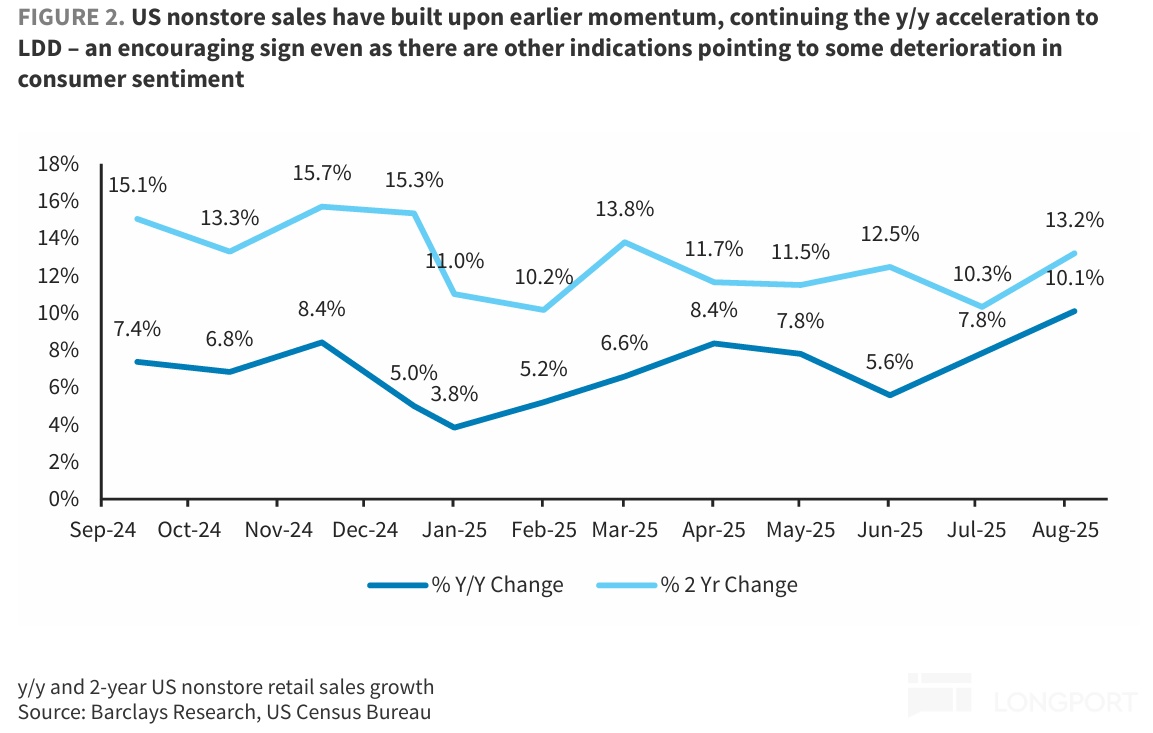

Among them, North American retail revenue growth was 11.2%, slightly accelerating by 0.1 percentage points compared to the previous quarter, consistent with the trend of improving U.S. non-store sales growth since June as reported by the U.S. Census Bureau. Currently, online consumption in North America remains resilient.

International retail business, excluding exchange rate effects, saw revenue growth of 10%, slightly down by 1 percentage point compared to the previous quarter, showing signs of slight weakening but still generally stable.

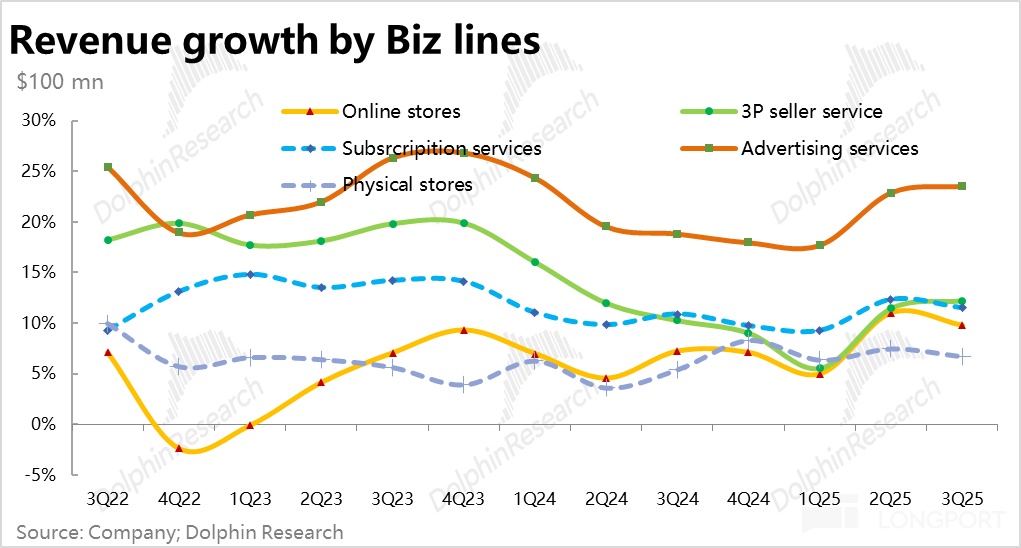

3. Advertising business continues strong growth: Among various business lines, advertising remains the "brightest" spot. This quarter's advertising growth reached 23.5%, the highest among all business lines, and accelerated for three consecutive quarters. According to industry analysis, besides stable e-commerce advertising, the increase in advertising on Amazon's other multimedia content such as Prime Video is the main driving force.

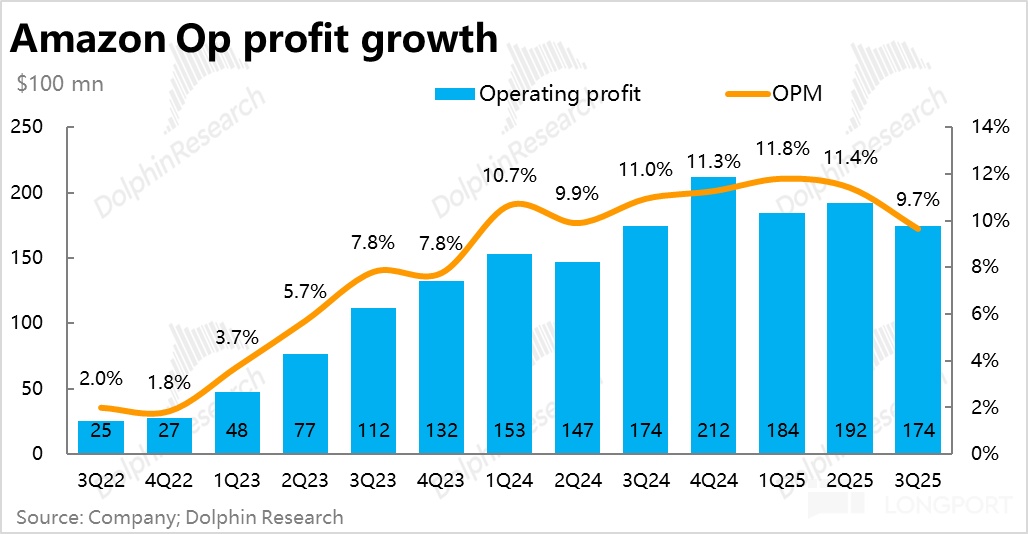

4. Excluding one-time impacts, actual profits meet expectations: In addition to good growth, this quarter's overall operating profit was $17.4 billion, seemingly significantly below expectations. However, this quarter confirmed $2.5 billion in legal fees and $1.8 billion in compensation fees related to reported layoffs being confirmed early. If legal fees are added back, actual operating profit would be $19.9 billion, up 14% year-on-year, roughly in line with market expectations. If the provisioned layoff fees are added back, operating profit would exceed market expectations by about 10%.

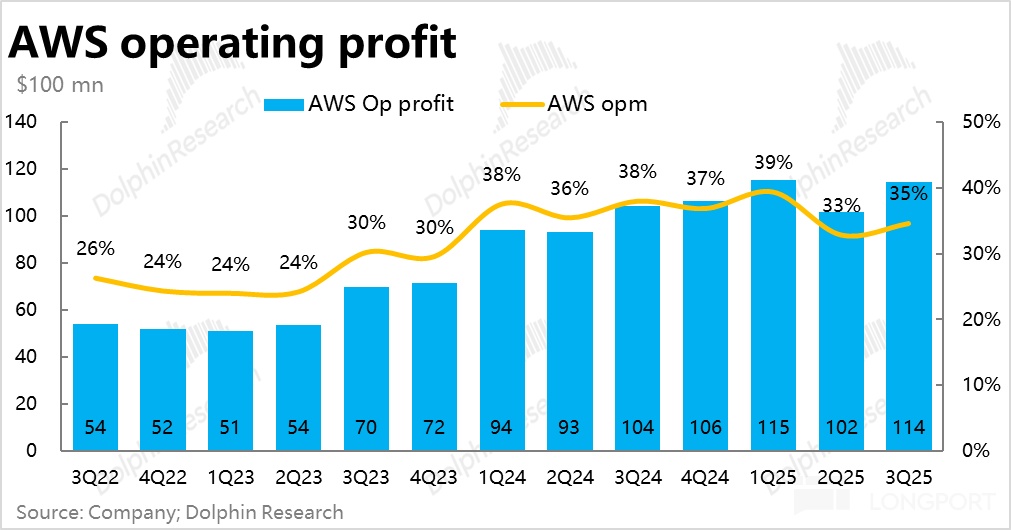

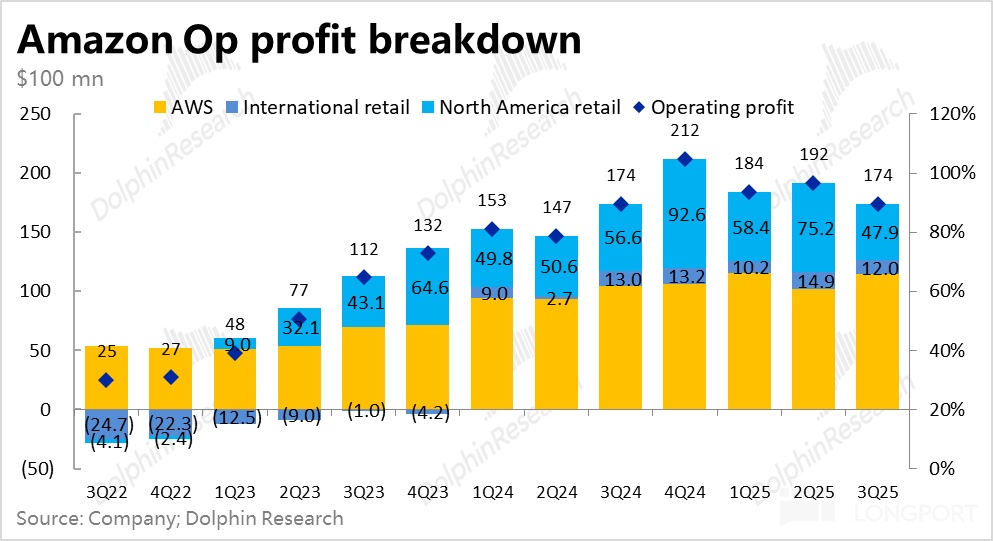

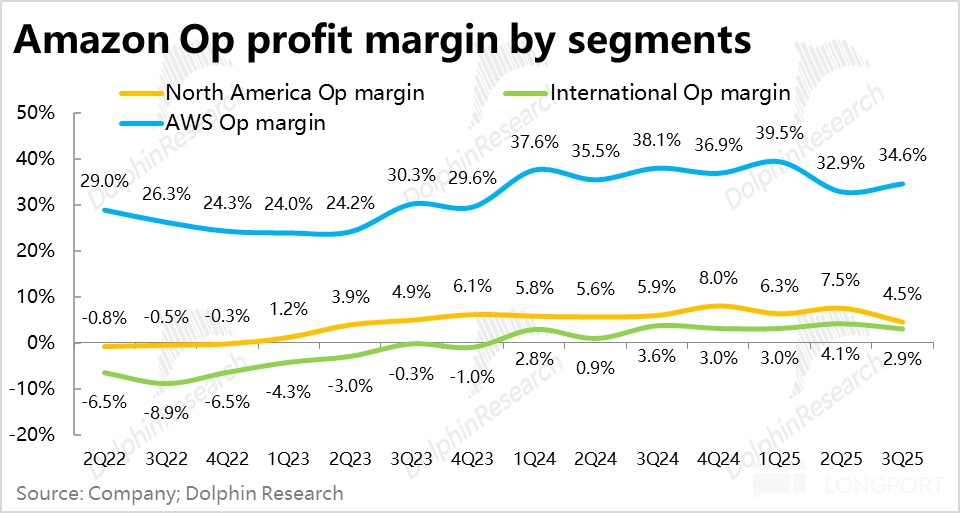

5. By segment profit: This quarter's AWS operating profit was roughly in line with expectations, but due to increased Capex and shortened server depreciation periods, the profit margin still declined year-on-year.

North American retail segment, if $2.5 billion in legal expenses are added back, is also roughly in line with expectations, with profit margins continuing to rise by 1 percentage point year-on-year. North American segment profits continue to improve.

However, the international retail segment's operating profit this quarter was $1.2 billion, significantly underperforming expectations, with a corresponding operating profit margin of 2.9%, down 0.7 percentage points year-on-year. Although there is an impact from the provisioned layoff fees, overseas profits seem to be trending worse.

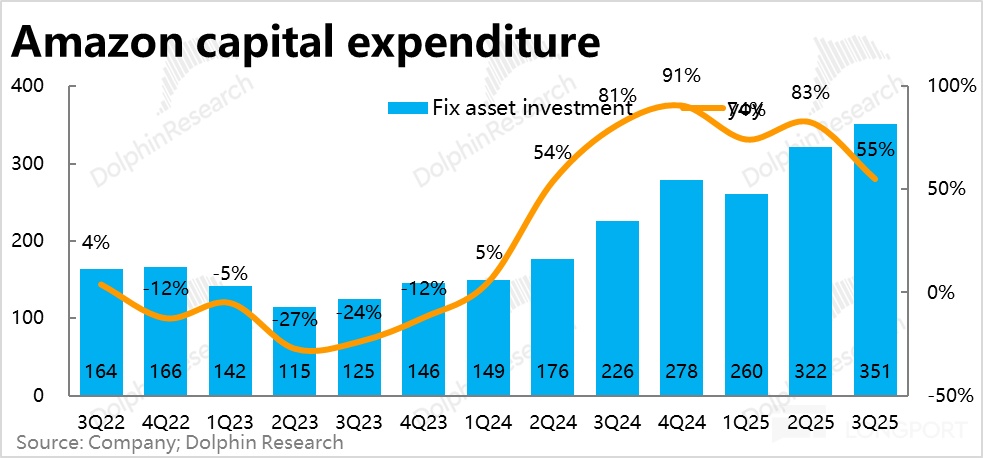

6. This quarter, Amazon's Capex further increased to $35.1 billion, setting a new historical high. Besides investments in cloud business, the company is also investing in e-commerce logistics, instant delivery, and satellite projects, making the absolute expenditure amount the highest among giants. The specific structure needs attention in the conference call where distribution may be mentioned.

Dolphin Research View:

Overall, the main focus of Amazon's performance this quarter is the previously lagging AWS, which finally delivered an acceleration beyond expectations. Since 2025, without considering post-earnings stock price increases, Amazon has been almost stagnant, significantly underperforming other Mag7 and the entire U.S. market.

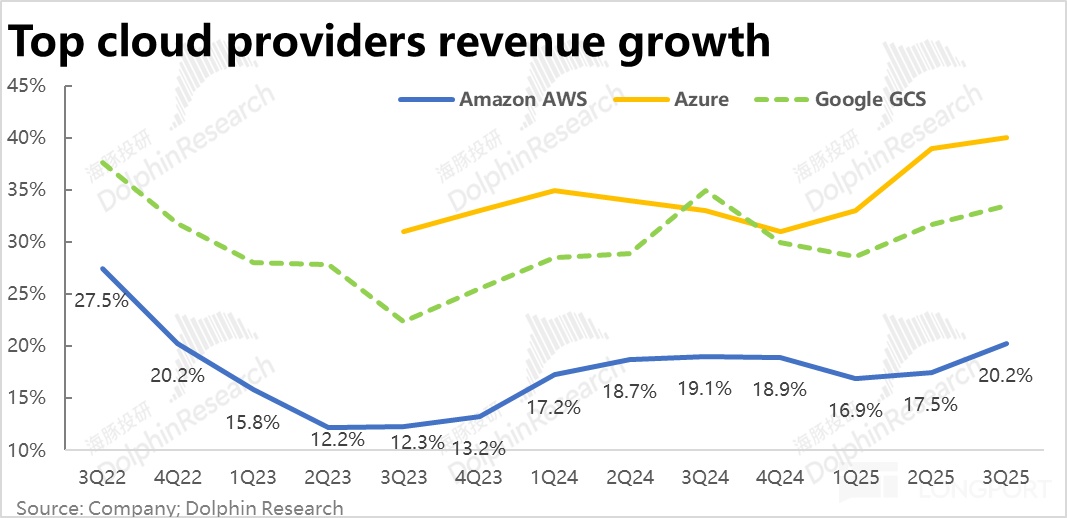

One of the main reasons for Amazon's previous underperformance is the AI wave, where AWS fell behind while Azure and GCP continued to accelerate, suggesting Amazon's competitiveness in cloud computing in the AI era showed signs of weakening. (Of course, compared to Microsoft with OAI support and Google's extensive research accumulation, Amazon is indeed weaker in this aspect).

Therefore, the correlation between profit and loss, the company's poor stock performance was due to AWS's weakness. This quarter, AWS showed signs of narrowing the gap with competitors, with reduced computing power bottlenecks and cooperation with Anthropic partially strengthening its AI competitiveness, Dolphin believes the post-earnings surge is not "overly excited," and can be said that most of it is just filling the lag in the company's stock price increase this year.

Of course, looking more calmly, besides AWS's acceleration, Amazon's retail segment and profit performance can be said to be generally resilient and in line with expectations. So how to view the company after this performance?

Firstly, combining the company's guidance, we look at the upper limit, the implied revenue growth rate in the guidance is consistent with this quarter at 13.4%. In other words, even if AWS does not continue to accelerate significantly quarter-on-quarter next quarter (corresponding to a slowdown in retail segment growth), AWS is at least likely to maintain growth similar to this quarter.

The upper limit of guided operating profit corresponds to a year-on-year growth rate of 30%, with a profit margin of 12.2%, expanding by 0.9 percentage points year-on-year. Without this quarter's one-time impacts, next quarter's profit growth will be stronger than this quarter.

Therefore, from the company's guidance, next quarter's performance is still in a stable and improving growth trend, with profit margins continuing to release.

From the company's recent business dynamics, the main points include:

1) Currently, cooperation with Anthropic can contribute inference revenue to AWS, and the API business has not yet fully released. According to a foreign bank's estimate, after the Claude 5 model is fully adopted, it is expected to contribute about 5% revenue to AWS (quantitative data for reference only).

2) The key project Project Rainer (a large data center, expected total capacity to reach 2.2 GW) currently under construction is expected to go online in 2026. According to a bank's estimate, once fully loaded, it is expected to contribute annual revenue of $14 billion to AWS, equivalent to about 10% of current AWS revenue.

These two points are potential drivers for AWS's continued acceleration.

3) Additionally, it is important to note that the company is also investing in instant retail, overseas business (such as Latin America), Kuiper satellites, and streaming media. The pressure on Capex and expense spending is significant. Therefore, the company's future profit margins are likely to be under pressure (signs have been evident in the past two quarters), and caution is needed in this regard. It is necessary to observe the balance between efficiency improvement (such as the recently announced potential layoff of up to 30,000 people) and growth in investment.

From a valuation perspective, we have raised the previously estimated net profit for fiscal year 2026 to $90 billion (higher than market expectations before the earnings). The company's market value after earnings corresponds to a 26x PE for 2026. In absolute terms, it is not cheap, but compared to other Mag7, it is not expensive. Moreover, AWS's current improvement should only be in the early stages, with benefits not fully released, and there should still be opportunities. However, it should be noted that Amazon is more about narrowing the technical gap in AI with early movers like Microsoft and Google, and it does not necessarily mean Amazon can fully catch up.

Detailed comments are as follows:

I. AWS: The long-awaited acceleration has finally arrived, and the gap with competitors is starting to narrow?

Currently, for almost all companies involved in cloud business, the growth rate of cloud business has almost become the single indicator that determines success or failure. Therefore, the most important AWS revenue this quarter grew by 20.2% year-on-year to $30.9 billion (similar growth rate at constant exchange rates), with a significant increase of 2.7 percentage points compared to the previous quarter. The long-awaited AWS growth acceleration has finally arrived.

Although before the earnings report, some sellers and investors believed that AWS growth would improve this quarter, setting the expected growth rate at 18%~19%. However, this view was not a consensus, and the actual performance exceeded this expectation, providing a genuine surprise beyond expectations.

Comparing horizontally with the other two major cloud service providers, previously, while Azure and GCP's growth continued to accelerate for the past 3~4 quarters, AWS's growth stalled, which was the core reason for Amazon's stock performance significantly underperforming all other Mag7 companies recently. And this quarter, while the growth rate of the two competitors slowed down, AWS showed signs of acceleration, indicating that AWS's growth rate on the report and at the business level (especially AI-related) is narrowing.

Based on pre-earnings reports, this outperformance is attributed to the alleviation of AWS computing power supply bottlenecks and the contribution to computing power demand from cooperation with Anthropic.

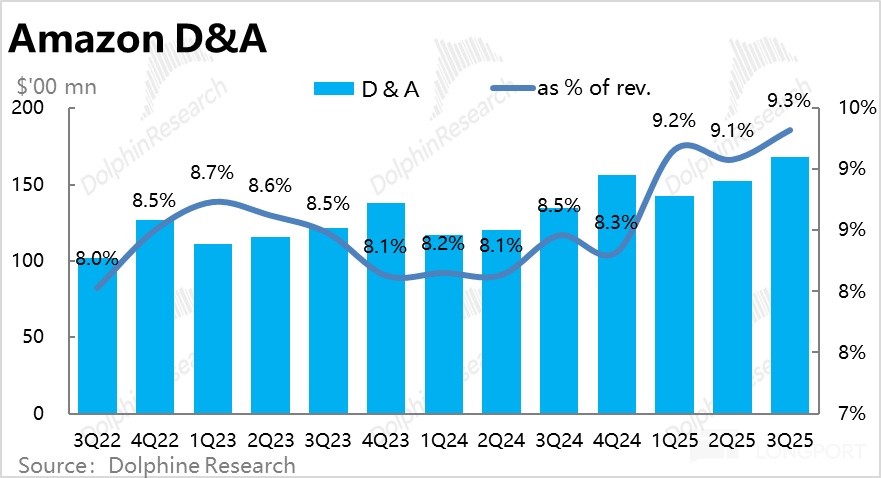

In terms of profit, AWS's operating profit margin this quarter contracted by 3.4 percentage points year-on-year, with the margin decline expanding over the past 2~3 quarters. This reflects the company's decision at the beginning of the year to shorten the depreciation cycle of servers, GPUs, and other assets by one year, as well as the impact of increasing Capex and depreciation. However, it should be noted that this quarter, the impact of the provisioned layoff subsidies was confirmed early, which exaggerated the extent of profit margin deterioration.

This quarter, AWS's actual operating profit was approximately $11.4 billion, although only growing by 9% year-on-year, it was still slightly better than expected.

II. North American e-commerce growth is stable, multimedia advertising drives growth

The general retail segment, this quarter's total revenue was $147.2 billion, up 12% year-on-year, roughly consistent with the previous quarter. By region, unaffected by exchange rates, North American retail revenue growth was 11.2%, slightly accelerating by 0.1 percentage points compared to the previous quarter, generally stable.

According to the U.S. Census Bureau, since June, U.S. non-store sales growth has been continuously improving, indicating that online consumption in North America remains resilient, consistent with Amazon's data trend.

Meanwhile, the nominal growth rate of international retail business was 14%, slowing down by 2 percentage points quarter-on-quarter. However, excluding exchange rate effects, the actual revenue growth rate in international regions was 10%, slightly down by 1 percentage point compared to the previous quarter, showing signs of slight weakening but still generally stable.

By business line, growth across business lines was relatively stable, whether slightly accelerating or decelerating, quarter-on-quarter changes were mostly around 1 percentage point. More specifically:

Self-operated retail, offline stores, and subscription service revenue growth slightly slowed, while advertising revenue and third-party merchant service revenue growth slightly accelerated. Notably, this quarter's advertising absolute growth rate reached 23.5%, the highest among all business lines, accelerating for three consecutive quarters. According to seller reports, strong advertising growth, besides stable e-commerce advertising, the increase in advertising on Amazon's other multimedia content such as Prime Video should be the main driving force.

III. Excluding abnormal settlement fees and layoff provisions, actual profit performance meets expectations

Combining all business lines, driven by AWS's outperformance and stable growth in the e-commerce segment, Amazon's total revenue this quarter was $180.2 billion, up 13.4% year-on-year, slightly accelerating by 0.1 percentage points quarter-on-quarter, also exceeding market expectations of $177.8 billion.

Overall operating profit was $17.4 billion, seemingly showing near-zero year-on-year growth and a significant decline quarter-on-quarter. However, this quarter confirmed $2.5 billion in legal fees related to settlement with the U.S. Federal Trade Commission (FTC), and previously reported layoff expectations possibly generating $1.8 billion in compensation fees were confirmed early this quarter.

If $2.5 billion in legal fees are added back, operating profit would be $19.9 billion, up 14% year-on-year, roughly in line with market expectations. If the provisioned layoff fees are added back, operating profit would exceed market expectations by about 10%.

By segment, as mentioned earlier, AWS's profit margin, although declining, was roughly in line with expectations. In the retail segment, North America's operating profit, after adding back $2.5 billion in legal expenses (excluding layoff provision fees) was approximately $7.3 billion, roughly in line with market expectations, corresponding to an operating profit margin of 6.9%, still increasing by 1 percentage point year-on-year. This is a performance that meets expectations and is quite good.

However, the international retail segment's operating profit this quarter was $1.2 billion, lower than last year's $1.3 billion, and significantly underperforming expectations. Corresponding operating profit margin was 2.9%, down 0.7 percentage points year-on-year. Although the company explained it was due to the aforementioned early confirmation of layoff fees, North American retail and AWS business, even considering the impact of layoff provisions, still met expectations. In contrast, the profit performance in international regions was relatively poor.

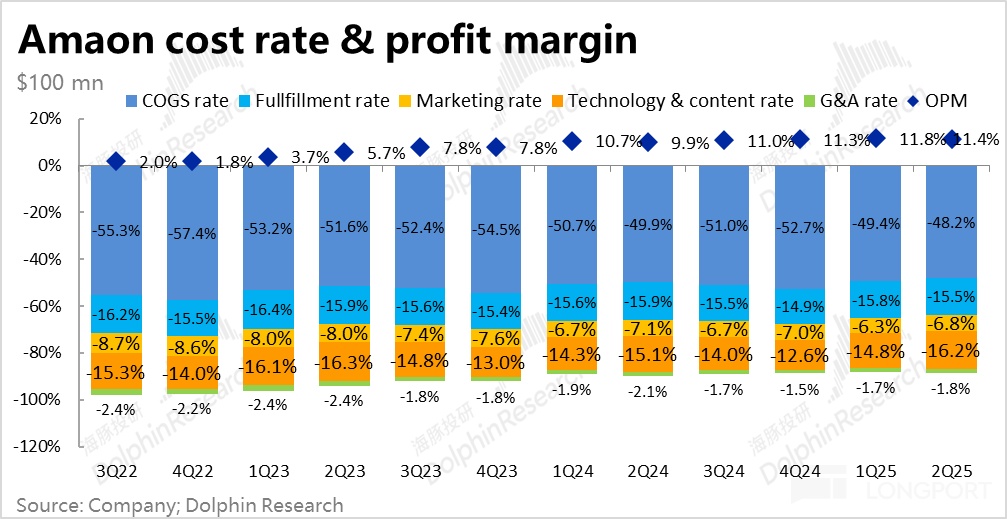

IV. Gross margin continues to expand, R&D costs increase by 30%

From the perspective of costs and expenses, firstly, this quarter's overall gross margin was 50.8%, expanding by 1.8 percentage points year-on-year. It can be seen that even with continuously increasing capital expenditures and current AI investments putting pressure on cloud business profit margins, with changes in the company's overall business structure and improved operational efficiency, the company's gross margin is still in an expansion cycle, and the extent has not narrowed. Actual gross profit was $91.5 billion, up 17.5% year-on-year, exceeding market expectations of $88.9 billion.

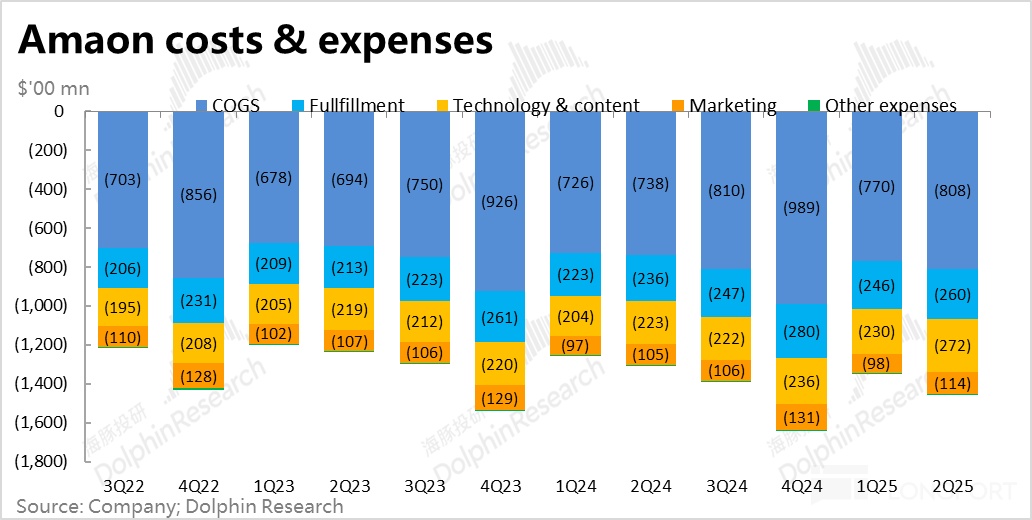

From the expense perspective, due to the confirmation of settlement legal fees in other expenses, it will distort the expense growth situation. We exclude the impact of these other expenses, and the combined growth rate of regular operating expenses still reached 18% (including layoff provision fees) , compared to the previous sustained growth rate of operating expenses not exceeding 10% for over two years, it can be seen that the company is re-entering an investment cycle.

Specifically, fulfillment, sales, and administrative expenses grew by 6%~12% year-on-year, still not considered high. Only R&D and content expenses grew by 30% year-on-year, with growth rate rapidly increasing. Since AWS employee salaries, R&D costs, some equipment costs, and streaming media content production costs are recorded in this expense item, it can be seen that it is mainly due to investments in cloud business.

V. Capex continues to rise, multi-line approach

This quarter, Amazon's Capex further increased to $35.1 billion (this is the figure disclosed in the company's cash flow statement, with some discrepancies from the conference call figure, but generally similar), setting a new historical high. Besides investments in cloud business, the company is also investing in e-commerce logistics, instant delivery, and satellite projects, making the absolute expenditure amount the highest among giants.

Correspondingly, this quarter, Amazon's depreciation as a percentage of revenue continued to rise, reaching 9.3%, and with further increases in Capex, the drag from depreciation may become more apparent.

<End of text>

Past Dolphin Research on [Amazon]:

Earnings Commentary

May 2, 2025 Conference Call "Amazon (Minutes): AI Computing Power Still Has Bottlenecks"

May 2, 2025 Earnings Commentary"AI Investment, Tariff Disruption, Amazon Re-enters "Squatting Period"?"

February 7, 2025 Earnings Commentary"Amazon: Aggressive Cloud Investment, Profit Release Period Gone Again?"

February 7, 2025 Conference Call "Amazon (Minutes): GPU Cloud Depreciation Arrives, DS Absolute Benefit!"

November 1, 2024 Earnings Commentary"Amazon: Profit Exploded Again, But Massive Capex "Clouds Overhead""

November 1, 2024 Conference Call "Amazon: Can Profit Margin Continue to Rise Under Massive Investment?"

August 4, 2024 Earnings Commentary "AI Accelerated Investment, Users More Frugal, Amazon "Taking a Break" Again?"

August 4, 2024 Conference Call "Amazon: Views on Consumer Sentiment and AI Investment Pace"

May 1, 2024 Conference Call "Amazon: Profit Rocketing Up, Clash of Strong Performance and High Expectations"

May 1, 2024 Earnings Commentary "Amazon: Profit Will Continue to Rise, But Investment Cycle is Restarting"

February 2, 2024 Conference Call "Amazon: Retail Continues to Improve Efficiency, AI Cloud Computing Space Huge"

February 2, 2024 Earnings Commentary ""Reborn" Amazon, How Many Surprises Left?"

In-depth Research

December 18, 2024 "Amazon E-commerce Endgame Speculation: Retail's Disguise, Advertising's Soul?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.